Turkey Tanker Spat Escalates With Millions of Barrels Stuck

This article from Bloomberg may be of interest to subscribers. Here is a section:

Late last month, Turkey announced that passing tankers would have to provide letters from their insurers proving they were covered to navigate the straits, through which almost 700 million barrels of crude flowed in the past year. Turkey’s move was a response to European Union sanctions against Russia that bar insurance of vessels if the oil they’re carrying costs above $60 a barrel.

‘Unacceptable’

US and UK officials have been pushing for Turkey to reconsider the proof-of-insurance requirement, especially given that cargoes from Kazakhstan are not subject to sanctions.

“We’ve been in touch with Turkey about how the price cap only applies to Russian oil, and explained that the cap doesn’t necessitate additional checks on ships passing through Turkish waters,” US Treasury spokesman Michael Gwin said. “Our understanding is that virtually all of the delayed tankers are not carrying oil from Russia and are not affected by the cap.”

Still, Turkey said it was “unacceptable” for protection and indemnity clubs that insure risks including collisions and spills not to provide confirmation letters to their commercial customers.

“This letter demanded by us is only about confirming that the ship’s insurance is valid during its passage through Straits,” the ministry said.

Turkey is working on a separate solution for ships without letters that were bound for Turkish refineries, the ministry said, citing “public good and national interest.”

Turkey appears to be taking a leaf out of Singapore’s playbook. As pipeline supply to Europe slows down, Turkey has a clear incentive to position itself as a major centre of refining and as an oil and gas pipeline terminus. That also suggests Turkey will soon break ground on LNG export facilities. This is not a new idea. There has been talk of Turkey being a major energy hub for at least a decade.

The iShares Turkey ETF broken out of a four-year base formation over the last months and looks susceptible to some consolidation. The big question for Turkey is how long the war in Ukraine lasts and whether it will result in permanent change in terms of altered supply routes.

The iShares Turkey ETF broken out of a four-year base formation over the last months and looks susceptible to some consolidation. The big question for Turkey is how long the war in Ukraine lasts and whether it will result in permanent change in terms of altered supply routes.

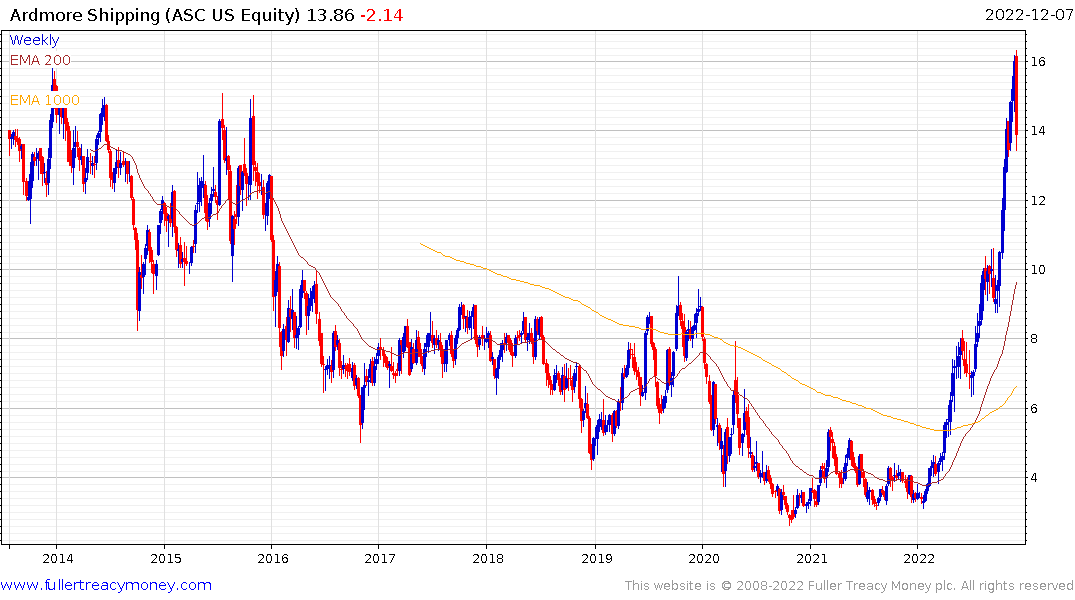

Meanwhile tanker stocks tend to be highly cyclical. They do best when economic activity is robust and oil prices are high. This sub sector of the shipping industry has rocketed higher over the last six months even as container volume has cratered. This week has delivered a large number of downside weekly key reversals and suggests a peak of at least near-term and potentially medium-term significance for oil tankers.

It is worth remembering that massive outperformance by commodity plays is a hallmark of the final stages of an economic expansion.

For example Ardmore Shipping has jumped from around $3 to $16 this year and became significantly more volatile this week.

For example Ardmore Shipping has jumped from around $3 to $16 this year and became significantly more volatile this week.