Treasury Yields Plunge as Traders Run With 'Good News' on CPI

This article from Bloomberg may be of interest. Here is a section:

Yields in the world’s biggest bond market spiraled downward as traders slashed their outlook for just how high the Federal Reserve will need to hoist its policy rate after consumer-price pressures slowed more than estimated last month.

Swaps traders downgraded the odds of another three-quarter-point rate increase in December almost to nil, while continuing to price in a half-point hike. On the prospect of a slower tightening trajectory the five-year yield tumbled as much as 31 basis points, putting it on track for its biggest one-day drop since 2009. The benchmark 10-year yield fell as much as 27 basis points to 3.82%. US stocks soared and the Bloomberg dollar index plunged.

The so-called terminal rate, or the expected peak for the Fed’s policy rate, was cut to under 4.9%, sometime around May. Before the latest CPI readings the peak rate in swaps referencing the central bank’s policy meetings was around 5.09%.

“Markets are reacting aggressively to the CPI release,” said Gregory Faranello, head of US rates trading and strategy at AmeriVet Securities. “After a year like we’ve had, people are very anxious for some good news.”

The convexity of bonds (their sensitivity to interest rates) declines the higher yields move. The reason yields surged earlier this year was because prices were high, yields were low and the market was especially sensitive to interest rates hikes. The higher yields go, the more attractive they become. Obviously 4% is more attractive than 0.5% and compounds at a much more impressive rate.

The fact that there are only seven weeks left in the year and the 60/40 structure has had its worst performance in decades suggests investors are desperate for an opportunity to rescue their year. If inflation is peaking, the relative value represented by the risk free rate is attractive to many fixed income investors.

The point I have made in several big picture videos is quantitative tightening first leads to Treasury yields rising because investors worry about supply increasing. Then yields collapse because investors worry more about deflation. Today’s break lower suggests that may now be underway.

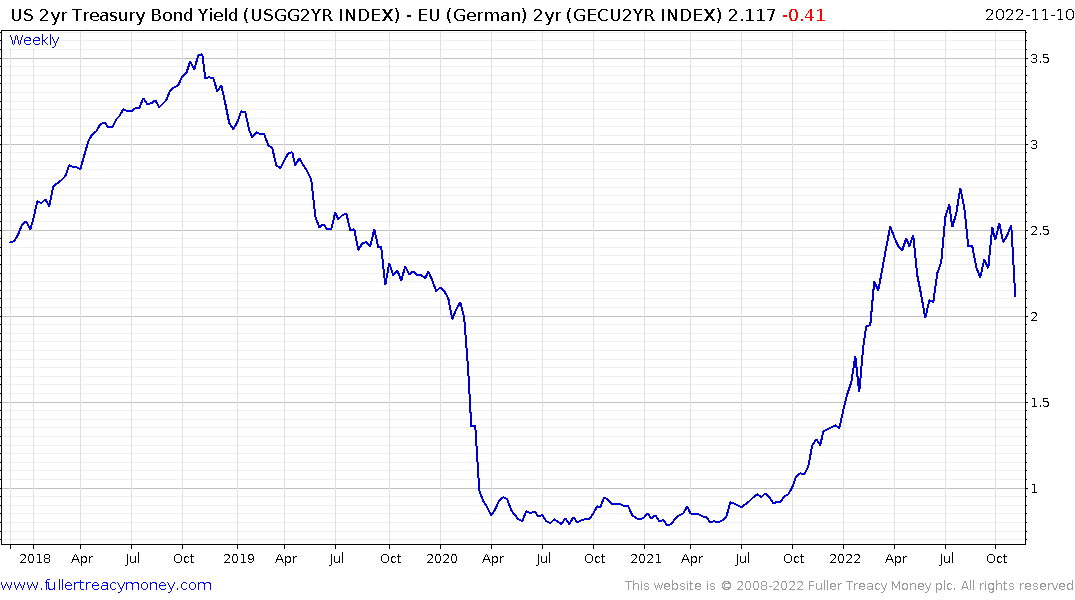

The Dollar also broke lower which confirms the only thing holding it up has been the interest rate differential. The spread between the US and EU 2-year yields is rolling over suggesting investors are already pricing in a much narrower interest rate spread going forward.

On the other side of the ledger if, for any reason, relations between Russia and Europe thaw there is significant scope for European currencies to rebound. Crude oil has steadied with Dollar weakness but did not react in anything close to the same way as gold or copper.

Gold’s upward dynamic this week has clearly broken the seven-month sequence of lower rally highs. It confirms short-term, and potentially medium-term support in the region of $1600. If the dollar continues to lower, gold’s rebound to new all-time highs before spring will be significantly burnished.