Treasury Market's Long-Dormant Term Premium Is Finally Reviving

This article by Liz Capo McCormick and Luke Kawa for Bloomberg may be of interest. Here is a section:

“We remain of the view that the U.S. term premium is still too low when conditioned against the macro outlook, and the uncertainty around it,” Francesco Garzarelli and his fellow strategists wrote in a note Tuesday. “We recommend preserving a short duration exposure and expect the rebuild of the term premium to lead to a steeper” U.S. yield curve.

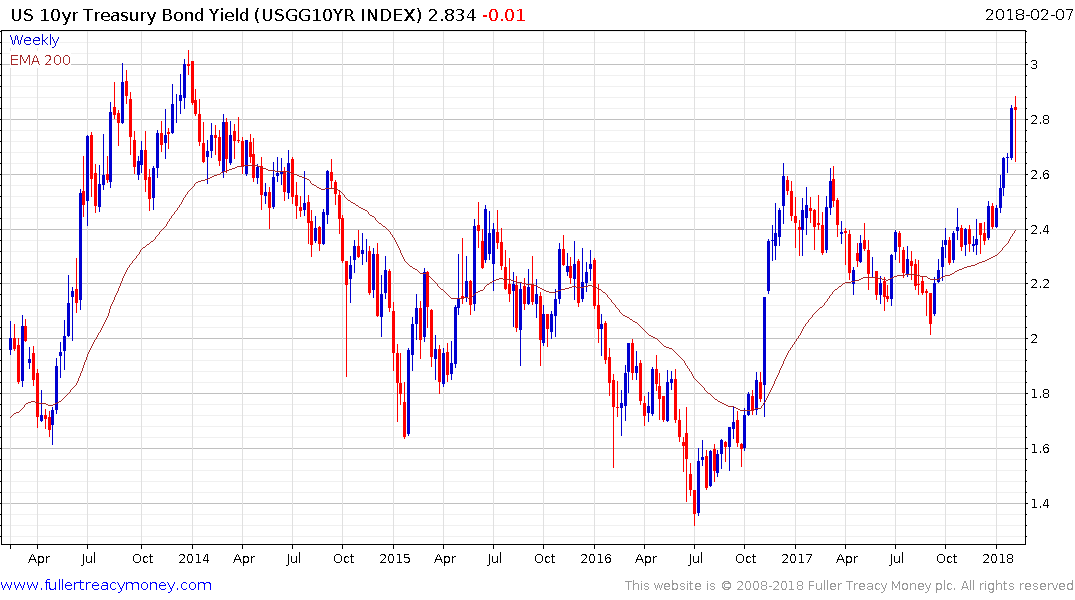

Goldman Sachs issued a short recommendation for 10-year Treasuries in November, which the strategists maintain. The firm’s model for fair value -- given economic fundamental and the expected pace of Fed tightening -- has the note at 3.09 percent, compared with about 2.8 percent now.

The term premium is the extra compensation that buyers demand to hold longer-maturity debt instead of a succession of short-term securities year after year. A widely used valuation tool, it tumbled across world markets in the wake of the financial crisis as the Fed and its counterparts bought debt as part of stimulus measures.

The 10-year Treasury term premium is negative 0.29 percentage point, up from a record low of negative 0.84 percentage point in 2016. As the name implies, it’s normally positive.

Its increase in 2018 marks a departure from its typical downward trend during Fed tightening cycles. But much is different this time around -- namely, the central bank’s balance-sheet tapering.

The Fed is buying fewer bonds and the Treasury is attempting to issue more. That is a recipe for yields to move higher. The imposition of deficit fueled tax cuts has reignited the prospect of the bond market taking issue with fiscal profligacy while the prospect of an additional infrastructure bill is likely to have an even greater deleterious effect.

US 10-year Treasuries posted a large downside key reversal on Monday but have so far not followed through on the downside. In fact, with tepid demand at today’s Treasury auction and investors beginning to gesticulate about the lack of a term premium there is scope for additional upside. A sustained move below 2.6% would now be required to question current scope for additional upside.

.png)

This graphic piqued my interest this morning; showing the number of times ‘healthy correction’ appeared in Bloomberg stories. It seems to me there is still a lot of complacency among investors, with a tendency to dismiss the largest pullback in years as a blip appearing to be common among commentators. I think we have seen a peak of medium-term significance and it is reasonable to expect a good deal of ranging before confidence is restored.

Meanwhile shares that still have wide overextensions relative to the trend mean are obviously at the most risk of pulling back.

The overt desire of the US administration for a weak Dollar may be receiving some push back from the Eurozone with the Euro now unwinding its short-term overbought condition relative to the trend mean. However, a sustained move below $1.20 would be required to question medium-term scope for continued upside.

.png) Gold is now pulling back from the upper side of its 18-month range and is potential for a successful break out is to remain credible it will need to bounce to from the region of the trend mean which is currently near $1286.

Gold is now pulling back from the upper side of its 18-month range and is potential for a successful break out is to remain credible it will need to bounce to from the region of the trend mean which is currently near $1286.