Two Oil Supertanker Giants Combine to Form World's Largest Fleet

This article from Bloomberg may be of interest to subscribers. Here is a section:

Frontline Ltd. and Euronav NV are considering an all-stock merger that would produce the world’s biggest tanker fleet, just as Russia’s invasion of Ukraine drives a recovery in the market.

The creation of a tanker behemoth -- capable of carrying the equivalent of about 100 days of German daily oil demand -- would come at an opportune moment. With shippers shunning Russian vessels, demand for other carriers is increasing, boosting a market that’s languished for more than a year.

Shares of both Frontline and Euronav have rallied this year, valuing a combined tanker company at more than $4.2 billion.

“A combination of Frontline and Euronav would establish a market leader in the tanker market and position the combined group for continued shareholder value creation in addition to significant synergies,” John Fredriksen, who owns a 39% stake in Frontline, said in a joint statement on Thursday.

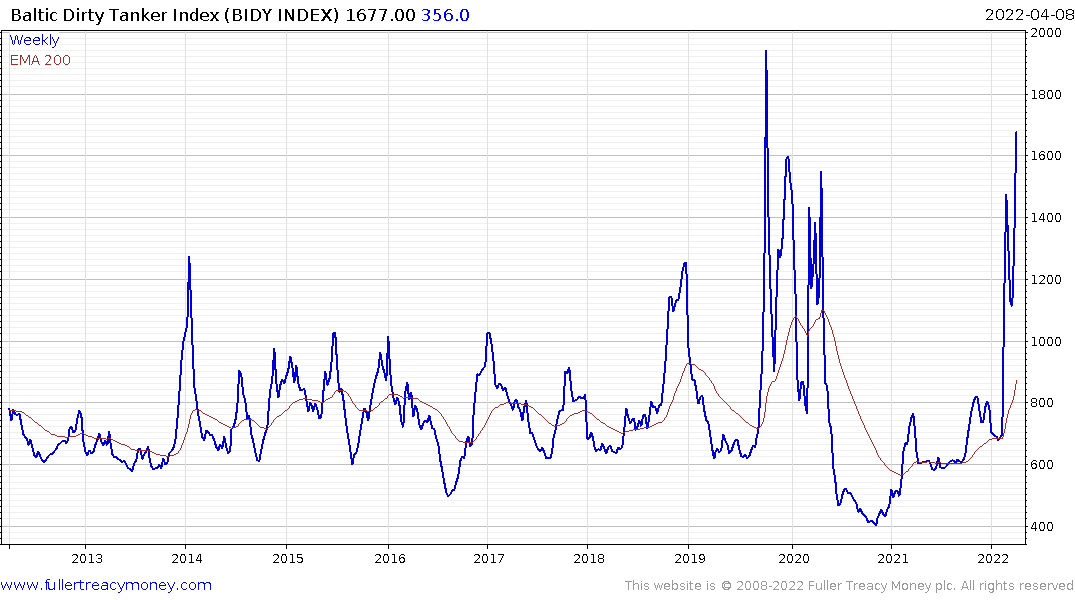

The Baltic Dirty Tanker Index remains on a recovery trajectory since Russia’s fleet is having difficulty moving around. The Index hit a new 14-year high on Friday. Meanwhile Brent crude oil prices are back below $100 and likely to fall further as China’s demand outlook worsens. That begs the question how long the surge in tanker prices will last.

The Baltic Dry Index has fully unwound its 2021 surge and is pulling back into the underlying base formation. Since there has not been a major surge in supply of new ships, that suggests demand is declining as trade with Russia declines and some of China’s ports are locked down.

Meanwhile Euronav popped on the upside last week on news of the merger with Frontline. Consolidation within the industry may bring pricing power but a bear market would be required to prove that case.

Generally speaking, commodities do well in the late stages of an expansion and defensives do best last. Neither are lead indicators for recessions. In fact, they tend to do best right ahead of a recession because demand is strong, and it takes time for monetary oppression to have an effect.

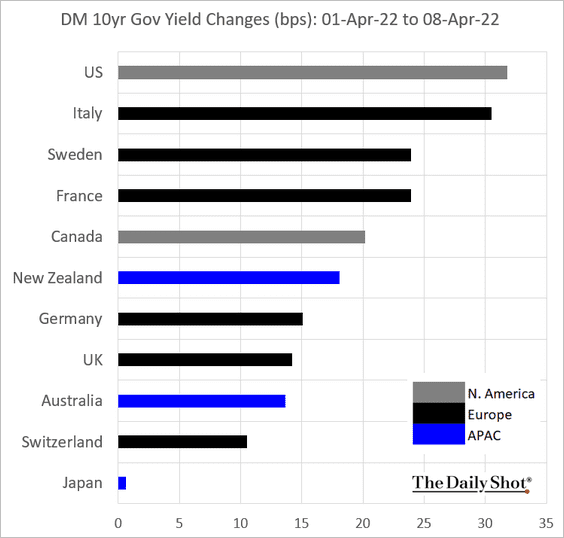

The leading indicators and PMI are not yet sounding alarm bells and high yield spreads have contracted recently. However, the bond market is experiencing severe distress. It is not usually a good sign that US Treasuries are posting higher yields than just about every other bond market. The only developed markets with higher yields at present are Australia and New Zealand but Treasury yields are playing catch up. This action continues to point towards slowing financial market stress.

The leading indicators and PMI are not yet sounding alarm bells and high yield spreads have contracted recently. However, the bond market is experiencing severe distress. It is not usually a good sign that US Treasuries are posting higher yields than just about every other bond market. The only developed markets with higher yields at present are Australia and New Zealand but Treasury yields are playing catch up. This action continues to point towards slowing financial market stress.