Transcript of Felix Zulauf's interview by Grant Williams -

Thanks to a subscriber for this summary of the discussion at the recent Mauldin conference which may be of interest. Here is a section:

Here is a link to the full report and here is a section from it:

Speed is key here. If the Fed weakens policy quickly and weakens the dollar, we could have an extension of the business cycle. And that will be an investment decision I will have to take in the second half of this year. Depends on what they do…

This decline we are seeing in the stock market will run into the second half of the year. We will have a medium-term low between August and October and then a meaningful rally. And if the central banks begin to ease, led by the U.S. Fed, then you could have another big rally maybe back to the highs or even slightly higher in some markets into 2020. Which would play into the hands of Mr. Trump.

If they do not ease, we will have an ongoing bear market. But bear market from 2020 on will be a very different animal than the bear market we had in 2008. Usually, people look at what happened last time and they project that forward. What happened last time will not happen. Maybe what happened before last time is more likely.

I don’t think we see a waterfall decline; I think we are in for a multi-year bear market with large swings in the stock markets. We live in a time where authorities will come in and they will buy stocks, they will buy the market and you will have a very volatile environment.

When you look at our starting point today with very high valuations and very high equity ownership, all you can expect over the next 10 years is the dividend yield.

We do not go flat-ish, we get wide swings with no progress and you just end up earning the dividend yield.

This is very different from the environment over the last 10 years. You could have been a passive index investor where you buy-and-you-sit-and-you-hold and that game worked marvellously for you. I think that game is over. I think you have to be a market timer to play the medium-term swings… the mini cycles I expect. And you have to be a good picker of stocks and sectors. Because what will be lacking is economic growth and profit growth.

We will have margin squeezes in the corporate sectors due to social pressures. More of the profits will go to the workers and less to the shareholders. The share to labor will go up so you have a profits margin squeeze.

And when you have a lack of profit growth, you need to pick sectors and companies that will have profit growth.

The response of the stock market last week to the whiff of easing rhetoric from the Federal Reserve suggests investors are still willing to give the benefit of the doubt to the positive effect loose monetary and potentially fiscal policy can have on asset prices and by extension the economy.

The big question is about when the anticipated rate cuts will be delivered. Wait too long and the risk of a recession rises considerably as the full effect of quantitative tightening last year becomes felt.

Considering nothing but the price action if the recent lows hold the balance of probabilities still resides with an upward break for the primary Wall Street indices. However, that is going to need liquidity to fuel it. China continuing to run deficits, quitting the balance sheet run-off and the Dollar weakening would all provide the kind of bump required.

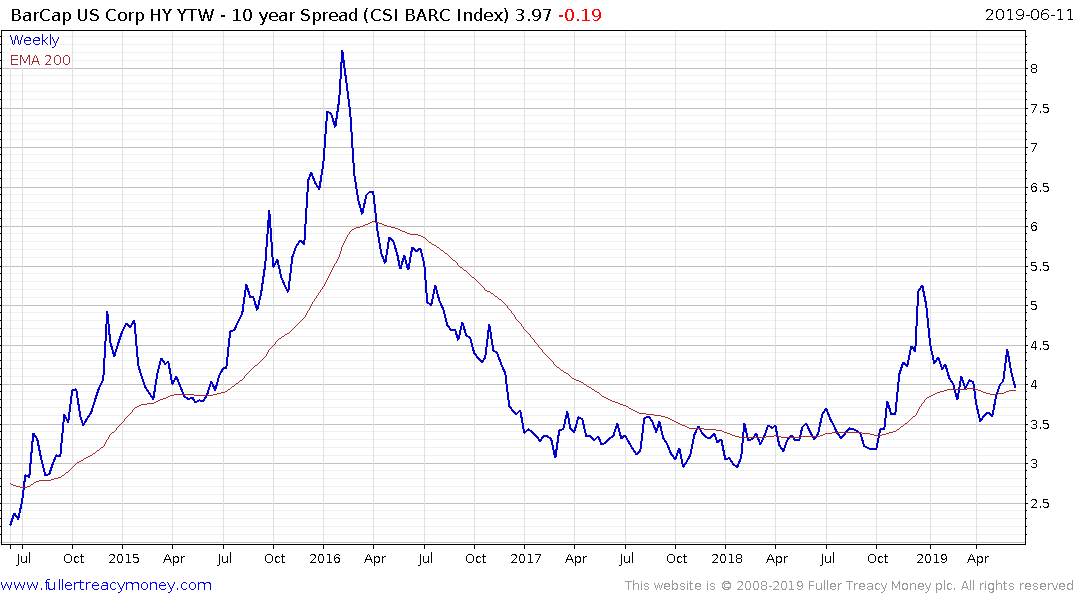

Everything I have seen over the last month is pointing towards the bubble in this cycle being in the nonbank sector represented by lenders, private equity and the indebtedness of the corporate sector. That suggests high yield is indeed the canary in the coal mine for this sector in particular.

The spread over Treasuries contracted over the last week but a sustained move below 350 basis points will be required to signal a return to demand dominance beyond the short term.