U.S. Stocks Advance Amid Drug Maker Rally as Caution Subsides

This article by Anna-Louise Jackson and Bailey Lipschultz for Bloomberg may be of interest to subscribers. Here is a section:

“There was a big flight to safety trade earlier and a lot of that has reversed,” said Michael Antonelli, an institutional equity sales trader and managing director at Robert W. Baird & Co. in Milwaukee. “You’re looking at a market that’s lacking direction right now. The primary driver for concern is what it always is -- a slow growth backdrop. We’re in a no-man’s land before the next Fed meeting and the kick-off of earnings next week.”

American equities shook off declines in global markets, which fell as knock-on effects of Britain’s vote start to materialize. Anxiety has increased over the potential for instability to spread after at least five asset managers froze withdrawals from U.K. real-estate funds following a flurry of redemptions, while data on Wednesday showed German factory orders were unchanged in May, disappointing forecasters who had called for an increase.

Before yesterday’s decline, the S&P 500 capped its strongest weekly rise since November, boosted by assurances that central banks are prepared to loosen monetary policy to limit the fallout from Brexit. The benchmark is trading at 16.6 times estimated earnings, a higher valuation than the MSCI All-Country World Index and above its own three-year average.

10-year Treasury yields steadied today in the region of 1.38% amid a deep overextension relative to the trend mean. Some consolidation in this area is looking likely but with absolute levels so low there has been a surge into assets with the prospect for a higher dividend yield or dividend growth.

The Dow Jones Utilities Index (P/E 20.33, DY 3.05%) continues to improve on its recent surge but is increasingly overextended relative to the trend mean. If growth fears are indeed subsiding the Index is susceptible to mean reversion but a clear downward dynamic will be required to check momentum.

The S&P500 Telecommunication Services Index (P/E 16.41, DY 4.21%) failed to sustain a breakdown from the three-year range in August 2015 and rebounded impressively to test the upper boundary. It found support in the region of the MA from May and is also now somewhat overextended relative to the trend mean.

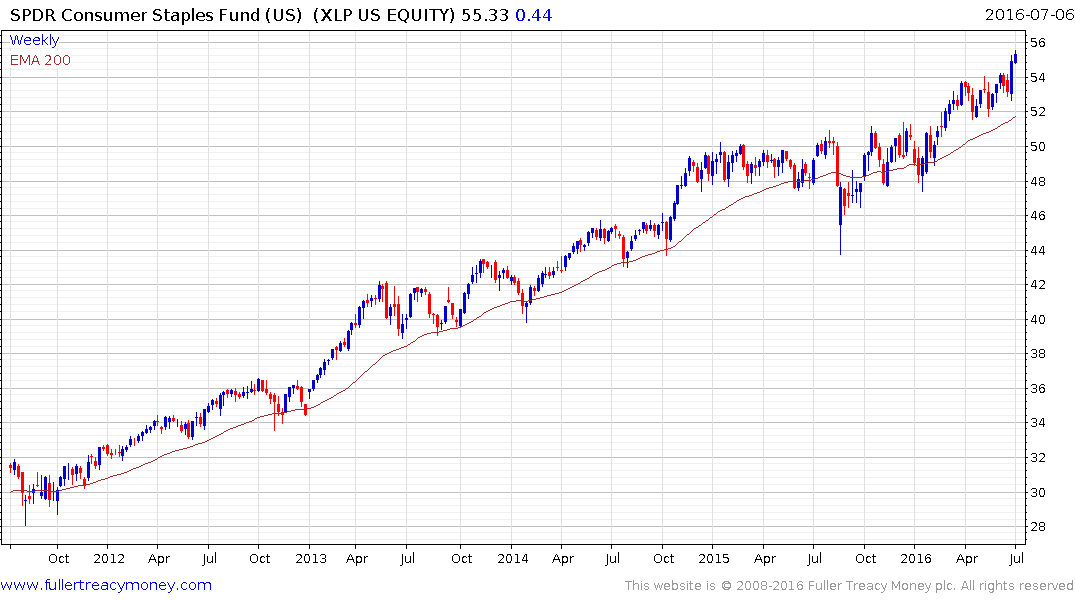

The SPDR Consumer Staples ETF (DY 2.34%) has been relatively unaffected by the events that have dominated headlines over the last months and remains in a generally consistent medium-term uptrend.

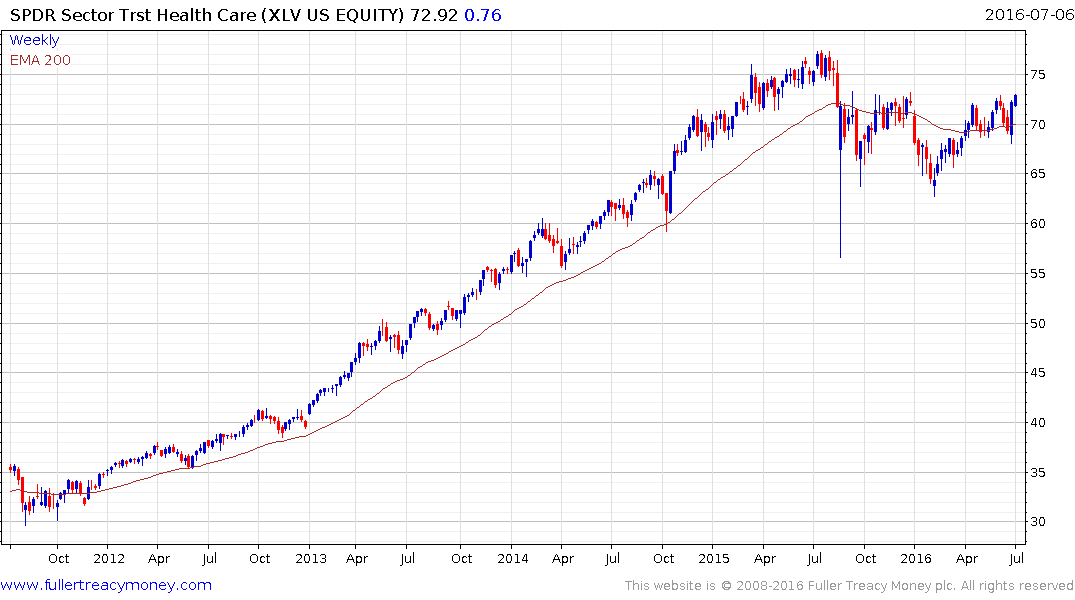

The SPDR Healthcare ETF (DY 1.49%) experienced a massive reaction against the prevailing uptrend during the flash crash in August last year but has now returned to test the upper side of an almost yearlong range and posted an upside weekly key reversal from the region of the MA last week.

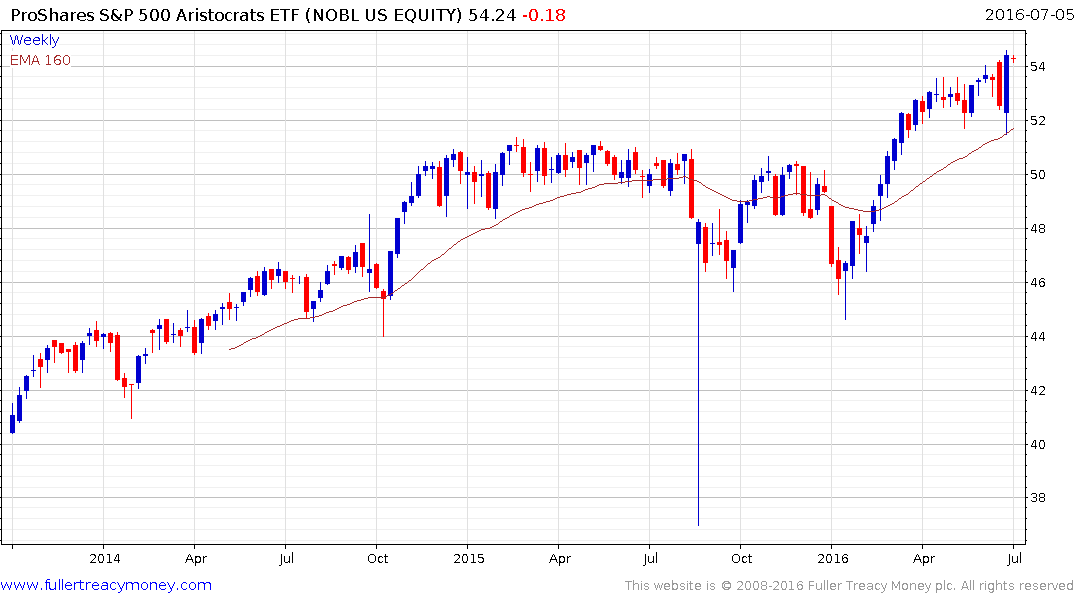

The ProShares S&P500 Aristocrats ETF (DY 1.81%) broke out to new highs in March and bounced emphatically last week from the region of the trend mean.