TSMC Expects 30% Sales Rise Despite Global Economic Ructions

This article from Bloomberg may be of interest to subscribers. Here is a section:

Sales growth this year should accelerate from 2021’s 24.9%, which was in dollar terms, Chairman Mark Liu said at the company’s annual shareholder meeting on Wednesday. That’s in line with executive remarks in April that gave an official outlook of topping mid- to high-20% growth in 2022.

TSMC’s projection comes as concerns persist that inflation, the war in Ukraine and Chinese lockdowns will hammer demand for gadgets. On Wednesday, executives acknowledged smartphones and computers have been hard-hit but that spending in other areas such as electric vehicles have exceeded expectations. They played down the effect of inflation, saying the rise in prices was gradually abating.

“The current inflation has no direct impact on the semiconductor industry as the demand drop is mainly for consumer devices like smartphones and PCs while EV demand is very strong and partially exceeds our supply capacity so we are making inventory adjustments,” Liu said. “Utilization rate is full for the rest of the year.”

TSMC reaffirmed previous projections for $17.6 billion to $18.2 billion of revenue this quarter, supporting gross margins of as much as 58%.

TSMC, the most advanced maker of chips for tech giants from Apple Inc. to Nvidia Corp., rose more than 1% in Taipei, after having shed more than a tenth of its value this year. While the Taiwanese company has been one of the biggest beneficiaries in past years of soaring demand for chips in a growing range of connected devices, investors fear policy tightening around the world will begin to erode consumption in 2022.

BMW reported today that its sales of electric vehicles are on track to double this year. That’s in line with the company’s projections even as sales of conventional vehicles decline sharply. Tesla also reported sales of vehicles in China are rebounding quickly.

This is great news for a company like TSMC. In normal circumstances the flattening out of demand in PCs and smartphones would be a drag. Today, the rising cost of gasoline and diesel is catalysing the decision of many consumers to buy EVs. That’s supporting demand for at least that segment of chips.

![]()

TSMC had a peak to trough decline of almost 50% so it is natural to think whether the selling pressure has been overdone and if value is now present. There is certainly room for a further bounce back towards the 200-day MA. At least some time for support building remains likely following an initial short covering rally.

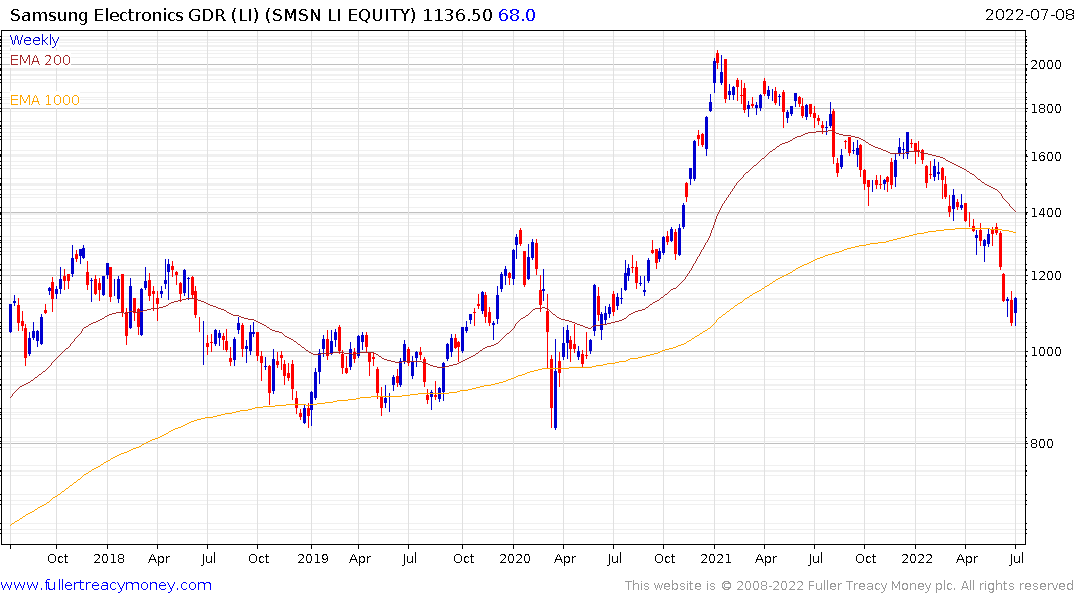

Samsung Electronics also had strong quarterly sales but guidance was flat. It is much more reliant on consumer electronics rather than exposure to the automotive sector. The share has also fallen by almost 50% and is now steadying. It is equally liable to experience a period of support building if this is in fact the low.

![]()

Both these shares led the wider semiconductors sector lower. The Philadelphia Semiconductors Index has fallen less and is now steadying in the region of the 1000-day MA. A break in the sequence of lower rally highs is the minimum requirement to signal more than a short-term low.

Nvidia fell more than any of the above but is also pausing in the region of the 1000-day MA. It has a stronger focus on the PC, crypto mining and database sectors. These represent where the greatest risk resides as financial conditions tighten.

The Nasdaq-100 is also in the region of its 1000-day MA. This long-term trend mean has historically been the most reliable buy the big dip opportunity in secular bull markets. Therefore, the broad market is at a critical juncture. The Nasdaq-100 has been the best performing large cap index globally for 14 years. If this trend is still intact, the 11,000 level will hold.

The big question therefore is whether the fountain of liquidity is still going to be pour forth when inflationary pressures abate.

Resistance in the region of the 1000-day MA would clearly signal a break of the secular trend. The continued rebound in Treasury yields suggests there will be continued volatility.

Back to top