Trump trade investigation will 'poison' relations with China, media warns

This article by for the Guardian may be of interest to subscribers. Here is a section:

“Given Trump’s transactional approach to foreign affairs, it is impossible to look at the matter without taking into account his increasing disappointment at what he deems as China’s failure to bring into line [North] Korea,” the English-language paper said.

“But instead of advancing the United States’ interests, politicising trade will only exacerbate the country’s economic woes, and poison the overall China-US relationship.”

An administration official said diplomacy over North Korea and the potential trade probe were “totally unrelated”, saying the trade action was not a pressure tactic.

The China Daily said it was unfair for Trump to put the burden on China for dissuading Pyongyang from its actions.

“By trying to incriminate Beijing as an accomplice in [North Korea’s] nuclear adventure and blame it for a failure that is essentially a failure of all stakeholders, Trump risks making the serious mistake of splitting up the international coalition that is the means to resolve the issue peacefully,” it said.

The US Administration might be backing away from confrontational rhetoric regarding North Korea, but the question of China’s trade practices is now moving centre stage. China’s practice of insisting on technology transfer, which is then used to promote domestic manufacturing in direct opposition to the original foreign firm’s interests is predatory. It’s hard to imagine that a government investigation won’t be able to find evidence of unfair trade practices if it wants to.

Some commentators, not least Kenneth Rogoff, have pointed towards China’s large holdings of US Treasuries as an inhibiting factor to trade sanctions. However, if the Chinese were to sell US Treasuries en masse they would necessarily be buying Renminbi which would result in a massive currency appreciation, killing off the manufacturing sector in the process. Of course, significantly higher yields would also have a deleterious effect on the USA’s ability to fund itself so it would be a beggar they neighbour strategy, akin to nuclear confrontation.

A subtler alternative would be to highlight how integral China is to the global supply chain by once again restricting supply of rare earths. On this occasion China could curtail global exports rather than simply focusing on Japan. China dominates the global supply chain for rare earth metals and by restricting supply back in 2005 sent prices soaring. It then flooded the market with supply to force new heavily indebted mines into bankruptcy.

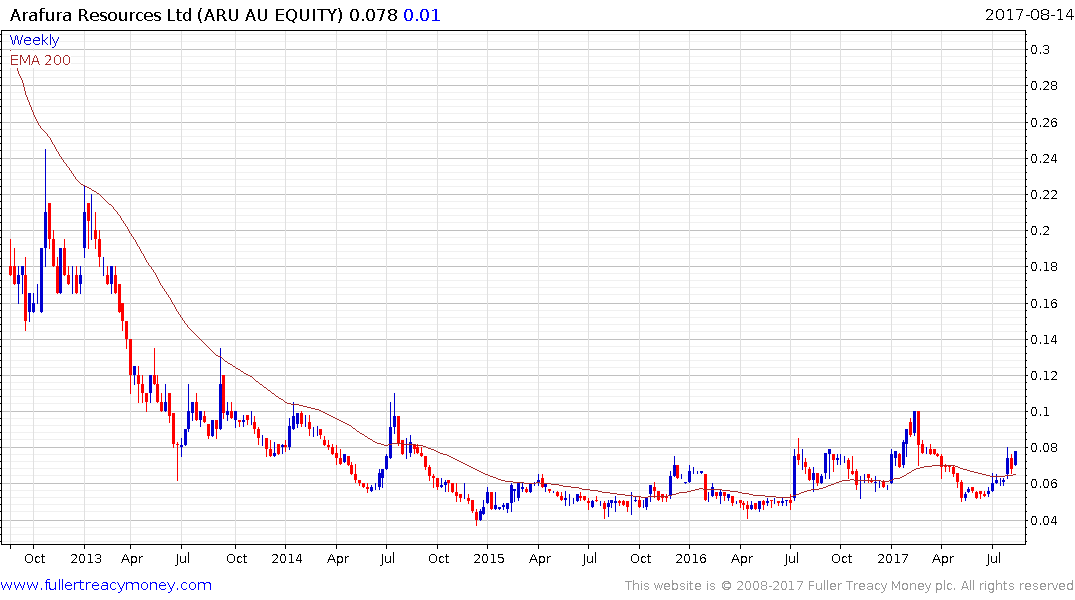

Australian listed Lynas Corp, Arufura, Alkane Resources and Greenland Minerals are all back trading above their respective trend means.