Time for an Upgrade

Thanks to a subscriber for this report from Deutsche Bank focusing on the India utilities sector:

Why retirement? Substantial savings for state utilities, better efficiency

India is planning a retirement policy to dispose of 18% of India’s coal-fired old capacity (36GW) over 5-6 years, starting with 6GW (2.2%) by Mar’17. Stringent new pollution norms and a coal linkage transfer policy have been instigated to hasten the retirement. Retirement will lower coal consumption by ~30% and will also cut pollution and reduce the tariff burden for state utilities.Replacement is warranted and pressing

The states’ role in power generation is declining and will trigger a new capex cycle, for energy security. Additionally, with shut-downs we estimate annual requirement of 19-22GW projects to avoid power shortages. Government (CEA) estimates corroborate the requirement of 24GW annually. Rising PLFs should exceed the 2008 peak by FY19-20e, necessitating further investments now – as the power project cycle is six years from concept to commissioning.Stage-I Capacity utilisation recovery to benefit utilities (Prefer NTPC)

With higher retirement and lower supply addition (just a 2% CAGR over FY17-22E) – we believe capacity utilisation rates are likely to stage a strong recovery. We raise PLF estimates for utilities by 2-3pps beginning FY18E. With 37% volume growth over four years and valuations still at a c20% discount to the historical average, the sector looks attractive.

Here is a link to the full report.

Revitalising the electricity utility sector to remove outdated coal fired stations and to build new more efficient operations is a very positive development. It is also a testament to the ability of the new government to remove roadblocks to Indian infrastructure development that investors despaired would ever be achieved under the last administration.

There are obviously challenges that will need to be overcome to add an additional 24 GW of power to India’s electricity network but the requirement is also a clear signal of the robust economic growth that is taking place as more people are lifted out of poverty.

India listed NTPC has a rounding characteristic consistent with accumulation and bounced over the last couple of weeks from the region of the trend mean.

It is often difficult for retail investors to purchase shares listed in India and the suite of ADRs and GDRs listed all over the world does not offer exposure to the infrastructure sector.

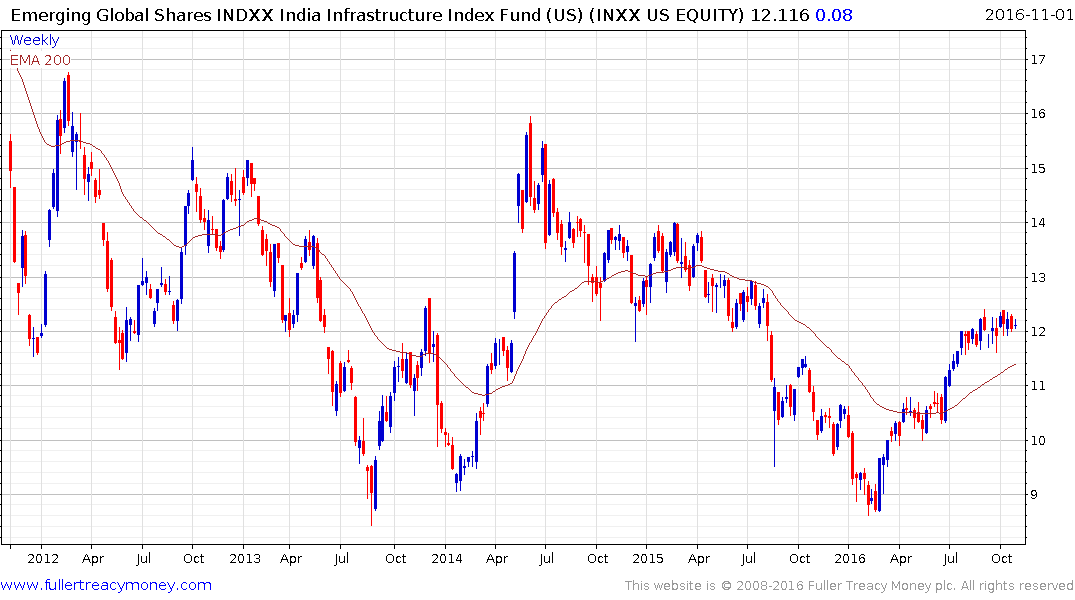

The US listed Emerging Global Shares India Infrastructure Fund (INXX) is a general infrastructure fund rather than utility specific but it has held a progression of higher reaction lows since retesting the 2013 lows in February and a sustained move below the trend mean would be required to question potential for additional higher to lateral ranging.