Treasury Yields Surge Past 1.6%, Sounding Alarm for Risk Assets

This article from Bloomberg may be of interest. Here is a section:

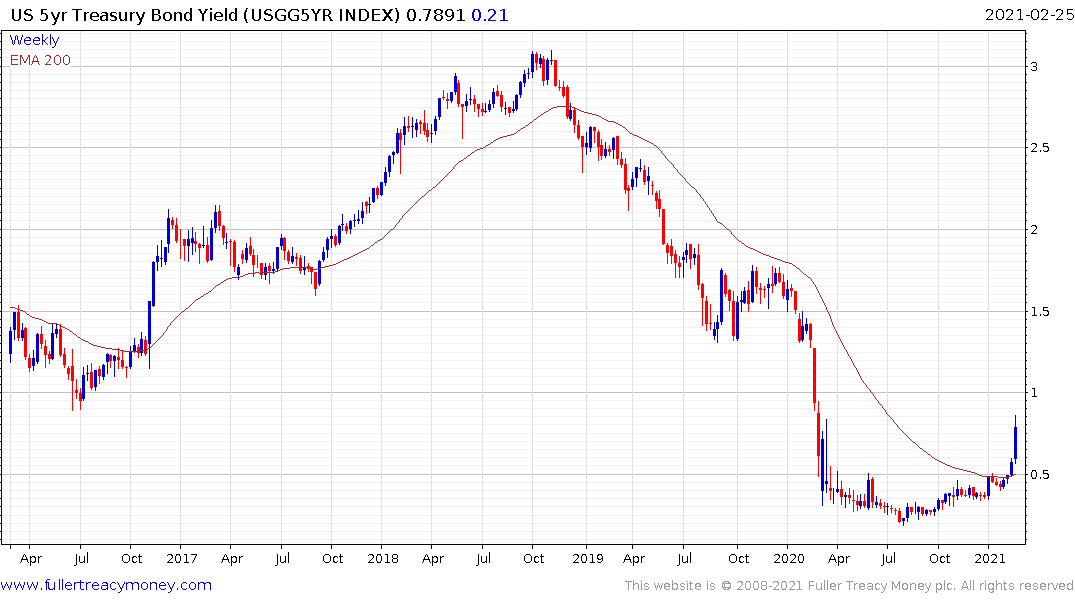

The 5-year note is of particular interest to many in the $21 trillion Treasuries market. Earlier this week, tepid demand in an auction of five-year notes brought into focus this key part of the curve, which also reflects medium-term expectations for Fed policy. Then on Thursday, a measure of demand for a $62 billion auction of 7-year Treasury notes came in at a record low.

The rout comes as investors continue to reprice expectations for Fed hikes as the vaccine rollout and the prospect of additional stimulus foster a rosier outlook for the economy. Yields on 2- and 5-year yields are more influenced by the starting point and speed of normalization, said Bank of America Corp. rates strategist Ralph Axel.

“Everything that we see keeps pushing us into sooner, faster, more in terms of removing accommodation,” Axel said.

The surge in yields is hurting riskier assets. Emerging-market currencies such as the South African rand and Mexican peso sold off sharply against the dollar, and the S&P 500 Index dropped as much as 2.6%.

In Europe, peripheral countries have led a bond sell-off, with Italy’s 10-year yield spread over Germany climbing back above 100 basis points. Core debt wasn’t spared, with yields on France’s benchmark debt turning positive for the first time since June.The 5-year note is of particular interest to many in the $21 trillion Treasuries market. Earlier this week, tepid demand in an auction of five-year notes brought into focus this key part of the curve, which also reflects medium-term expectations for Fed policy. Then on Thursday, a measure of demand for a $62 billion auction of 7-year Treasury notes came in at a record low.

The rout comes as investors continue to reprice expectations for Fed hikes as the vaccine rollout and the prospect of additional stimulus foster a rosier outlook for the economy. Yields on 2- and 5-year yields are more influenced by the starting point and speed of normalization, said Bank of America Corp. rates strategist Ralph Axel.

“Everything that we see keeps pushing us into sooner, faster, more in terms of removing accommodation,” Axel said.

The surge in yields is hurting riskier assets. Emerging-market currencies such as the South African rand and Mexican peso sold off sharply against the dollar, and the S&P 500 Index dropped as much as 2.6%.

In Europe, peripheral countries have led a bond sell-off, with Italy’s 10-year yield spread over Germany climbing back above 100 basis points. Core debt wasn’t spared, with yields on France’s benchmark debt turning positive for the first time since June.

The 5-year Treasury best approximates the average duration of the US debt market so it tends to attract a lot of notice from bond traders. The surge in yields is being driven by two factors. The first is investors are increasingly willing to price in a quick recovery. The second is the indifference of the Fed to higher rates.

Jay Powell gave a green light to speculation this week. He opined that the recovery will take a long time and that unemployment will remain elevated. The market thinks otherwise. They both can’t be right. Investors are betting the Fed will have to raise rates, the Fed has said they are not going to do that.

Some will think this is the return of bond vigilantes who are intent on imposing fiscal constraint on the US government. Instead, it may simply push the Fed into further examples of outright monetary financing.

The primary reason for the Fed’s reticence to embrace the quick reflation narrative is because they know there are big issues yet to tackle. Delinquent commercial property mortgages and homeowners who were granted forbearance on their loans still need to be dealt. There are also still millions of consumers struggling to make ends meet.

The higher yields climb, the greater the pressure on the Fed to act. I’ve been saying since the beginning of the year that they would be unlikely to act until the stock market gives them a reason to. The Fed has given up making forecasts, they are waiting for the market to tell them where the point of resistance is on rising yields.

The S&P500 erased the rebound of the last couple of days today but is still holding the short-term sequence of higher reaction lows. A deeper reaction will likely be required, possibly towards the 200-day MA or about 10%, to spur action.