Treasuries Tumble After ADP Employment Tops Highest Estimates

This note by Elizabeth Stanton for Bloomberg may be of interest to subscribers. Here it is in full:

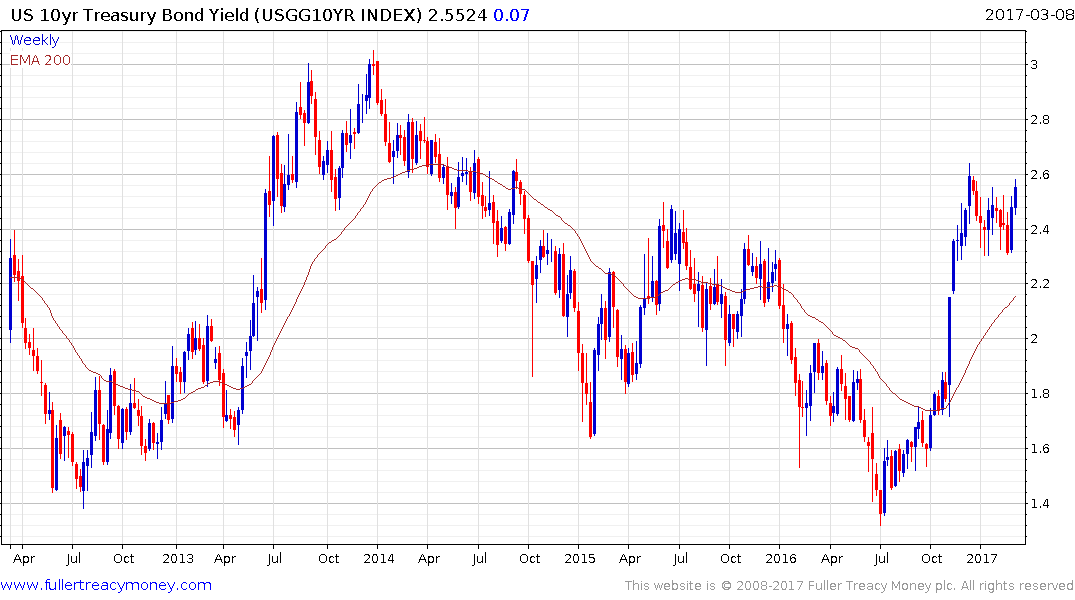

Treasuries slumped, pushing 10-year yields to the highest level since December, after a measure of U.S. private-sector job growth for February exceeded the most optimistic expectations two days before the Labor Department’s monthly employment report.

Yields were higher by 4-6 basis points at about 9:10 a.m. in New York as the market priced in a faster pace of Fed rate increases following the one already expected next week. The 10- year climbed as much as 6.4 basis points to 2.582 percent, the highest level since Dec. 20.

Treasury plans to sell $20 billion of the 10-year note in an auction at 1 p.m. The new notes yielded 2.575% in when-issued trading, above 10-year auction stops since July 2014.

ADP Employment increased 298k in February vs 187k median est. in Bloomberg survey, in which highest est. was 255k; February employment report is forecast to show 190k increase in nonfarm payrolls based on median est., which may rise if economists revise higher based on ADP

Yields across the curve touched the highest levels this year, led by the 5Y, which climbed 6.2bp to 2.111%

5s30s yield curve flattened, touching 104.5bp, within 5bp of lowest levels of recent years

USD OIS pricing upgrades odds of 25bp March hike to 87% (versus 83% Tuesday), while odds of a second 25bp hike in September, based on 5th Fed dated OIS, climbed to 97% from 87%IG credit issuance slate also in focus after nearly $40b priced over previous two sessions, weighing on Treasuries; United Health Group joins Wednesday’s slate with $benchmark 10Y and 30Y offering

The US economy has been on a recovery footing since 2010 and while the pace of the expansion has been modest it has delivered on job growth. The declining participation rate has flattered unemployment statistics but with more people being employed and upward pressure in the pipeline from higher minimum wages there is the potential for people to be attracted back into the workforce which could keep a temporary lid on inflation but would be unlikely to represent a long-term solution.

Most of the media commentary about the Trump administration’s childcare tax credit seems to focus on how it favours wealthier families. However that ignores the fact many people left the work force because they risked losing the healthcare subsidy and had to pay for childcare. Reducing the cost of both removes an obstacle to people re-entering the workforce.

The 10-year Treasury yield moved through 2.5% today to break the short-term progression of lower rally highs. A clear downward dynamic would be required to question potential for additional upside.

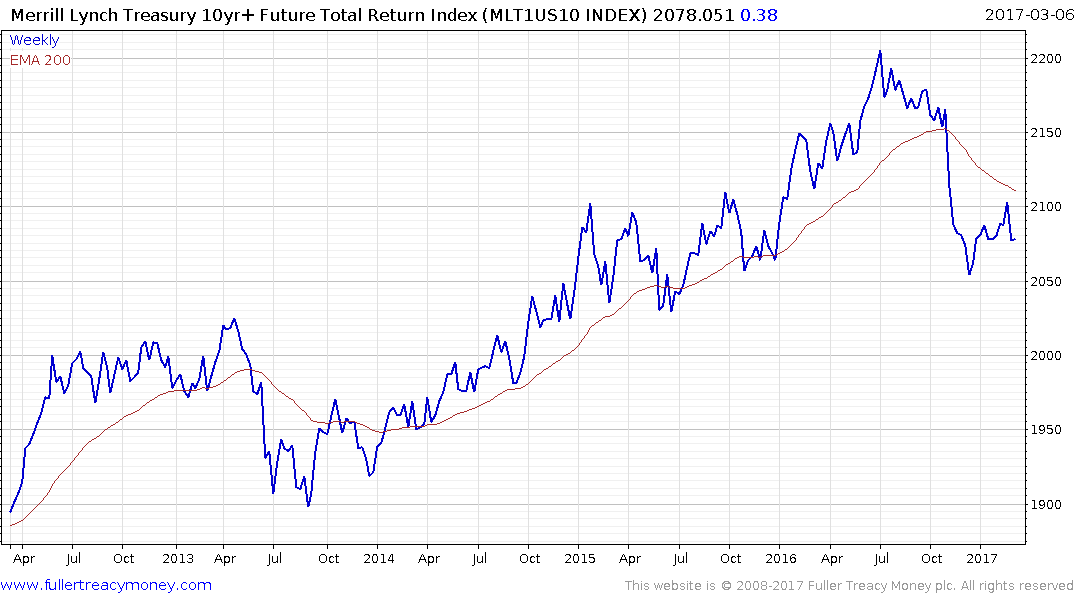

The Merrill Lynch 10-year US Treasury Futures Total Return Index has encountered resistance in the region of the trend mean and is testing recent lows. A clear upward dynamic is going to be required to signal a return to remand dominance.

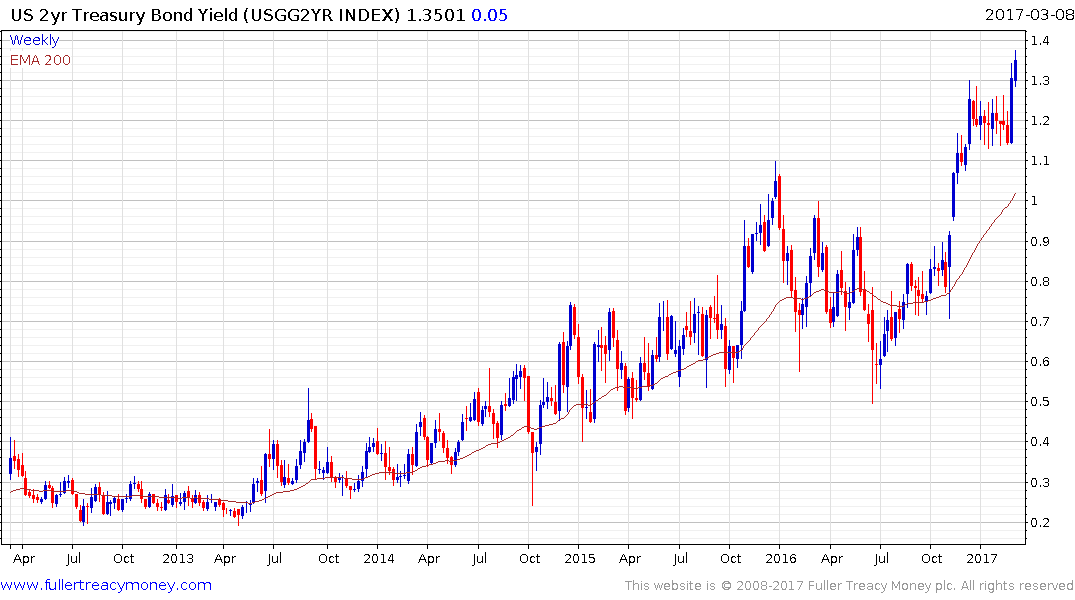

The 2-year note has completed a first step above the base and a sustained move below the trend mean would be required to question potential for additional expansion.