Treasuries Rally as Global Hunt for Yield Boosts Auction Outlook

This article by Susanne Walker for Bloomberg may be of interest to subscribers. Here is a section:

The yield gap has widened since the ECB began purchasing euro-region sovereign debt on Monday as part of a plan to stoke growth and avoid deflation.

“People are looking for higher yields, and long-dated U.S. Treasuries are looking attractive relative to their European counterparts,” said Jussi Hiljanen, head of fixed-income strategy at SEB AB in Stockholm. “We are constructive on Treasuries. The benign inflation will weaken expectations on the Fed’s rate increases.”

The Treasury bonds scheduled to be sold Thursday yielded 2.670 percent in pre-auction trading, compared with 2.56 percent at a previous sale on Feb. 12 and an auction record-low yield of 2.430 percent in January.

?U.S. 30-year bonds have returned 1.8 percent this year, according to Bank of America Merrill Lynch indexes. They returned 29 percent last year.

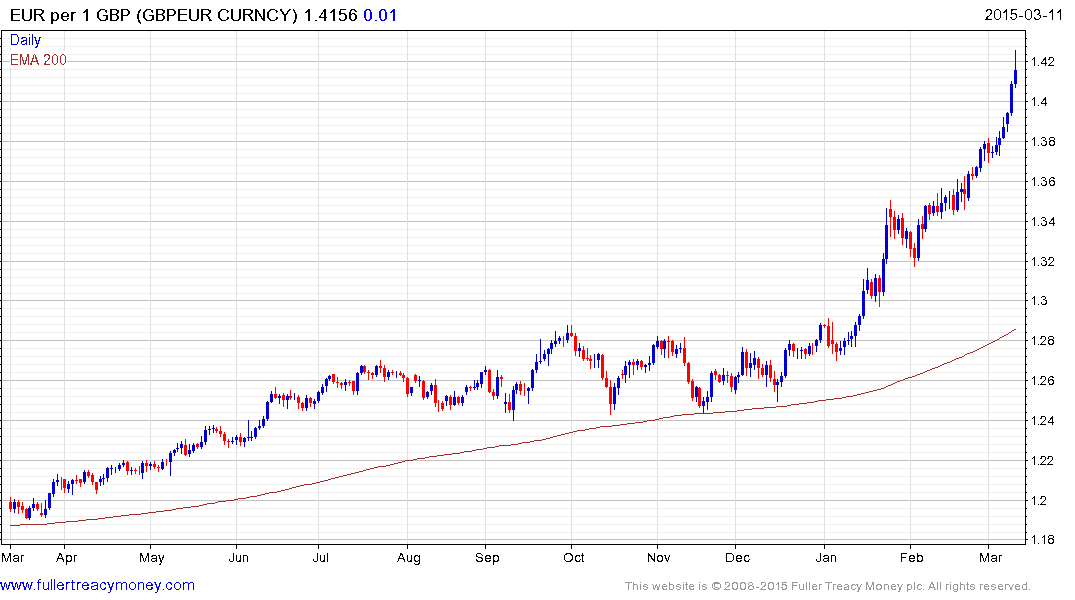

Yield is a precious commodity for fixed income investors presented with central banks intent on courting inflation in any way they can think of. As a result the relative attraction of Treasuries has been burnished as Eurozone yields compress. The weakness of the Euro has been an additional tailwind for Treasuries and helps to explain why prices have steadied over the last couple of days despite continued worries about the impact of the first Fed interest rate hike since 2006.

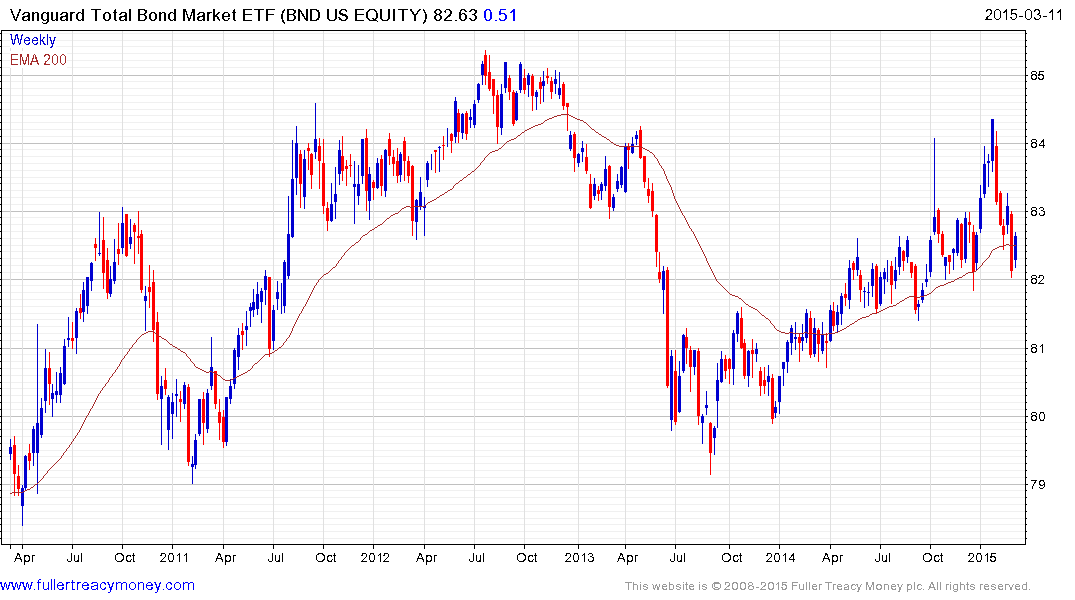

The Vanguard Total Bond Market ETF has steadied in the region of $82 and a sustained move below last week’s low would be required to question the medium-term progression of higher reaction lows. The fund’s performance is representative of the sector.

I clicked through a number of the bond fund categories in the Chart Library today and the underperformance of Pound denominated Euro area funds is noteworthy. The Euro’s decline has been so abrupt that a number of funds have not had time to react with the result that their NAV’s have contracted aggressively. For example the iShares Euro Covered Bond ETF has returned to test the region of the 2010 through 2012 lows. With the Euro finding at least short-term support against the Pound there is scope for some steadying in this area.

Back to top