UBS Ends $10 Billion State Backstop That Helped Seal Merger

This article from Bloomberg may be of interest. Here is a section:

The decision offers reassurance on “the health of the Credit Suisse non-core portfolio,” Citigroup analysts said in a note. “The early voluntary repayment could potentially also help in other matters, such as negotiating the retention of the Credit Suisse Swiss business.”

The fate of the Swiss bank has been widely watched as Swiss-based companies and politicians have voiced concerns over the market power that the combined bank would exercise. UBS plans to make a decision in the third quarter on whether it will fully integrate it with its own Swiss unit or seek another option such as spinning it off or listing it publicly.

The Swiss government essentially gifted Credit Suisse to UBS. In so doing they have given the impression that UBS is now too big to fail since it is the only remaining Swiss bank with global heft. Regardless of whether the rump of Credit Suisse is spun off, the dominant position now held by UBS is unassailable within the Swiss market.

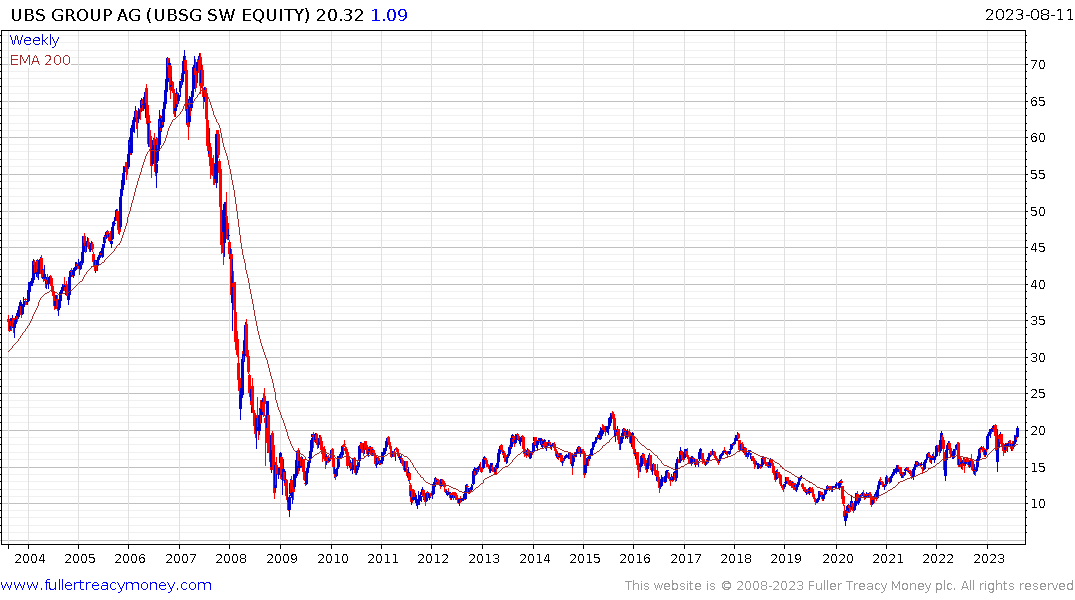

The share is in the process of completing a first step above the 15-year base formation.

The share is in the process of completing a first step above the 15-year base formation.

The only other banks in Europe that have truly global franchises are Santander, BBVA and HSBC.

Both Santander and BBVA offer exposure to the recovery in Latin American markets as rates come down from very elevated levels. BBVA (Est P/E 5.95, DY 5.99%) is firmed in the region of the 2017 peak.

Both Santander and BBVA offer exposure to the recovery in Latin American markets as rates come down from very elevated levels. BBVA (Est P/E 5.95, DY 5.99%) is firmed in the region of the 2017 peak.

Santander (Est P/E 5.82, DY 3.28%) is testing the upper side of a three-year base formation.

HSBC (Est P/E 6.42, DY 7.5%) is much more focused on Asia and Hong Kong in particular. Sentiment towards China is a drag on the share even as the business fundamentals are improving. An unwinding of the short-term overbought condition is currently underway.

HSBC (Est P/E 6.42, DY 7.5%) is much more focused on Asia and Hong Kong in particular. Sentiment towards China is a drag on the share even as the business fundamentals are improving. An unwinding of the short-term overbought condition is currently underway.

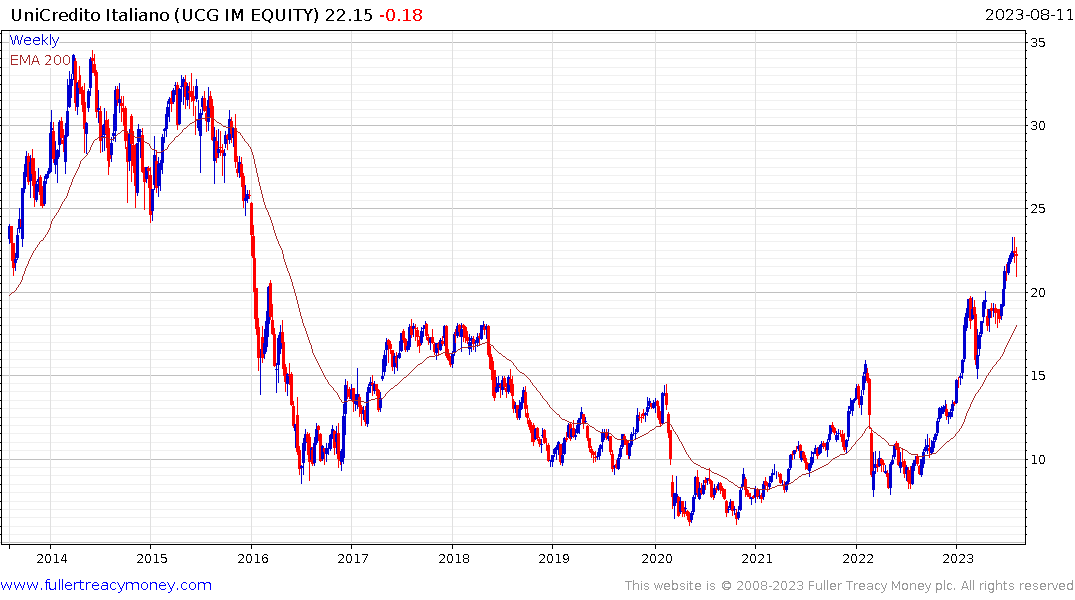

Unicredito has rebounded over the last couple of days as the uncertainty around the impact of the Italian windfall tax is reassessed. The share has broken out of its base and is due some consolidation. The benefit of the doubt can be given to the upside provided it continues to find support in the region of the trend mean.

Unicredito has rebounded over the last couple of days as the uncertainty around the impact of the Italian windfall tax is reassessed. The share has broken out of its base and is due some consolidation. The benefit of the doubt can be given to the upside provided it continues to find support in the region of the trend mean.