U.K. Stocks Jump on Osborne Raised Forecast

This article by Roxana Zega for Bloomberg may be of interest to subscribers. Here is a section:

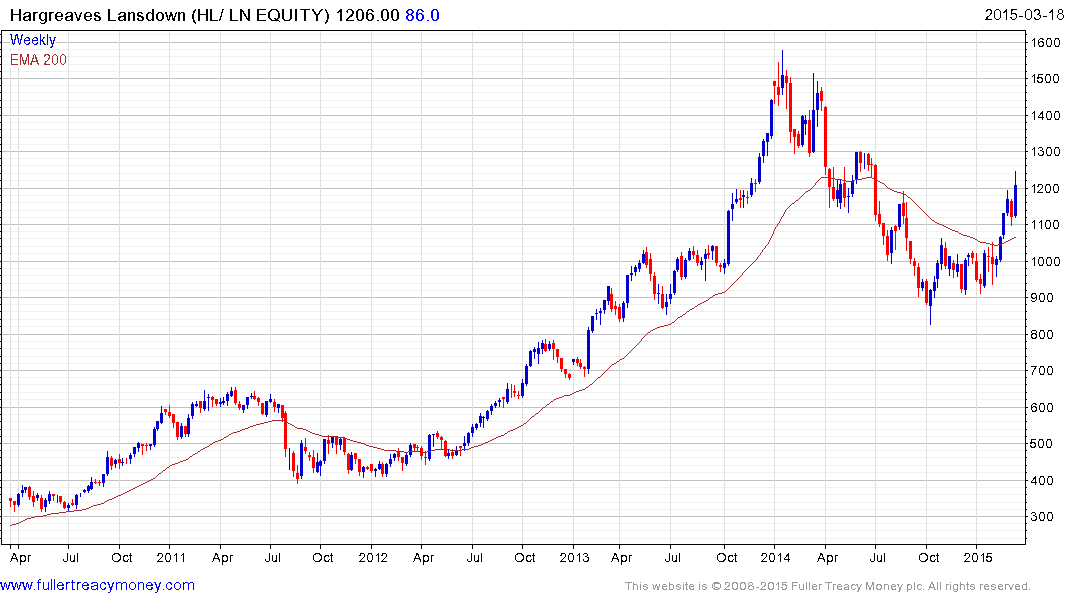

U.K. stocks extended gains after Chancellor of the Exchequer George Osborne raised the country’s growth forecast. Hargreaves Lansdown Plc and St. James’s Place Plc led insurance stocks higher on his proposed savings plan.

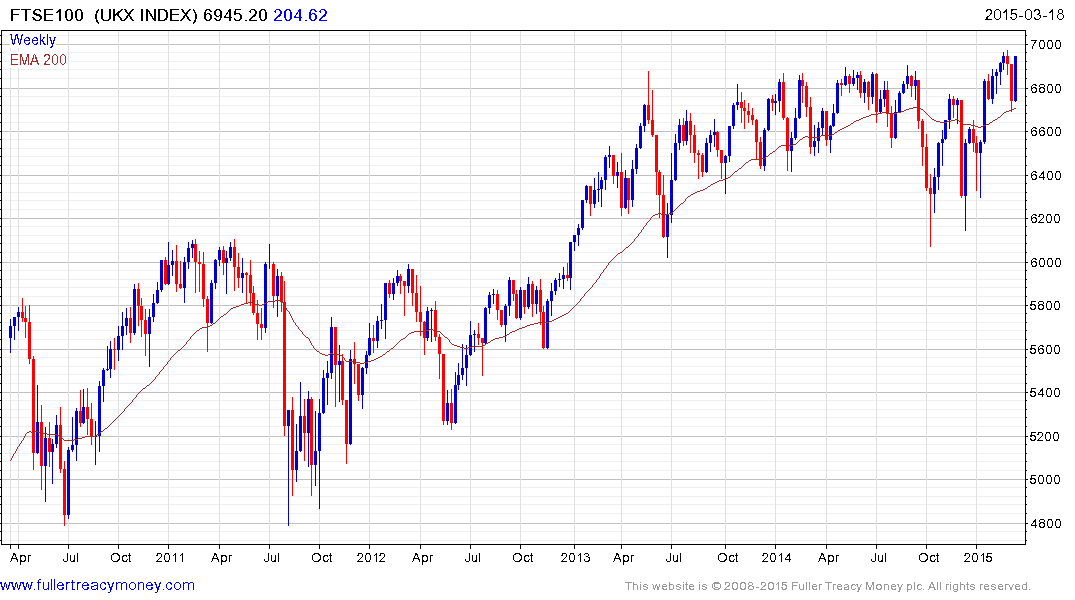

The FTSE 100 Index added 1.5 percent to 6,940.32 at 3:13 p.m. in London, extending an earlier advance to bring the increase of the year to 5.7 percent. The benchmark is within 0.3 percent of a record 6,961.14 reached on March 5.

In his final budget before the May 7 election, Osborne said the economy will grow 2.5 percent this year and 2.3 percent in 2016, up from December forecasts for 2.4 percent and 2.2 percent, respectively. He also said the government plans to top up savings for first-time home buyers.

?“The market is responding quite positively to a less austere budget, a bit more spending throughout the duration of the next parliament,” said Jasper Lawler, a market analyst at CMC Markets Plc in London. “But a big part of the rise in the FTSE today was before the budget. Unemployment rose a little bit so the net effect is that rates are going to stay low for much longer in the U.K. and that’s generally positive for stocks.”

The FTSE-100 has been left out in the cold while across the Channel in the Eurozone, a newly activist ECB has reignited investor enthusiasm for stocks. The UK may be ready to now play catch up. The FTSE-100 led European market performance today as austerity is set to ease, the Euro is rebounding against the Pound and the new savings plan should be a benefit to asset managers.

The FTSE-100 has been ranging below the psychological 7000 for nearly two years but found support this week in the region of the 200-day MA and a clear downward dynamic would be required to question current scope for a successful upward break.

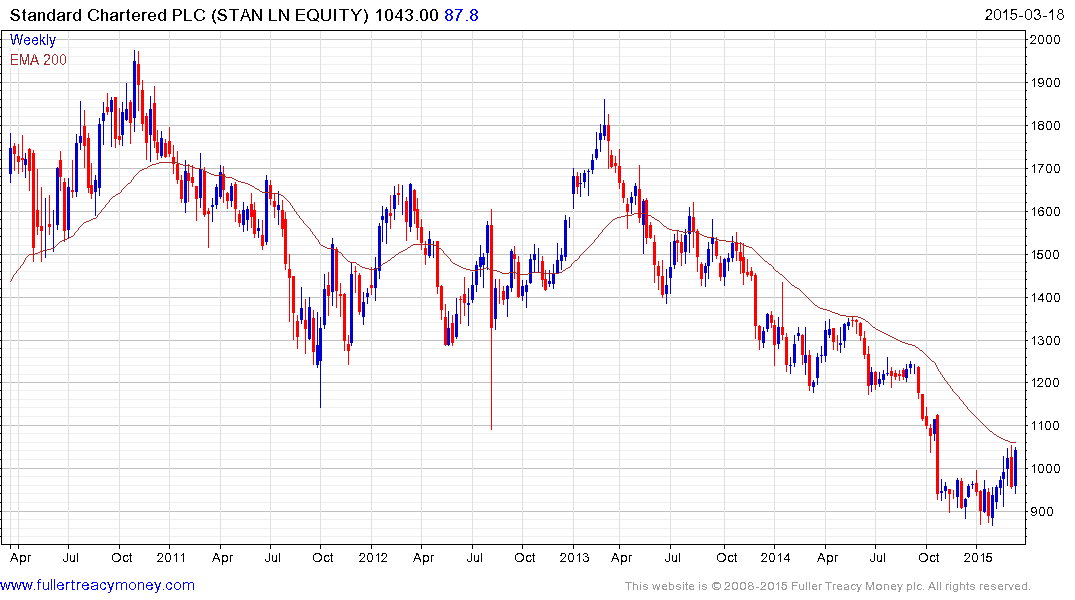

Standard Chartered retraced last week’s decline to retest the region of the 200-day MA. This strong performance helps to improve recovery prospects and a sustained move below 900p would be required to question medium-term scope for additional upside.

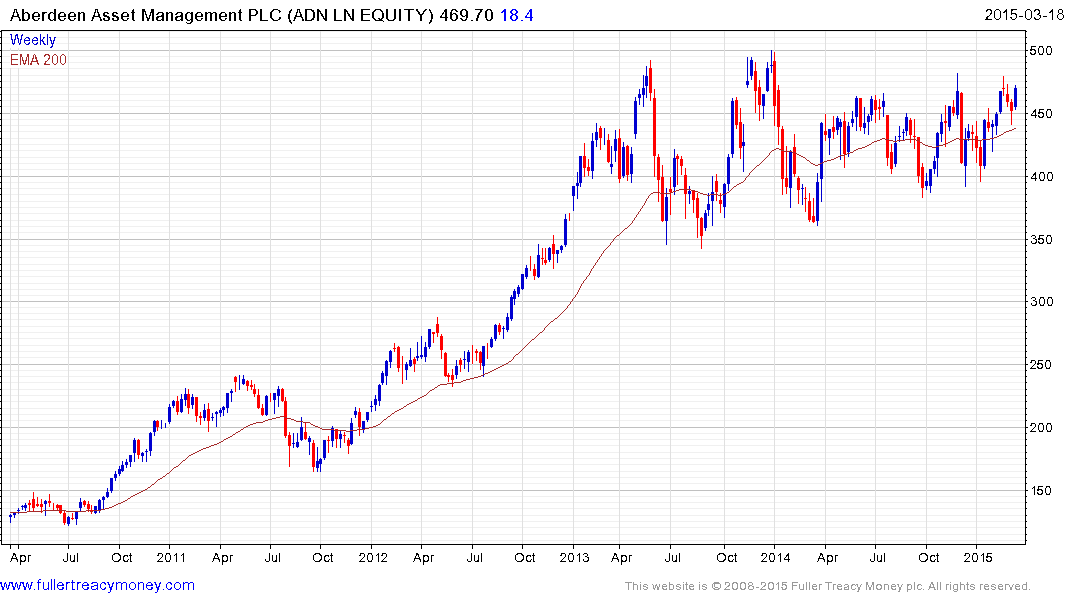

Aberdeen Asset Management has a broadly similar pattern to the FTSE-100 and is rallying towards the upper side of a two-year range.

Hargreaves Lansdown halved in 2014 but found support in the region of 800p from October and has held a progression of higher reaction lows since.

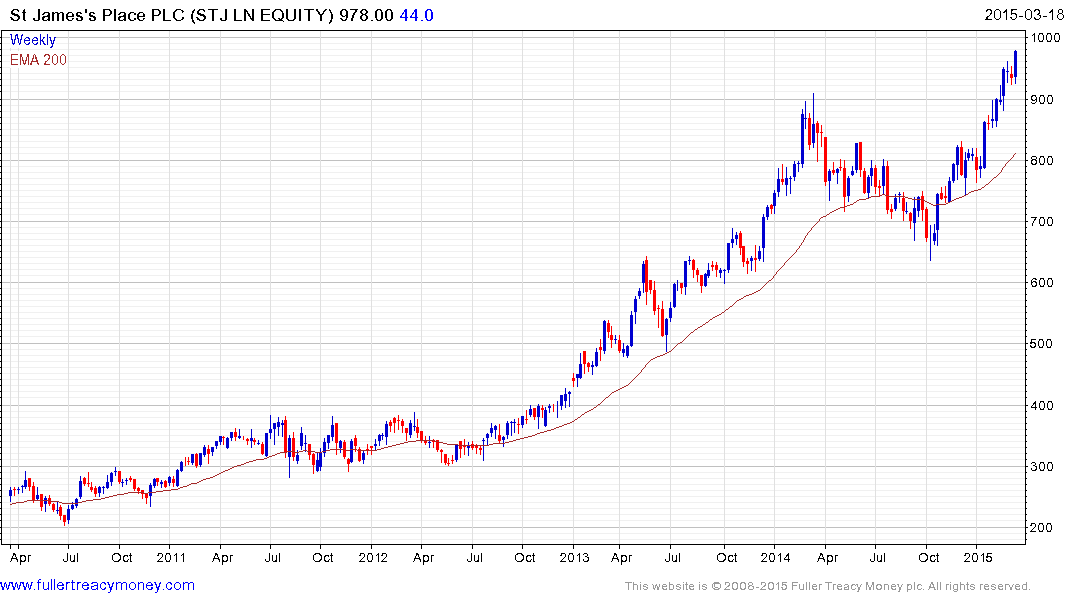

St James’s Place also found support in October and rebounded emphatically to break out to new highs. It continues to extend the advance and a break in the short-term progression of higher reaction lows would be required question medium-term scope for additional upside.

Back to top