Treasuries Advance as Investors Pounce After Global Bond Rout

This article by Susanne Walker for Bloomberg may be of interest to subscribers. Here is a section:

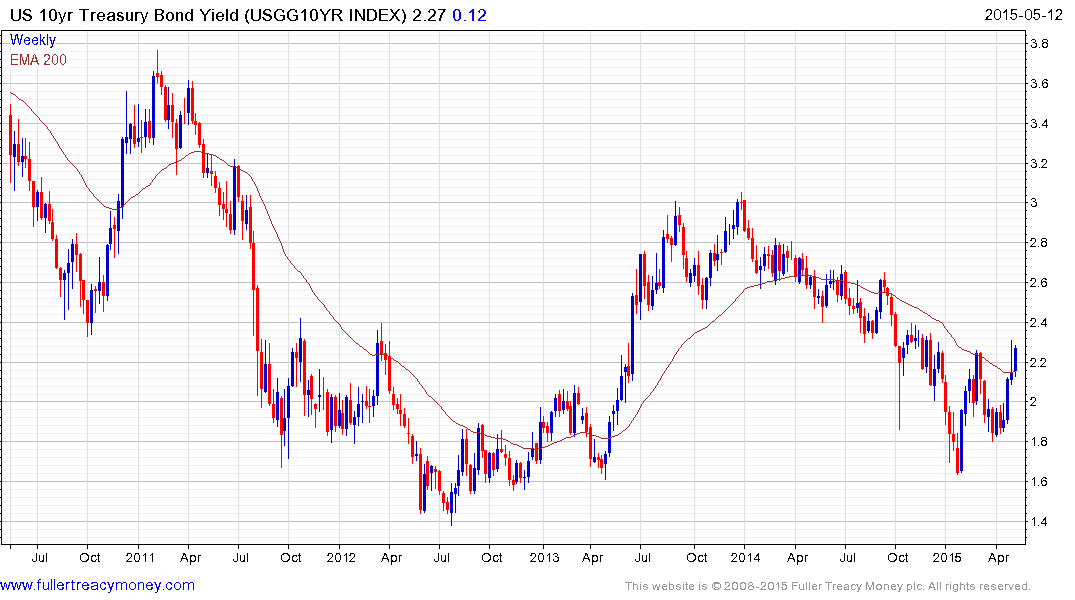

U.S. 10-year yields fell after touching the highest level since November, fueled by a global bond selloff that started in Europe. Traders have been selling debt securities that had reached record-low yield levels amid higher inflation and economic prospects. The Treasury will auction $24 billion of three-year notes Tuesday.

"We got to yield levels where guys were happy to take their paper back," said Thomas Tucci, managing director and head of Treasury trading in New York at CIBC World Markets Corp.

Treasury 10-year yields dropped three basis points, or 0.03 percentage point, to 2.25 percent as of 12:08 p.m. New York time, after reaching the highest level since Nov. 14. The benchmark 2 percent security due in February 2025 traded at 97 26/32.

There is a natural proclivity to follow a winning strategy until it has been proved wrong. Buying the dips in bonds has worked for years and despite the reliance on momentum that zero interest rates policies have engendered, investors still look on dips / jumps in yield as buying opportunities. The 35-year bull market is a bubble but we will not have categorical evidence it has popped until the buy the dips strategy stops working.

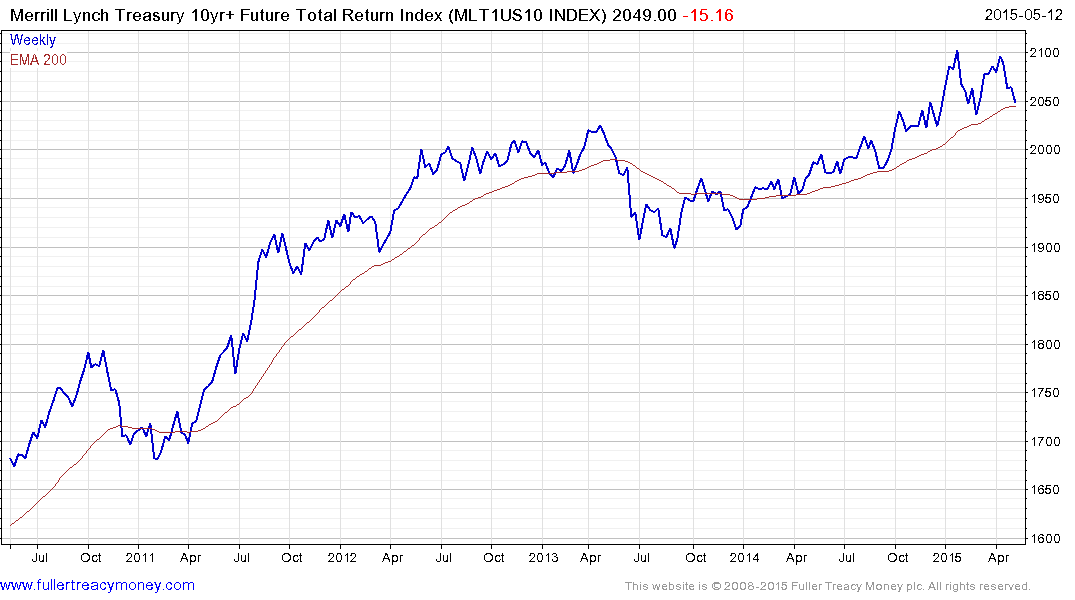

As a result of yesterday¡'s selling pressure the total return chart for 10-year Treasury futures is now testing the region of the 200-day MA. A sustained move below it would signal the medium-term trend of higher reaction lows has been broken.

10-year Treasury yields posted a higher reaction low in April and rallied to break the more than yearlong progression of lower rally highs yesterday. The yield will need to hold above the April low if a return to medium-term supply dominance is to remain credible.