Unconventional future: man vs. machine

Thanks to a subscriber for this report from Deutsche Bank which may be of interest. Here is a section:

Mining costs: labour, electricity drive continuing inflation at conventional mines

You may have opened this expecting a sci-fi/marvel-esque drama, instead, it is about cost history of PGM producers we cover. Cost inflation has run at around 9% p.a over the past five or so years. We estimate conventional mines unit costs are 20-25% above mechanised, & may continue to increase at around 10% p.a. without stringent cost control. Around 70% of their costs are labour & electricity. Mechanised mines have a balanced cost composition & could limit increases at mid-to-high single digit percentages. We adjust our cost inflation expectations & valuations for longer-term cost inflation rates. With a shift to lower costs, AMS is our top pick: Buy. Lonmin is our least preferred: Sell.Unit costs and inflation by mining method: conventional disadvantage to widen

Each mine faces different circumstances and each company has different cost disclosure. However, we are able to draw some broad industry conclusions. Conventional mines have c.25% higher unit costs relative to mechanised operations. Conventional mines’ inflation rates have been c.10% p.a. or higher over the last 5 to 6 years, driven by electricity and wages (making up c.70% of costs) and we think this cost-pressure is likely to continue. Mechanised mines’ costs have a greater proportion of contractors and stores/materials than conventional mines and are relatively light on labour costs. While mechanised mines have also faced strong cost inflation, some operations have managed to keep inflation to mid single digit CAGR percentages.

Composition of costs by mining method and cost inflation of categoriesLabour costs (c.60% of conventional costs) as a category have increased c.9 to 12%p.a. over the past 5-6 years. Utilities, c.8-10% of conventional on-mine cash costs, have increased at between 11 to 20%p.a. Stores/materials have increased at c.5.5% to 6.5% p.a. and are approximately 25 to 30% of costs.

Here is a link to the full report.

Platinum’s scarcity, the high cost of extraction and an increasingly uncertain situation in South Africa are long running considerations the market is familiar with. The growth of the electric vehicle market is a new development that needs to be considered because with no catalytic converters they don’t need platinum. That is one of the primary reasons platinum producers are so keen to promote fuel cell technology because they use the metal and electric car batteries don’t. That represents a hurdle for platinum entering a sustained bull market but it is rallying in sympathy with the other precious metals at present.

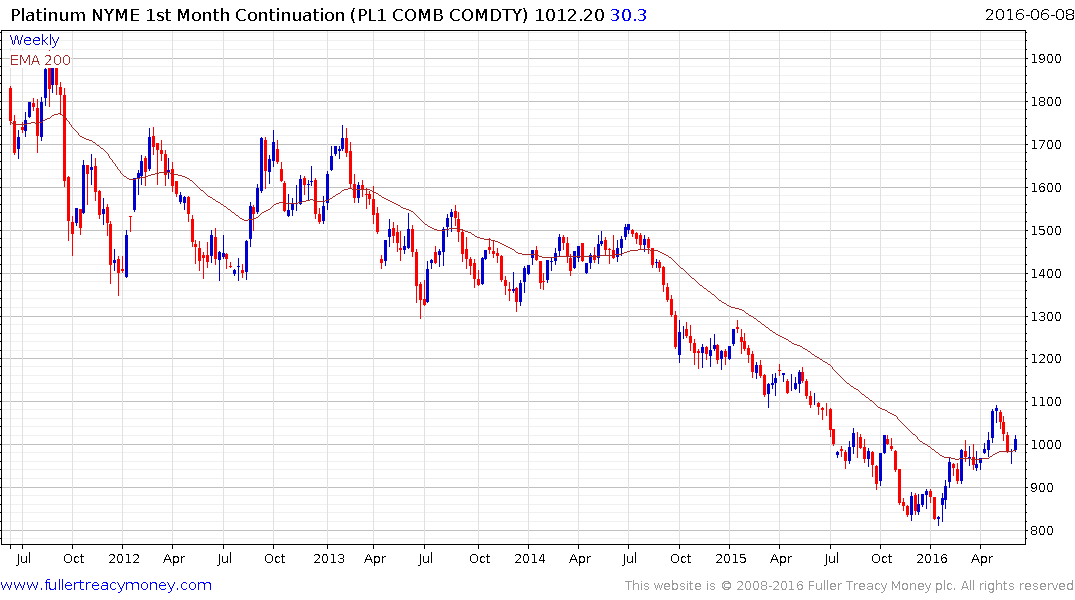

Platinum continues to bounce from the region of the trend mean and a sustained move below last week’s low would be required to question potential for additional upside.

The FSTE/JSE Platinum Miners Index has more than doubled this year while the Rand found at least near-term support over the same period. The Index continues to hold a progression of higher reaction lows and is finding support in the region of the trend mean. A sustained move below 22.50 would be required to question the recovery hypothesis.

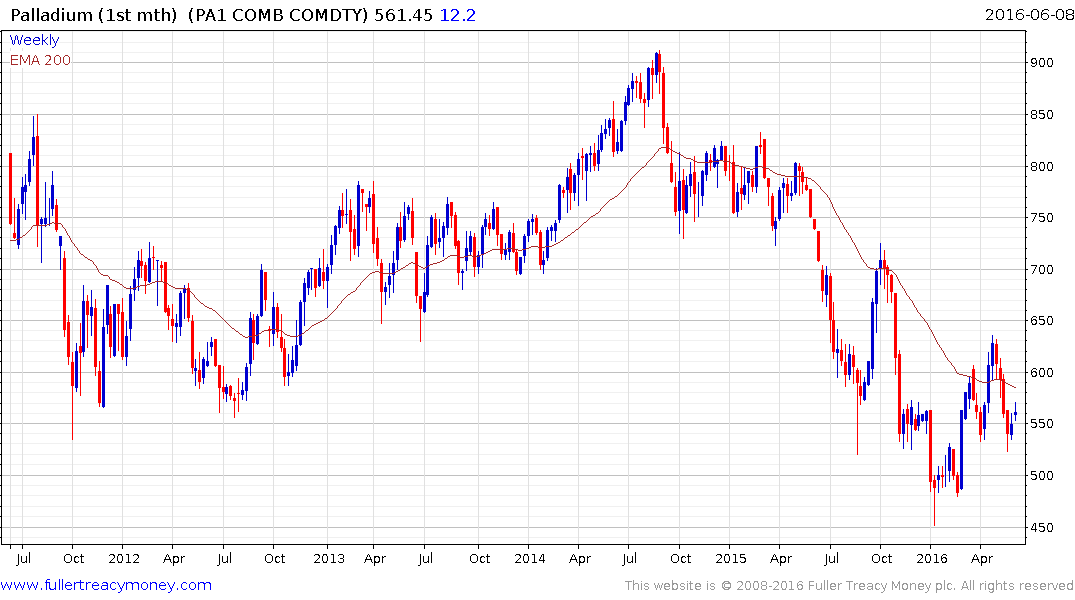

Palladium is a relative laggard and while it continues to bounce from the $525 area a sustained move above $600 will be required to signal a return to medium-term demand dominance.