U.S. Stocks Plunge as Yield, Trade Worries Deepen

This article by Jeremy Herron and Sarah Ponczek for Bloomberg may be of interest to subscribers. Here is a section:

U.S. stocks tumbled the most since April as fresh concern about the impact of the trade war with China roiled technology and industrial shares. Treasuries rose with the yen demand for haven assets.

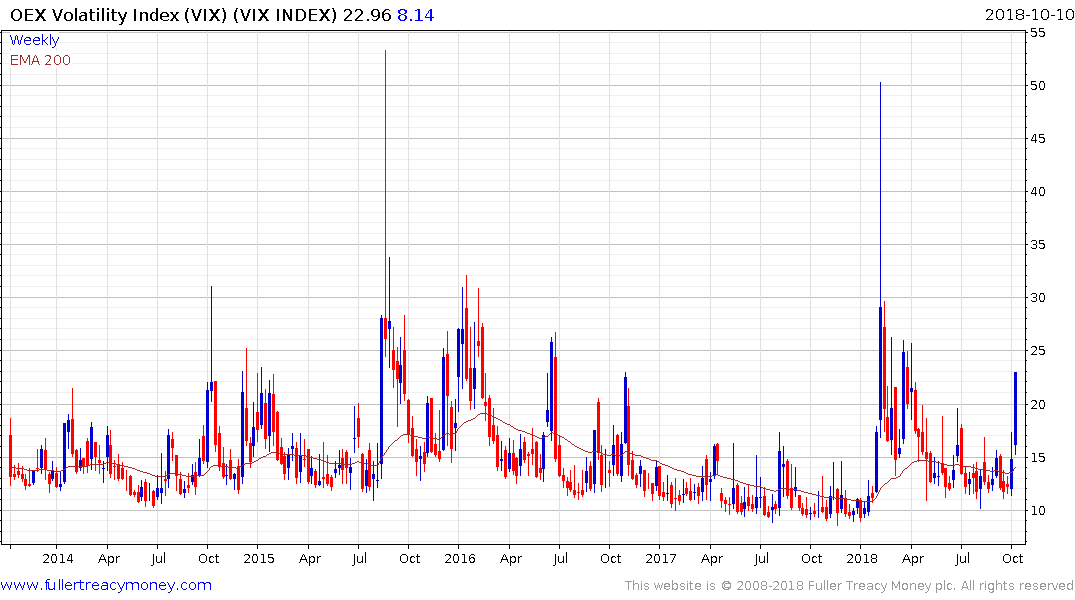

The S&P 500 fell to the lowest in almost two months, the Dow Jones Industrial Average plunged as much as 640 points and the Nasdaq 100 Index tumbled more than 3 percent in a broad selloff in U.S. equities. Boeing and Caterpillar dropped at least 2.9 percent, while computer companies kept the broader measure on its longest slide since Donald Trump’s election win.Fastenal Co. added to angst that the trade war with China is raising materials costs that will crimp profit margins. Estee Lauder and Tiffany led losses after French luxury goods maker LVMH confirmed China is enforcing customs rules more strictly as trade tensions remain high. The Cboe Volatility Index rose past 20 for the first time since April. Oil fell from $75 a barrel even as a major hurricane headed for the Florida Panhandle.

“The biggest thing going on in markets is you’re seeing an unwind,” Sameer Samana, a global quantitative and technical strategist for Wells Fargo Investment Institute, said by phone. “You had stocks doing really well, rates for the most part were very well-behaved. When you’ve got these risk-off moments, especially when you’re later in the cycle, there is some concern on the part of investors where it’s like, ‘Is this the beginning of the end?”’

The VIX Index popped on the upside today, for the first time in months, to break the sequence of lower rally highs that has been in evidence since the January spike. Perhaps more importantly it has held the advance through the close which suggests an absence of traders buying the dip.

The Russell 2000 has been the leading performer among US indices this year. It found support early in February, broke out to new highs first and has subsequently led on the downside. It pulled back below the psychological 1600 level today as it extends its drop below the trend mean. On previous occasions when it has dropped below the MA, it has bounced emphatically immediately afterwards. Therefore, we need to see evidence of a return to demand dominance soon if the uptrend since early 2016 is to remain consistent.

The NYSE FANG+ Index is being led lower by China’s tech companies and needs to bounce back above the trend mean soon if the medium-term demand dominated environment is to be reasserted.

The S&P500 experienced its largest pullback since February and will need to bounce soon to demonstrate support in the region of the trend mean.