There's More to the ECB Meeting Than Meets the Eye

This article from Bloomberg may be of interest to subscribers. Here is a section:

Actually, it all started moments before the ECB released its policy statement. The euro dropped like a stone by around 40 pips in a move that got me wondering whether there had been a leak. Most likely, it’s one of those trades that was going to be very directional, but it’s telling that the move was bearish the euro when most expected a jumbo hike and shows that investors expect the euro to remain under pressure, with high conviction on the trade.

Then came the unprecedented interest rate increase. And for everyone that expected some lively action, it seemed that screens were frozen. Little reaction from the common currency, same picture with the bond monitors. Was it down to some great communication by the ECB that there was little reaction? Or did the market just wait for more info before trading in size? The answer came a few minutes later when euro area bond yields felt some pressure as the decision by the Governing Council was unanimous.

It became totally evident when short-end yields led a double-digit advance across the curve and the euro didn’t budge. The current narrative goes that there’s little the ECB can do to support the euro given the energy crisis. And especially if inflation remains supply-driven in the euro area, higher rates won’t do the trick. Not as much as they can do for a demand-driven inflation, like the one in the US, as Lagarde said. After all, there’s been a deep breakdown of the correlation between the common currency and bond yields since mid-August, and yesterday just highlighted this divergence. Given natural gas prices fell to the lowest in almost a month as politicians draw plans to intervene in regional markets, it could be that the euro manages to set a medium-term bottom soon.

The ECB only has one mandate which is to control inflation. It has taken on a wide range of additional responsibilities over the last twenty years but the central mandate to target a 2% rate has not changed.

Of course, they never accounted for the possibility of mass hysteria among the ruling class during a pandemic and a war on the border of the EU shortly afterwards.

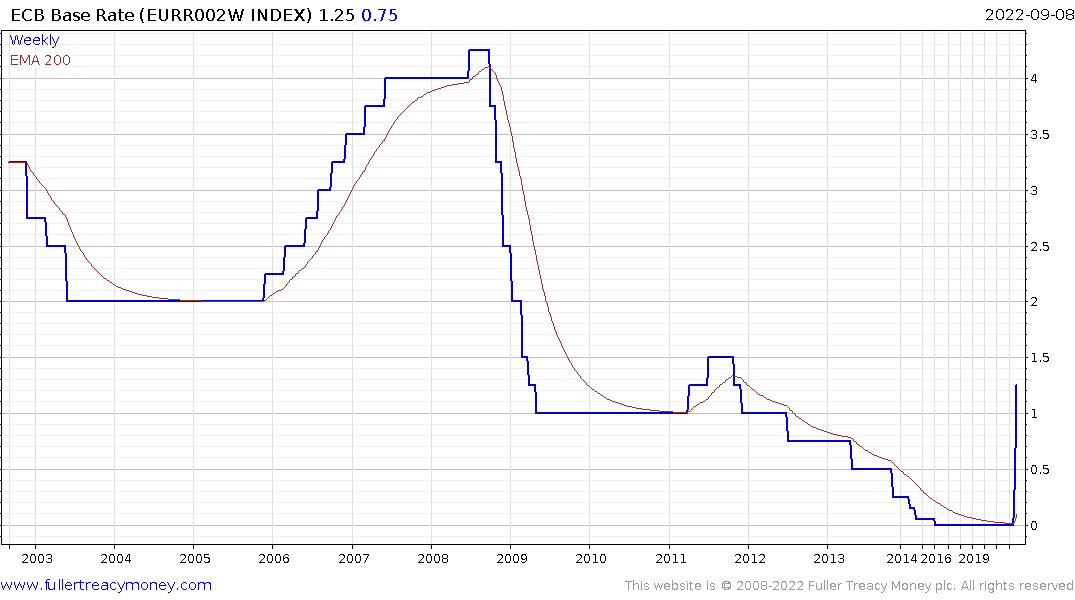

Little wonder, the ECB has been slow to begin raising rates even as inflationary pressures have amplified over the last few months. However, the need be seen to be doing something is now outweighing the futility of exacerbating the threat of recession by reducing demand.

ECB council members rallied around the idea of additional bold hikes today. Christine Lagarde also ruled out providing direct support to utilities in need of significant liquidity guarantees.

This helps the paradox the ECB is facing. They have to combat inflation, but if they follow their job description, they risk sparking a regional depression. Governments have no choice but to borrow and spend as much as is required to stem the decline in living standards or run the risk of significant social upheaval this winter. That is loading up debt sustainability discussions for later.

The Euro’s rebound was not sustained today and this two-week range continues to look like a pause in the region of the psychological $1.

The last time the ECB attempted to raise rates was in 2011. That lasted about six months before they had to reverse course. The current pace of hiking is the fastest in the central bank’s short history but they will still run up against the challenge of economic deflation and uncertain commodity supply before the year is out.