U.K. Data Cast Fresh Doubt Over Strength of British Economy

This article by from Bloomberg may be of interest to subscribers. Here is a section:

A picture of an economy losing momentum was reinforced by figures from the BOE showing unsecured credit rose just 254 million pounds ($348 million) in March, the least since November 2012. Mortgage approvals meanwhile dipped to the lowest level this year.

An interest-rate hike this month was seen as a done deal until recently. Investors, who at one stage were assigning a more than 90 percent chance to such a move, have slashed those odds to about 20 percent after weaker-than-expected inflation, cautious comments from Governor Mark Carney and dismal growth figures for the first quarter. Only a small part of the slowdown was due to the heavy snowfalls that brought chaos to the country, statisticians estimate.

“While adverse weather was partly to blame in February and March, there are no excuses for April’s disappointing performance,” said Rob Dobson, director at IHS Markit. “The chances of a near-term hike in interest rates by the Bank of England look increasingly remote.”

The strength of the Pound over the last 18 months will have been at least a contributory factor in the underperformance of factory output that has been cropping up in official statistics over the last few months. The prospect of a Bank of England rate hike is receding in the near term and in turn that has been weighing on the Pound.

Additionally, Amber Rudd’s ouster and replacement by a Euro skeptic has seen the Pound give up some of its advance against the Euro. It is now back testing the region of the trend mean and will need to rally from this region if a failed upside break is to be avoided.

Against the US Dollar, the Pound has dropped to break its progression of higher reaction lows and is now testing the trend mean. A clear upward dynamic is going to be required to confirm a return to demand dominance.

As much as Brexit fears have weighed on the Pound, the Dollar has been firm against a wide basket of currencies. It is now testing the psychological $1.20 area against the Euro and a clear upward dynamic would be required to confirm resistance in this area.

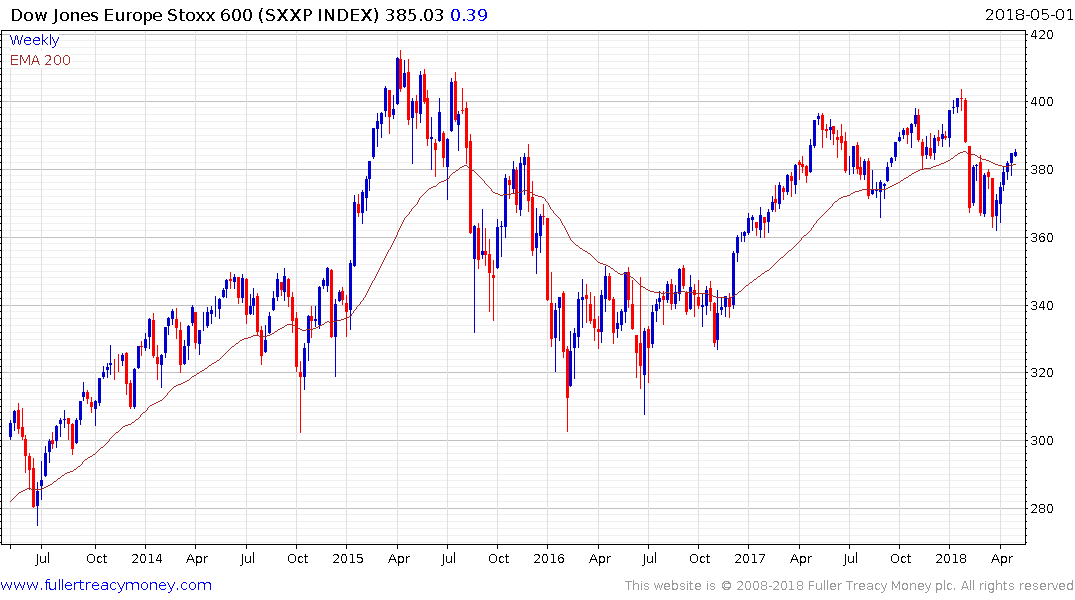

The Dollar’s weakness had been a contributing factor in the underperformance of European equities and vice versa over the last few weeks.