Today's Interesting charts November 2nd 2017

The Pound pulled back sharply against the Euro from the region of the trend mean to confirm the integrity of the medium-term progression of lower rally highs. Mark Carney reiterated the market’s view that the Bank of England will pursue a gradual interest rate hiking policy suggesting it could be some time before the next move is made.

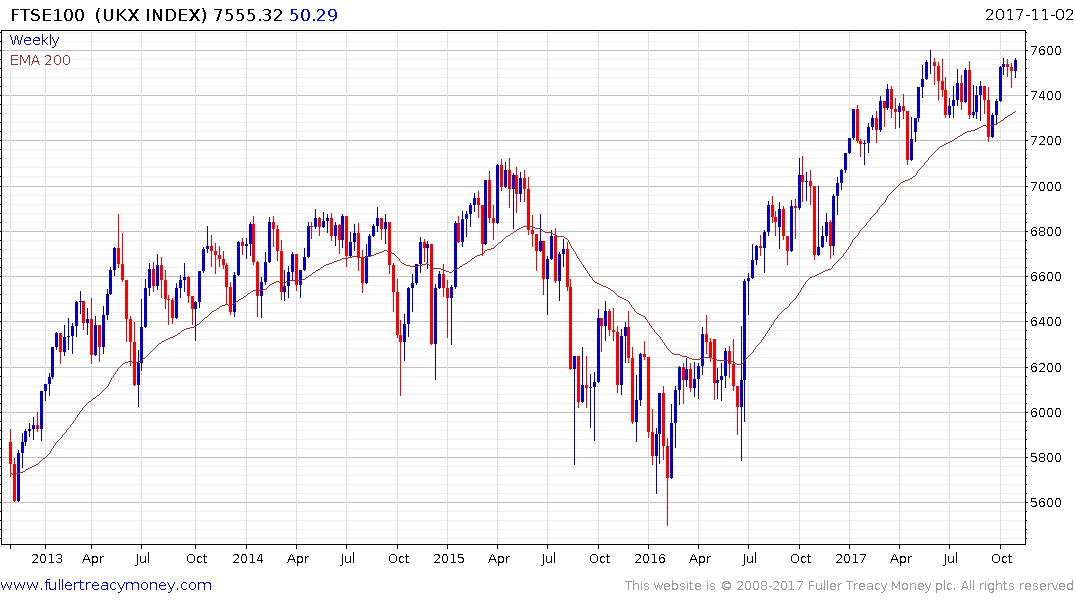

The FTSE-100 continues to experience an inverse correlation with the Pound and is now testing the upper side of a five-month range. A clear downward dynamic would be required to question near-term scope for a successful upward break.

The Trump administration released details of its tax plans today with an ambitious schedule to pass it by Thanksgiving. The S&P500 Banks Index continues to extend its breakout from the nine- month range. While increasingly overextended in the short-term, a sustained move below the trend mean would be required to question medium-term scope for additional upside.

Lumber has staged an impressive rally since hurricanes Harvey and Irma caused devastation, but was limit down today suggesting a peak of at least near-term significant.

The Nikkei-225 experienced an explosive breakout over the last six weeks to reassert medium-term demand dominance. While some consolidation is looking increasingly likely, a sustained move below the trend mean would be required to question medium-term scope for additional upside.