There Were Hawkish Bits in the Minutes, Too

This note from Cameron Crise at Bloomberg may be of interest to subscribers.

While the market has reacted as if the minutes were dovish, I am not sure if that’s the right interpretation. To be sure, they did repeat the line that a slower pace of tightening would likely be appropriate in the future, and of course there was the line about the risk of over-tightening.

But here’s the thing-- the minutes acknowledge that growth momentum is fairly weak and the economy will expand below trend in the second half. They even note that the headline labor market data may not represent the true state of the economy. But for now, the Fed doesn’t care. Below-trend growth is a feature, not a bug, of the current policy setting, because it is required to get demand more in line with supply to curb inflation. And while the uncertainty of the data does indeed make over-tightening a risk, the possibility of high inflation becoming entrenched was a “significant risk” if the public didn’t accept the Fed’s resolve to tighten appropriately.

In other words, fading the Fed’s commitment to tighten makes it more likely that they will fulfill it. Oh, and there is a nice bit about the need to regulate crypto as well, so perhaps the Wild West mentality of that market might find that its days are numbered.

In a bull market buying the dip always works. When it stops working, that’s about the clearest signal we have that a lengthier medium-term correction is unfolding. The majority of stock markets have rebounded over the last couple of months and sparked a lot of enthusiasm that the correction is over and new highs will be seen before Christmas.

The better than 50% retracement of the Dow Jones Industrials Average and S&P500’s declines has lent support to the view the worst is past. The relative underperformance of the NAsdasq-100 which is still down 17% for the year is a cautionary note.

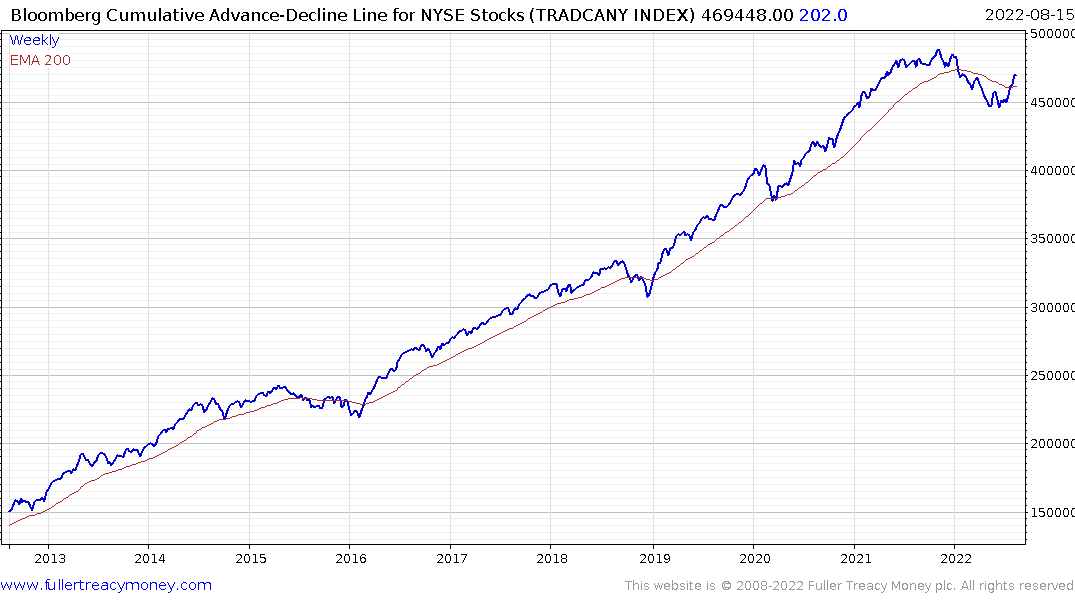

The rebound in the cumulative advance-decline line for both the NYSE and The Nasdaq also supports the view the lows are in. That is of course providing the breakout holds.

The reason I am still leery of that conclusion is the bond market is pricing in a recession, but the stock market is behaving as if it can skip along without earnings being impacted. That’s not generally how recessions unfold.

Apple has rebounded impressively and had not fallen as far as the wider market. That’s significant relative strength for the largest company in the world. It is now very short-term overbought. It is one to watch for any sign of relative weakness because if its weighting and bastion of confidence of many investors.