U.S. new homes sales hit eight-year high, point to firming economy

This article from Reuters may be of interest to subscribers. Here is a section:

New U.S. single-family home sales recorded their biggest gain in 24 years in April, touching a more than eight-year high as purchases increased broadly, a sign of growing confidence in the economy's prospects.

Tuesday's report from the Commerce Department, which also showed a surge in new home prices to a record high, offered further evidence of a pick-up in economic growth that could allow the Federal Reserve to raise interest rates soon.

?"Consumers are taking the leap and buying the biggest of big ticket items of their lives and this speaks to confidence. The Federal Reserve can raise rates at their June meeting without fear the economy is going to slow," said Chris Rupkey, chief economist at MUFG Union Bank in New York.

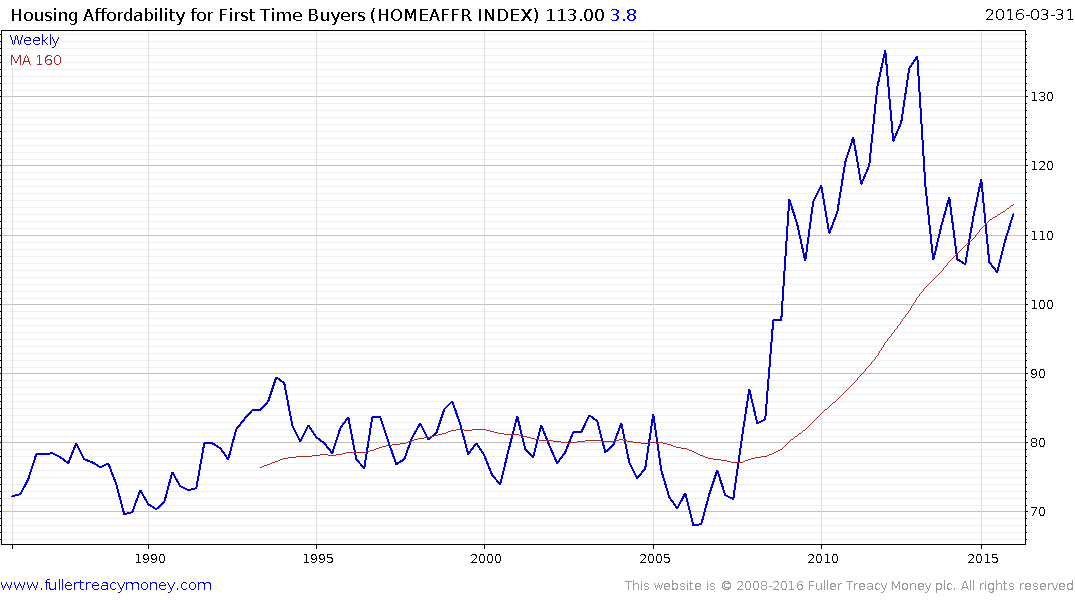

Home affordability has contracted since its peak in 2012 but is not back to where the previous norm was in the decades prior to the housing boom and subsequent bust. The role of ultra-low interest rates in bolstering affordability is seldom discussed and yet it represents a significant influence not least became wage growth did not improve until very recently.

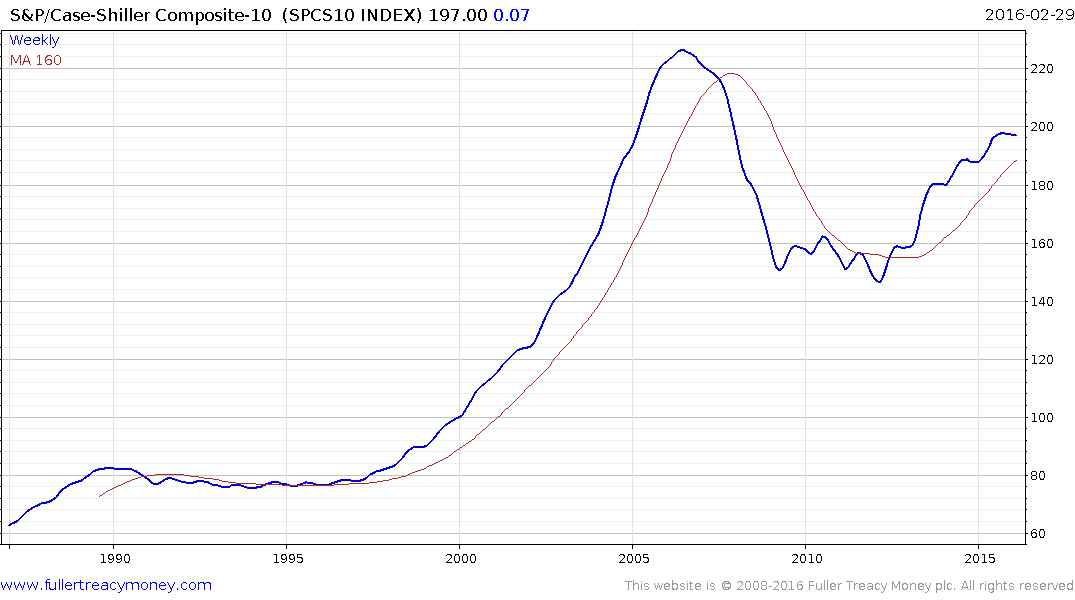

The S&P/Case-Shiller Composite 10 has rallied by a third since 2012 and homes in desirable locations took out their historic peaks more than a year ago.

With the number of young people living with their parents close to historic highs there is plenty of room for household formation provided earning potential improves. Homebuilders are taking notice and more affordable starter homes are being constructed to tap into that potential market.

NVR which offers both homes and mortgages remains a sector leader and has been trending consistently highs since 2011. A sustained move below the trend mean would be required to question that view.

Lennar Corp found support last week above the February low and a sustained move above $50 would signal a return to demand dominance beyond the short term.

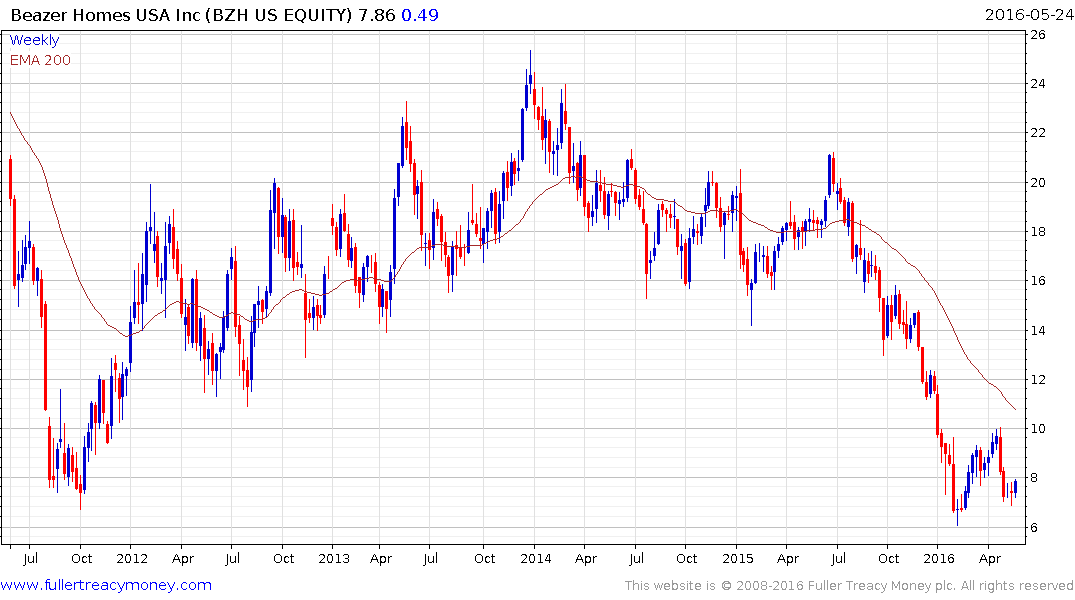

Beazer Homes has been a sector laggard and accelerated to its February low. It found at least near-term support above it last week and a sustained move below $6.80 would be required to question potential for additional higher to lateral ranging.