UBA Plans Angola, South Africa Moves as Nigeria Hit by Oil Price

This article by Chris Kay for Bloomberg may be of interest to subscribers. Here is a section:

Nigerian companies and the Lagos-based bank are “adequately protected” against a drop in the value of the naira and the price of oil, Oduoza said. The currency of Africa’s largest economy and crude producer probably won’t be devalued further and loan defaults are unlikely to increase, he said. Angola is the continent’s second-biggest oil producer.

Nigeria is struggling to cope with crude prices that plunged by more than half in the past six months. Policy makers responded by devaluing the currency in November, increasing interest rates to a record 13 percent and proposing spending cuts.

“We have done quite a lot of hedging and we have applied various financial products to make sure that the bank is adequately protected,” Oduoza said. “The naira is finding its realistic value,” he said. “I do not think you are going to see any major devaluation, if at all it is going to happen.”

In the aftermath of the 2008 crash the Naira traded in a relatively tight range, albeit with a mild weakening bias, until November when it broke downwards. Considering the extent to which the Nigerian economy is reliant on energy exports (95% of the total), it is too early to conclude the devaluation process has ended.

In local currency terms, the Nigerian Index has returned to test the December low but a clear upward dynamic would be required to signal more than temporary support in this area.

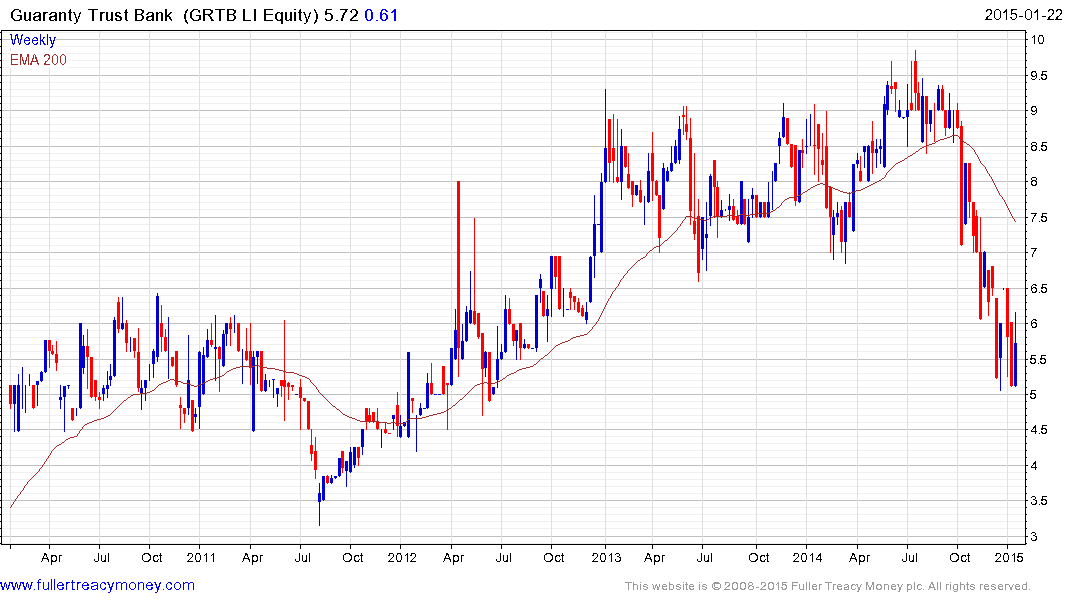

London listed Guaranty Trust Bank has a similar pattern.

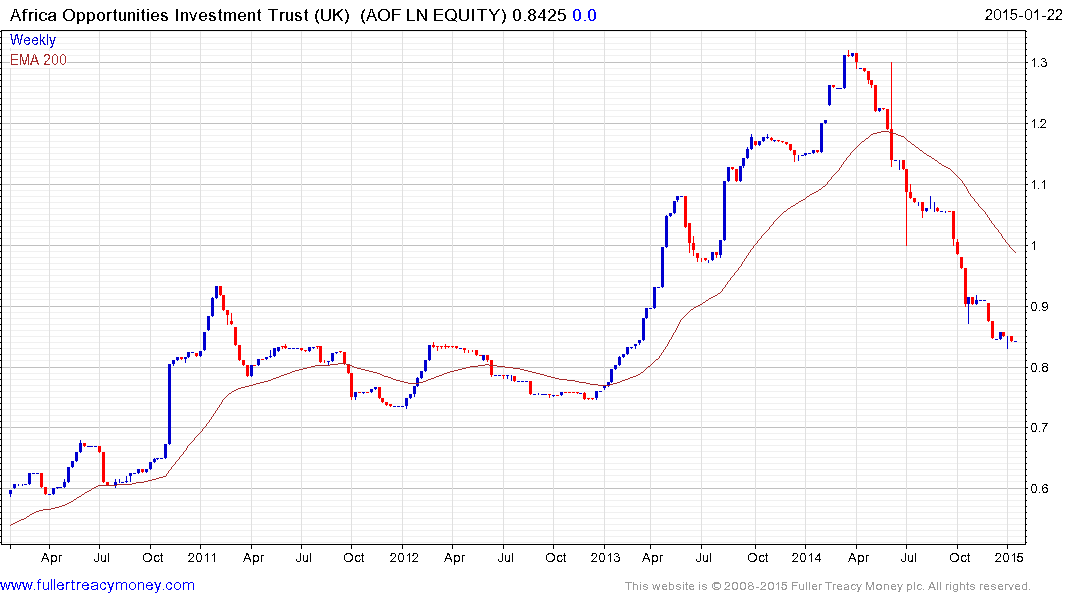

The UK listed Africa Opportunities Investment Trust is now trading at a discount to NAV of 16.83% but continues to trend consistently lower.

Back to top