Treasuries Slide Pushes 10-Year U.S. Yield to Highest Since 2011

This article by Liz Capo McCormick for Bloomberg may be of interest to subscribers. Here is a section:

The yield on 10-year Treasuries, a benchmark for global borrowing, rose to the highest level since 2011 amid growing optimism about the U.S. economy. The rate on 30-year securities reached a four-year high and the dollar gained.

Improved investor appetite for riskier assets drove the leap in yields, with stocks rising toward records on upbeat news about American jobs and ebbing concern about the fiscal situation in Italy. The jump in yields Wednesday, which pushed them above previous 2018 highs set in May, followed stronger-than-anticipated reports on U.S. services and private payrolls and came after the Federal Reserve lifted interest rates last week.

The government reports payroll figures for September on Friday, and economists forecast a decline in the jobless rate to 3.8 percent. It hasn’t been lower since 1969.

Treasuries are extending a September swoon that was triggered in part by quicker-than-forecast wage growth in employment data released early last month.

“This started overnight with the Italian risk-on trade and the U.S. data today was definitely stronger” than forecast, said Justin Lederer, an interest-rate strategist at Cantor Fitzgerald in New York. “After last month’s payroll, the market started to catch up to the Fed and it’s a continuation of that. There is reason to be believe we can continue to trickle to higher yields.”

The yield on the 10-year borrowing benchmark climbed as much as 7 basis points Wednesday to 3.1343 percent, surpassing the May intraday high of 3.1261 percent. The yield on the 30-year increased as much as 7 basis points to 3.29 percent.

Money-market traders are now pricing in more than two Fed hikes in 2019, seeing about 0.54 percentage point of tightening, approaching policy makers’ projections for three rate increases next year. About two months ago, the market saw just slightly

more than one increase.

The yield curve, which has been on a flattening trend for much of this year, steepened sharply amid Wednesday’s break-out in long-term yields.

The gap between 2- and 10-year yields surged more than 3 basis points to about 28 basis points, reaching its steepest since August.

The yield curve spread popped on the upside today with the yield on the 10-year breaking out. The last 10 basis point rally was between April and May so right now this is an equal sized rally within the downtrend but it will likely be enough to allay fears on an imminent inversion.

.png)

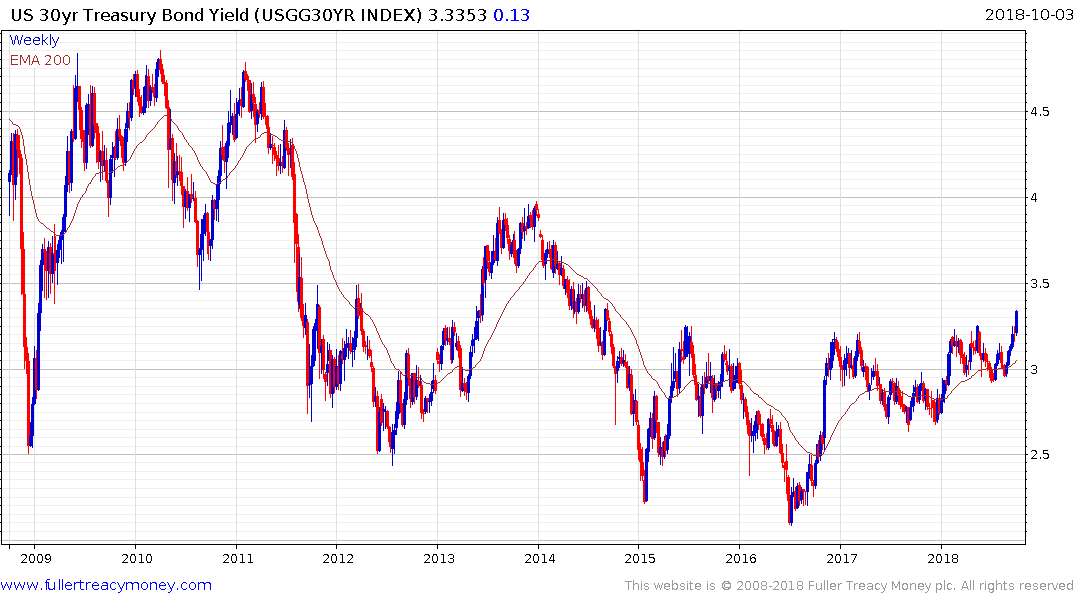

The 30-year yield has been forming a base below 3.25% since 2015 and broke through that level today. That a meaningful move and if sustained will signal a return to medium-term supply dominance.

The 10-year TIPS yield also hit new recovery highs today and a sustained move above 1% would complete the five-year first step above the Type-2 bottom.

The $8.12 billion iShares 20+ Year Treasury Bond ETF broke downwards today and is representative of the pressure coming to bear on the sector.

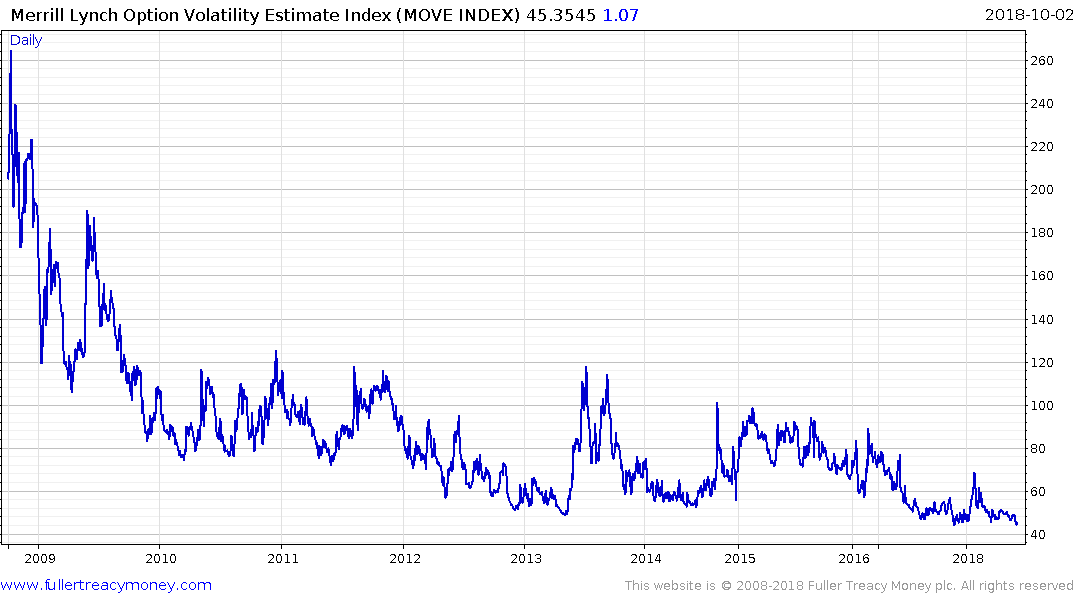

It seems, at least to me, that the volatility on the bond market is unusually low when bond prices are breaking lower on a such a widespread basis. It would appear to be only a matter of time before volatility picks up.