Trichet Sees G-7 Opportunity Window for Currency Accord

This article by Mark Deen and Simon Kennedy for Bloomberg may be of interest to subscribers. Here is a section:

Trichet’s comment follows a suggestion this month by economists led by Stephen King at HSBC Holdings Plc who said “there’s a case for a global accord” to safeguard the U.S. expansion and reduce savings elsewhere.

Under their blueprint, the U.S. would offset a stronger dollar with monetary and financial stimulus, while China would reduce household savings by opening up capital markets and boosting consumer demand. Germany would raise its retirement age to encourage its population to save less and reduce a current- account surplus.

“These measures would both support demand in the near term while sustainably reducing the global savings glut,” the economists wrote. “However, while the economic logic is strong, political realities are likely to prevent such an accord being reached, suggesting that the world economy remains highly unstable.”

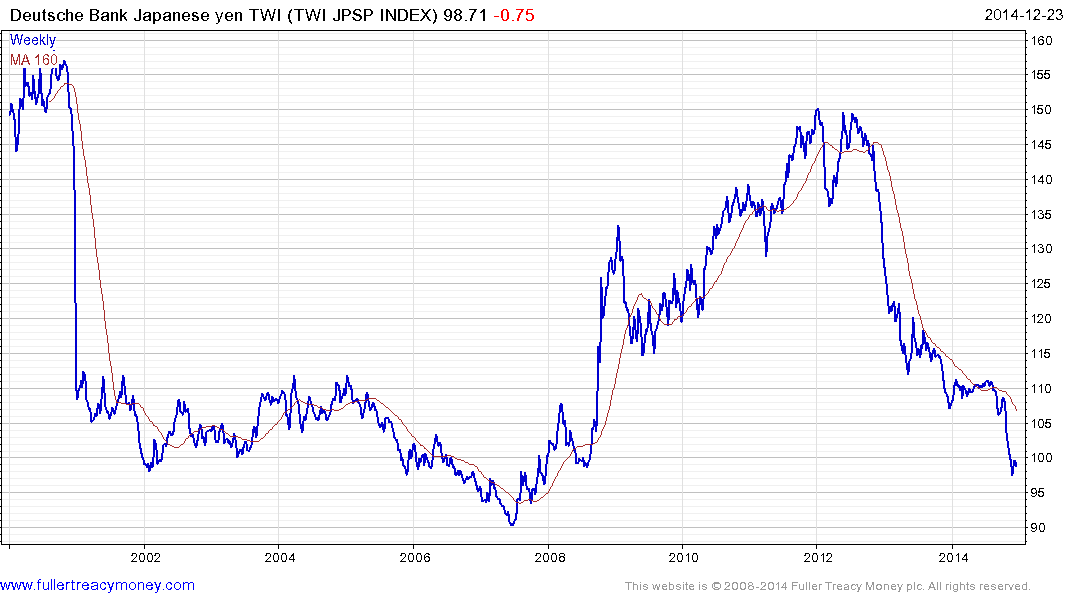

The Japanese decision to devalue the Yen from late 2013 has shaken up the status quo in the global currency markets. Not only is it one of the world’s largest freely traded currencies but also because the Japanese economy is a regional heavyweight in Asia. With Japan aggressively targeting its exchange rate other Asian countries had little choice but to allow some weakness in their currencies in order to remain competitive.

The Asian Dollar Index has completed a type-3 top formation falling for nine consecutive weeks. While somewhat oversold in the short term, a sustained move back above 114 would be required to question medium-term scope for additional weakness.

Japan and Europe in particular compete in many of the same markets not least the auto sector. The Euro was surprisingly firm throughout the most troubling period of its sovereign debt crisis not least because the ECB refused to increase the supply of money. As we enter a period where Europe needs a weaker currency in order to fend off non trivial deflation and to preserve competitiveness, there is scope for additional weakness in the Euro.

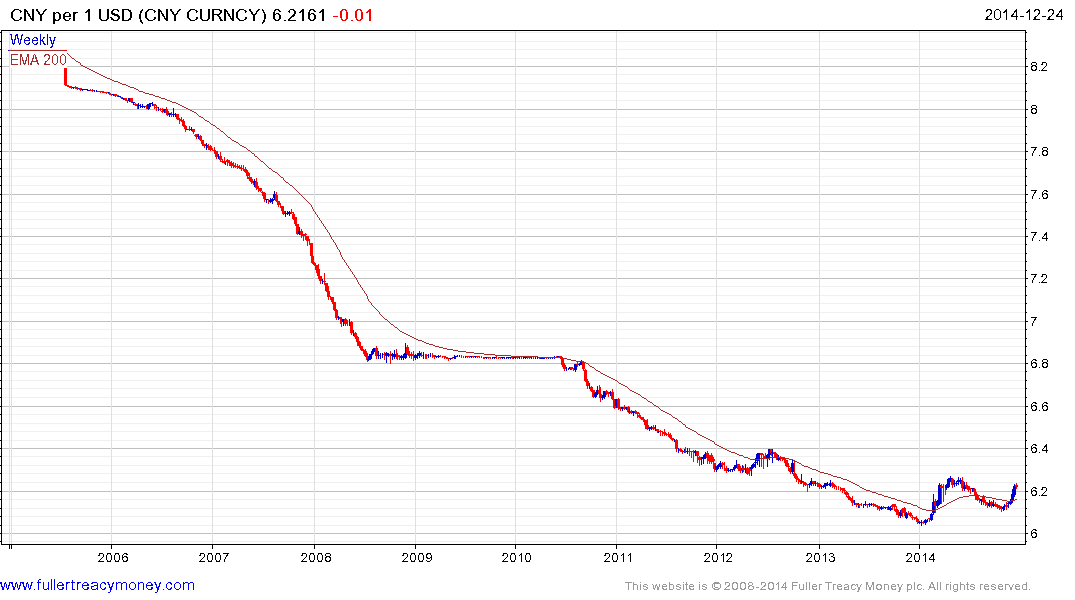

China has worked hard to manage the value of its currency higher over much of the last decade but that would now appear to be over since it is unlikely to tolerate being the only country in Asia with an appreciating currency.

Considering the competing themes evident from the above price charts, it would probably require a true currency crisis to deliver the political impetus necessary to force countries into a more stable currency regime.

Back to top