Traders Still See Another Quarter-Point Fed Rate Cut by Year-End

This article by Emily Barrett for Bloomberg may be of interest to subscribers. Here is a section:

Futures traders still see about another quarter-point of easing from the Federal Reserve this year, after the central bank cut rates on Wednesday and said it will “act as appropriate” to sustain the economic expansion.

The rate on the January 2020 fed funds futures contract was about 1.63% after the central bank’s announcement. The dot plot accompanying the statement shows policy makers’ median projections are for interest rates to remain on hold this year and next, but the balance of views has shifted more dovishly.

Judging by this level, traders still expect one more cut in either of the Fed’s two remaining decisions this year -- on Oct. 30 and Dec. 11. This estimate of the market’s pricing assumes that the effective funds rate moves toward the middle of the Fed’s new target range of 1.75% to 2%.

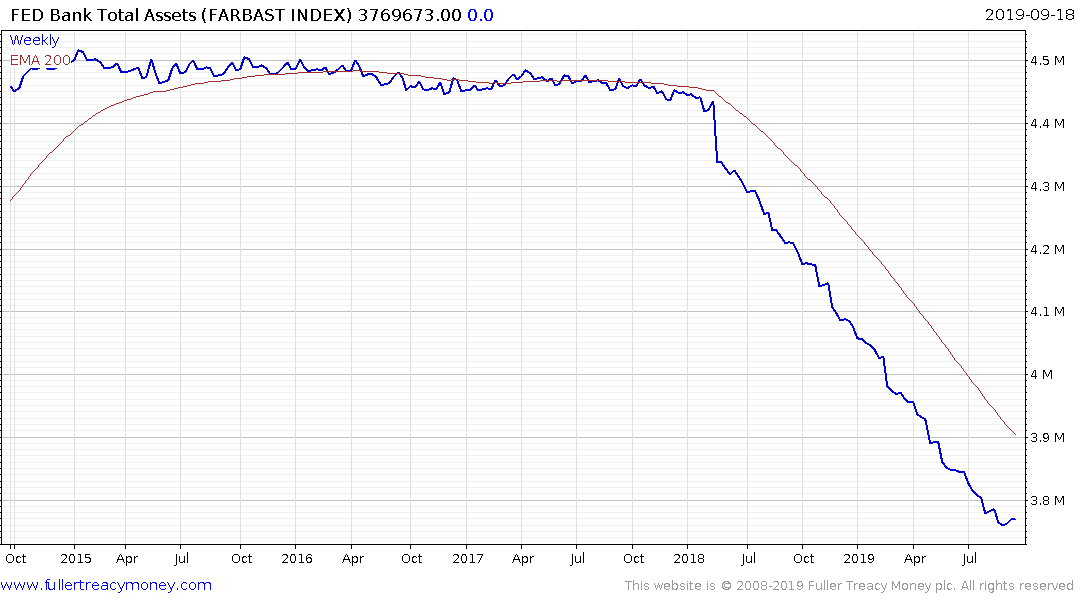

The Fed’s balance sheet is belatedly started to expand once more as the liquidity demands of the economy and Treasury market pressure the central bank to provide the funds necessary to ensure an orderly market. That is the most basic requirement for central banks, but the requirement has been exaggerated by the shrinking of investment and commercial bank balance sheets over the last decade. That suggests even without quantitative easing there is a clear need for the Fed to expand its balance sheet.

Inflationary pressures are starting to appear and the domestic US economy is still expanding so there is understandably some discussion about the need for additional rate cuts after today’s reduction. Nevertheless, the effect of the trade war and the Treasury’s growing demand for capital, at favourable rates, are likely to be factors which continue to skew the decision towards cutting.

Inflationary pressures are starting to appear and the domestic US economy is still expanding so there is understandably some discussion about the need for additional rate cuts after today’s reduction. Nevertheless, the effect of the trade war and the Treasury’s growing demand for capital, at favourable rates, are likely to be factors which continue to skew the decision towards cutting.

The Nasdaq-100 and S&P500 remain within a couple of percent of their all-time peaks and the upside can be given the benefit of the doubt provided they continue to hold the regions of their respective trend means.