U.S. Jobs Engine Keeps Defying Forecasts for 2017 Slowdown

This article by Shobhana Chandra may be of interest to subscribers. Here is the relevant section:

A confluence of reasons helps explain the outperformance, including steady consumer spending; bullish business sentiment on hopes President Donald Trump will cut taxes and boost growth; stabilization in oil prices; and improving export markets. Moreover, weak wage gains suggest employers are adding workers instead of investing in technology, something reflected in sluggish productivity. Recent hiring has been driven by typically low-paying industries such as restaurants, home health-care services and leisure.

“There is enough supply of labor to keep hiring growing at a fairly robust pace,” said Michael Gapen, Barclays Plc’s chief U.S. economist, who projects payrolls grew 200,000 in August. There’s also still plenty of demand for workers in this “slow but super-durable expansion,” he said.

Declining labor force participation has been a thorn in the side of policy makers for much of the recovery but that should begin to improve as the number of job openings increases and wages edge higher. The upgrading of GDP figures to 3% combined with surprisingly firm Chinese factory gauges point toward the continuation of this period of synchronized global economic expansion.

The Nasdaq-100 has rallied impressively over the last three sessions to retest its peak near 6000. There is scope for a pause here but considering it has spent most of the month trading just below this level any pause could prove transitory. Meanwhile, a sustained move below the trend mean would be required to question medium-term scope for additional upside.

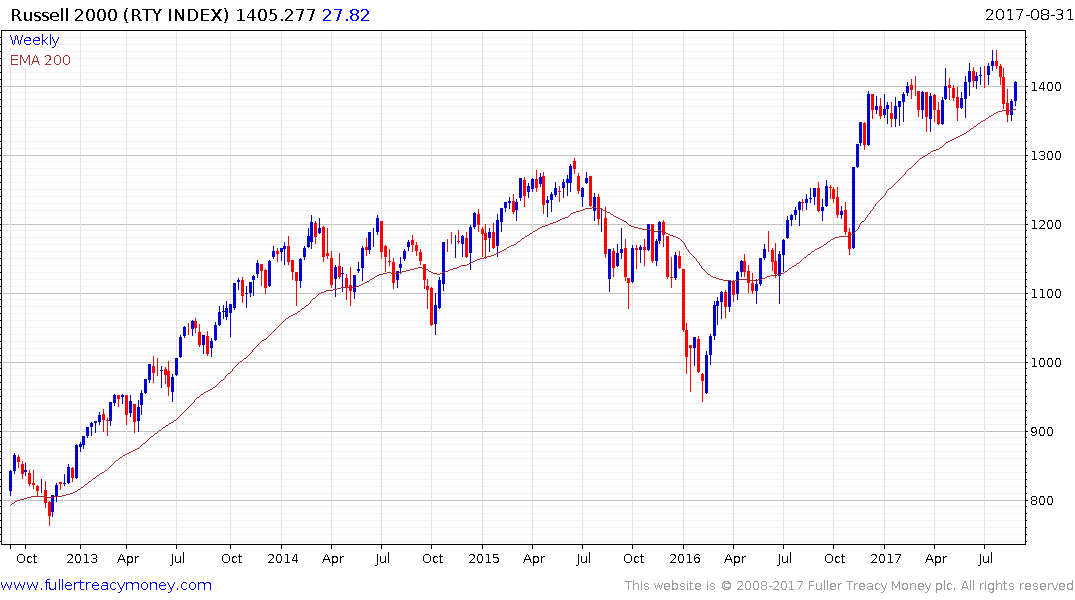

At the other end of the spectrum, the Russell 2000 has been ranging in a 100-point band since December and firmed two weeks ago from the lower boundary which coincided with the region of the trend mean.

The Euro STOXX 50 has held a progression of lower rally highs since Match and is now trading in the region of its trend mean. A break back above 3500 would confirm support in this area and a return to demand dominance beyond short-term steadying.

The S&P/ASX 200 is also firming from the region of its trend mean but is potentially being hampered, in nominal terms, by the relative strength of the Australian Dollar; a characteristic it shares with Eurozone indices.

The FTSE-100 experienced a shallower reaction and is also firming from the region of its trend mean.

The Hang Seng Index has been rallying consistently all year and is back testing its 2015 peak. A sustained move below 27,000 would be required to begin to question medium-term scope for additional upside.