U.S. Wage Acceleration Looks Real, at Least in Certain Sectors

This article by Matthew Boesler for Bloomberg may be of interest to subscribers. Here is a section:

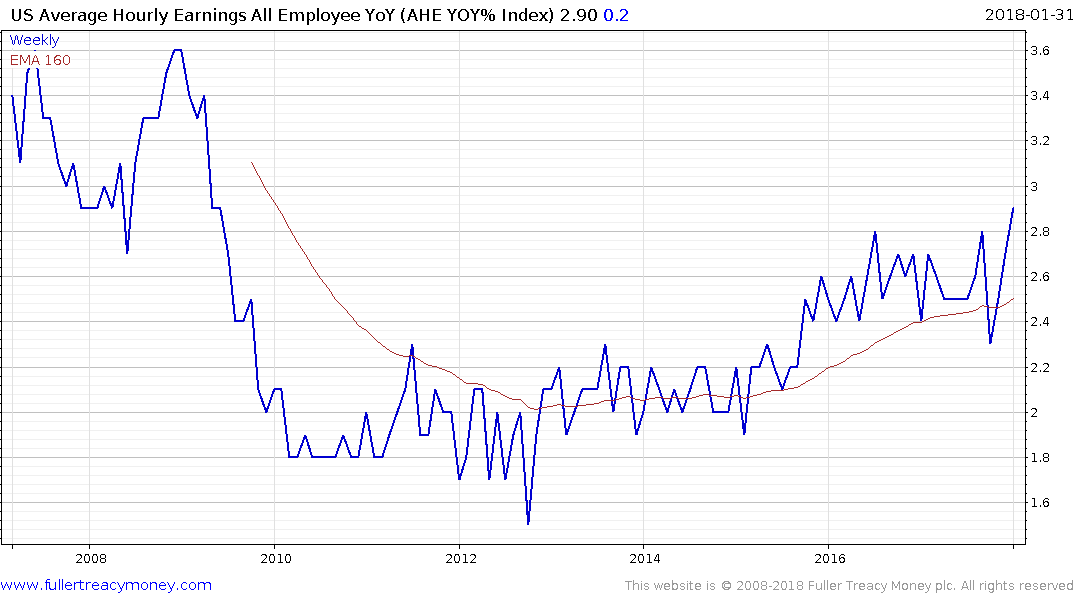

The largest contributors to the pickup in the all-employees earnings metric were the professional and business services sector, education and health services, and financial activities.

The professional and business services sector includes everything from highly-skilled technical workers like computer scientists to low-earning temporary workers. Wage growth for the entire sector hasn’t accelerated much since 2014 but is starting to push toward the high end of the range. Hours worked were down a bit from a year earlier, but not much. Earnings did pick up a bit more for all employees than they did for just production and nonsupervisory workers, so the jury is still out on whether this acceleration will last.

Wage growth is accelerating and the Dallas Fed is predicting a 5%+ expansion for the US economy in the first half. Wage growth figures hit a new recovery high today and that contributed to investors thinking that perhaps the outlook for the Dollar is not as pessimistic as has been priced in during what has been a steep decline over the last few weeks.

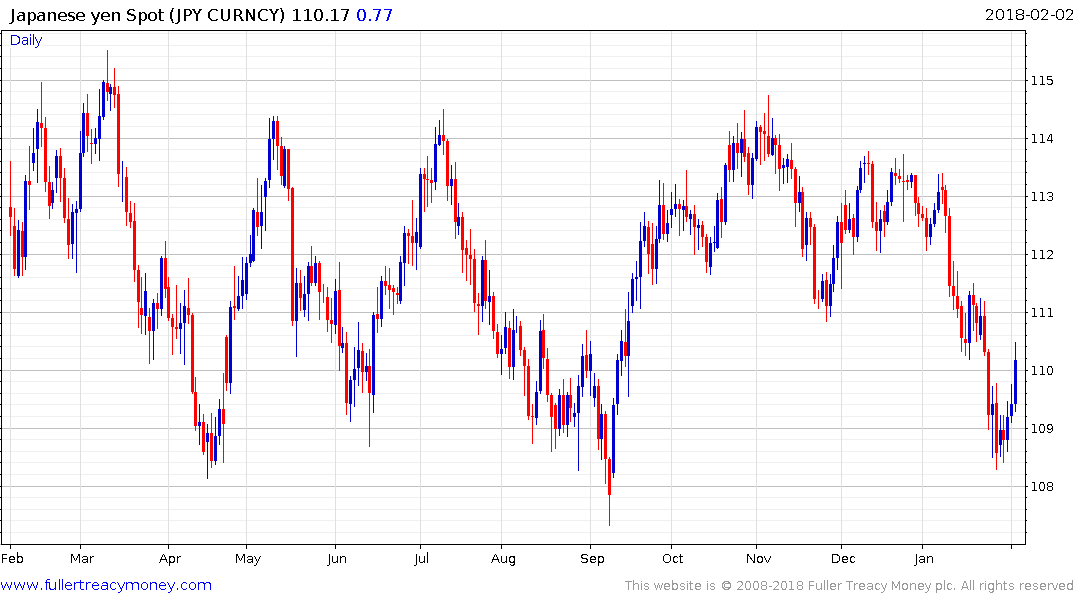

The Dollar rallied most today against the Yen, confirming support in the region of the lower side of its yearlong range.

Silver had the largest pullback among the precious metals and a clear upward dynamic will now be required to question near-term scope for a further test of underlying trading.

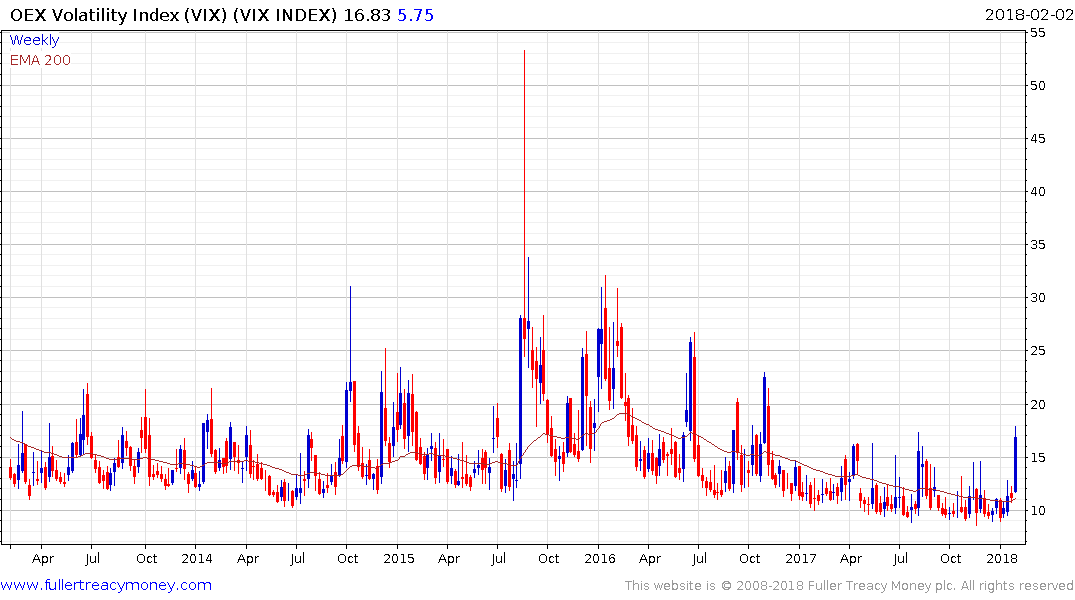

The VIX Index closed at its highest level since November 2016 today to cap a week where volatility returned with a bang.

The S&P500 also posted its first decline of more than 3% in almost two years this week.

Concurrent weakness across asset classes and the potential for the Dollar to rally should have investors alert to the potential for a return to risk off trading strategies where wide overextensions relative to the trend mean will be targets for short sellers.