Treasury Yields Surge as Fed Officials Quash Policy Pivot Talk

This article from Bloomberg may be of interest to subscribers. Here is a section:

Bond yields rebounded after San Francisco Fed President Mary Daly said the central bank is “nowhere near” being almost done in fighting the hottest inflation in four decades. Chicago Fed President Charles Evans signaled that the central bank needs to keep raising rates next year to contain price pressures. Over the weekend, Minneapolis Fed President Neel Kashkari said that there’s “a long way away from” achieving the central bank’s target.

PMI figures were surprisingly firm and that suggests the slowdown in the economy is not as pronounced as feared. That’s a signal to the Fed that the lagged effect of tightening policy has not yet been felt. They have no reason to stop tightening until they have clear evidence of an impact on growth and employment.

Initial demand for safe havens like gold and Yen ebbed while the Dollar posted an upside key day reversal when Nancy Pelosi’s plane landed unmolested.

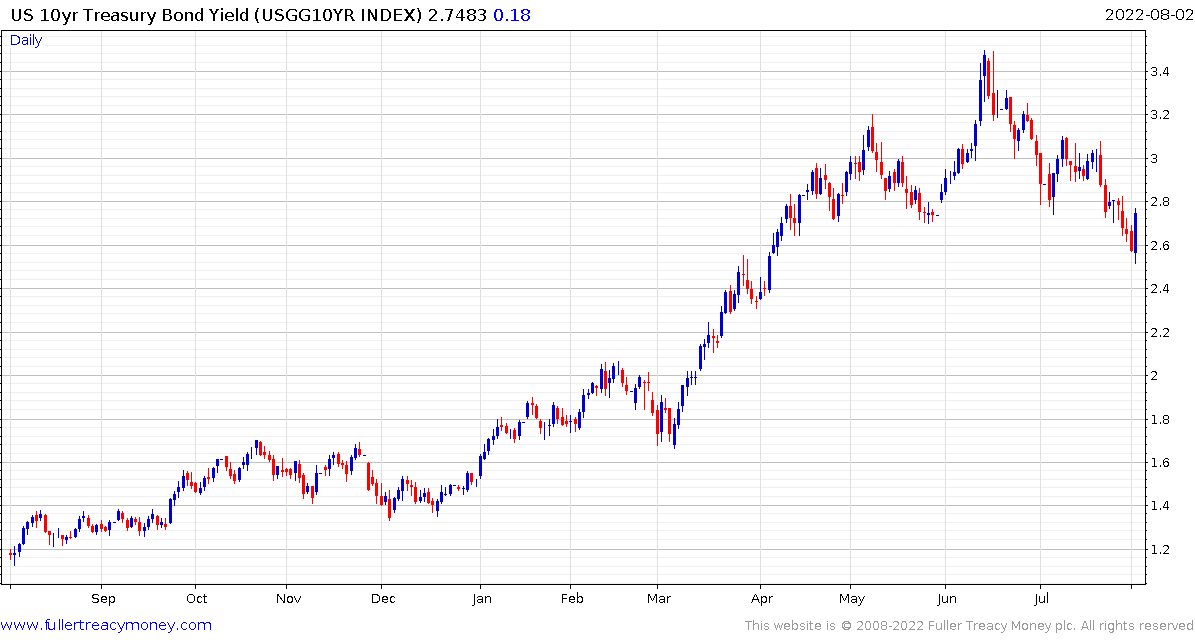

10-year Treasuries yields also posted an upside key day reversal.

10-year Treasuries yields also posted an upside key day reversal.

The stock market rebounded over the last couple of weeks and there is a lot of speculation the low is in. That might be the case. Several contrarian indicators support that view.

I feel conflicted because every other major low has tended to coincide with a Fed pivot so there is significant risk of additional volatility.

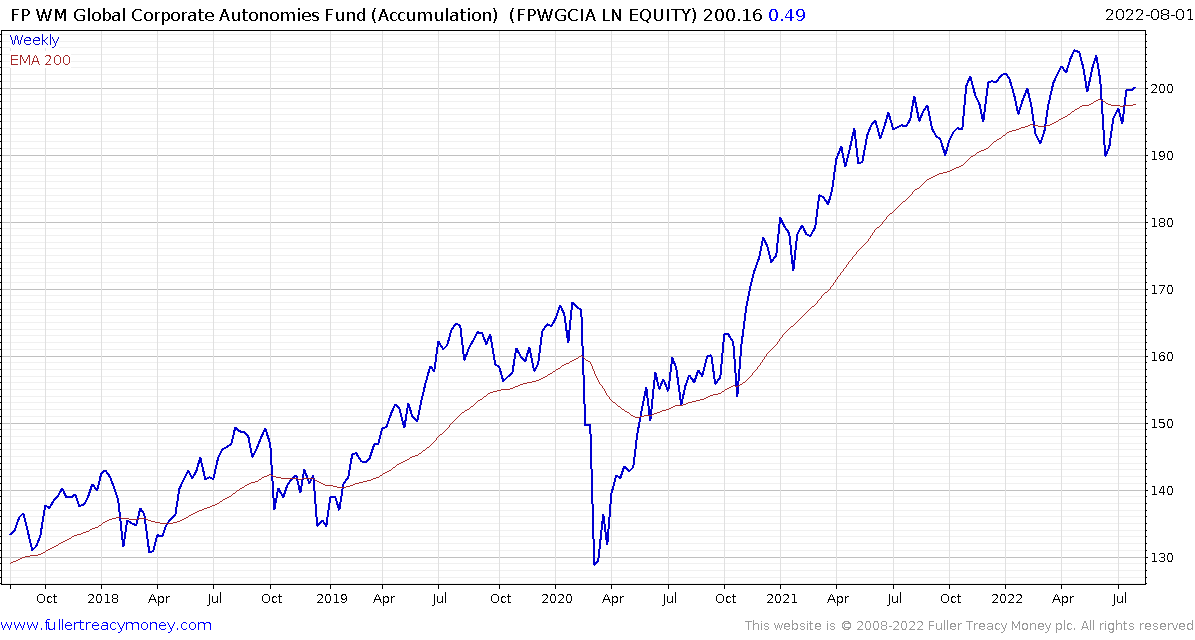

My sense is the Fed is going to keep tightening until they break something. Just because we have not yet had evidence that something has broken does not mean it won’t. That continues to point to a stock picker’s market.

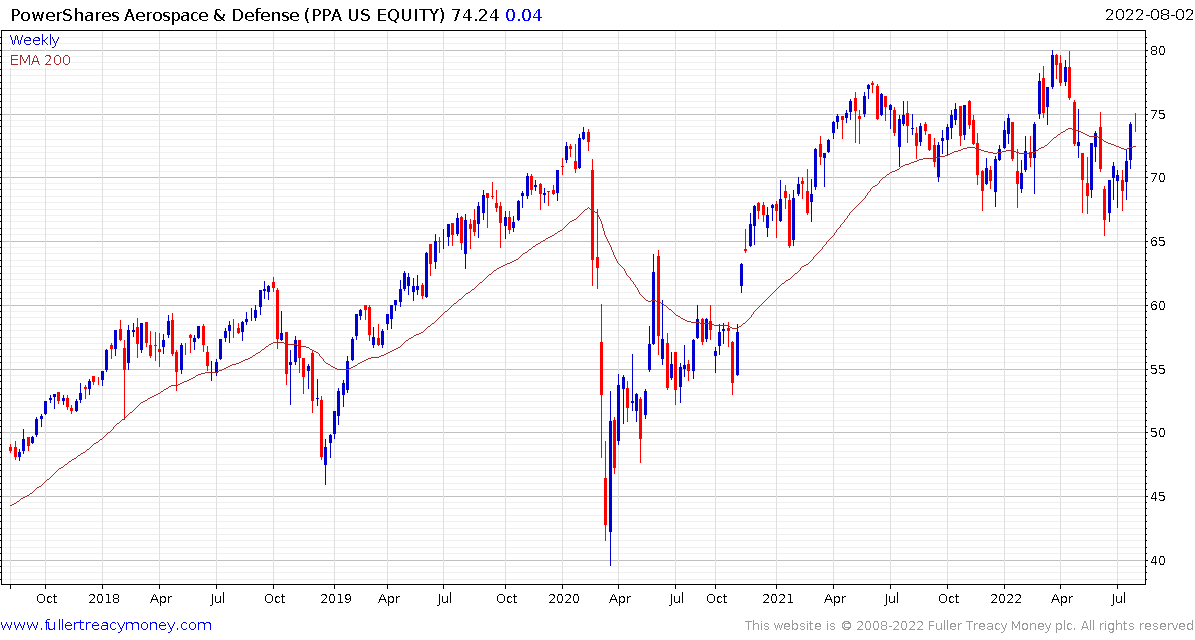

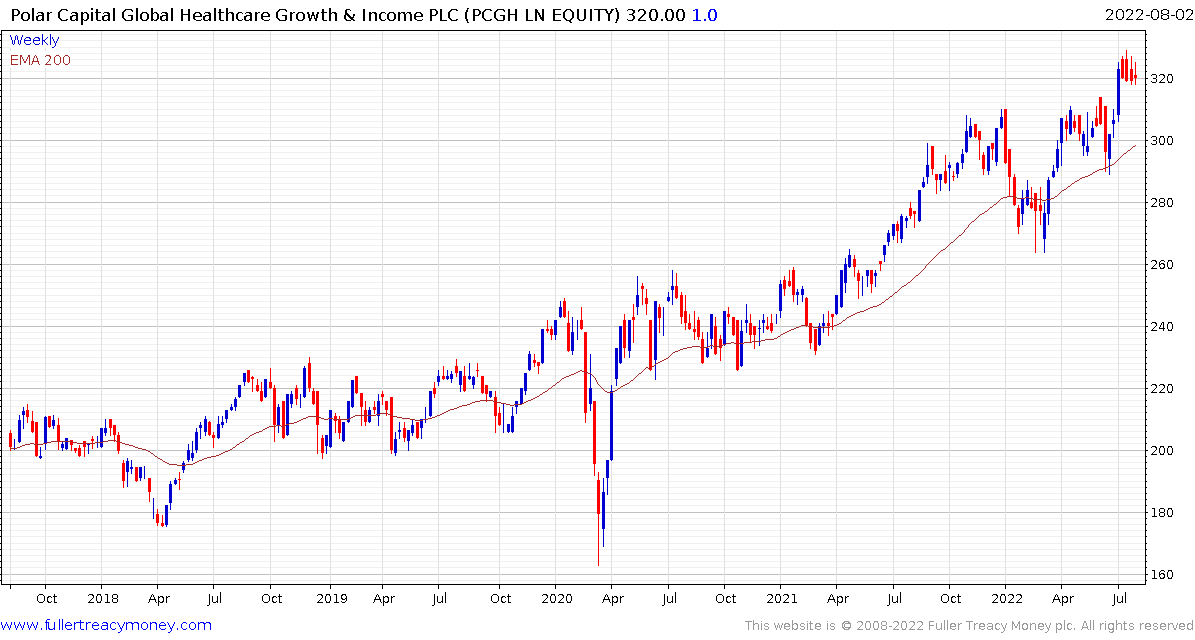

Fertilisers, defense, healthcare and select tech companies continue to weather this situation better than most.