This could be 'the scariest chart in the financial markets right now'

This is an example of one of the articles I have received from subscribers quoting the same data point. Here is a section:

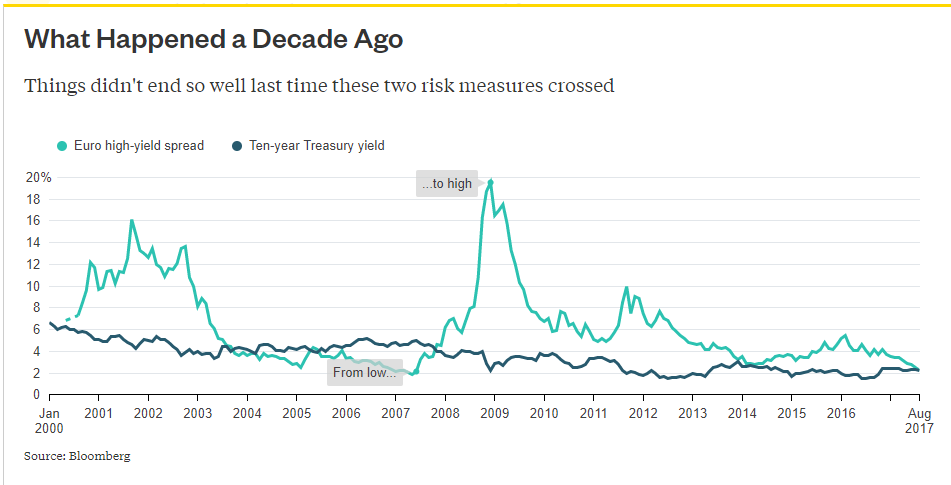

“As investors go ‘kookoo’ for risk assets, they have pushed (with the help of ECB) the yield of European junk bonds towards that of the U.S. Treasury yield. Honestly… I’m speechless,” Brkan adds.

Another one worried about low yields for European junk bonds is Wolf Street blogger Wolf Richter, who notes they offer around 2.42%, while the U.S. 10-year pays out about 2.24%. And Bank of America Merrill Lynch’s credit strategists are concerned, highlighting the “eye-watering levels that European high-yield has now reached.”

I initially saw a similar article on Monday, assessed the argument and set it aside. However, a number of subscribers have emailed me variations on the story so I thought it might be instructive to highlight why I set it aside in the first place.

There are two charts doing the rounds. The first highlights the tightening spread between Euro junk spreads and Treasury yields, the other the tightening spread between Euro junk yields and Treasury yields. Comparing yields with yields and spreads with spreads is the only logical course of action but aside from that both articles are making a fundamental mistake.

If we address the long-term comparison, it is when junk yields begin to rise that we have evidence of stress that might eventually lead to a recession. Falling junk bond yields, and the low absolute levels they are posting, might be a signal that we are already in a well-developed bull market but they do not signal an imminent market problem.

Surging junk bond yields, an inverted yield curve, collapsing margin debt balances, falling corporate profits, war or surging oil prices represents scarier potential outcomes. Of these the potential for war, not least with North Korea is the most pressing cause for concern right now.

Back to top