There's a Big Technical Reason for Low Volatility in Stocks

This article by Tracy Alloway for Bloomberg may be of interest to subscribers. Here is a section:

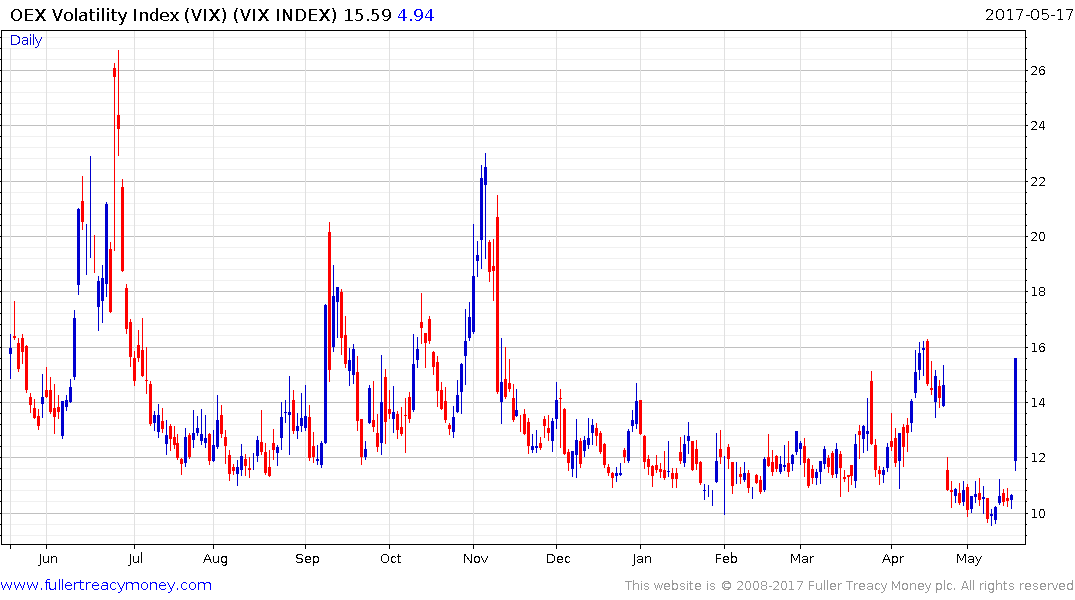

Large dealer banks that buy or sell the S&P 500 to hedge exposure to U.S. equities are helping to suppress realized volatility and keep the VIX low, the Deutsche Bank analysts say.

By their estimates, dealers would have to buy $14 billion if the S&P 500 fell by 1 percent. It’s all about "gamma" -- the third Greek letter.

“When dealers are long gamma they sell equities when equities are rising, but buy them when they’re falling,” write Deutsche Bank analysts led by Rocky Fishman. “The primary reason" for the VIX index being so low is the multi-decade low in fluctuations in the market itself, according to the team. And the long gamma positions of dealers "is a contributing factor to the ongoing low-realized vol,” they wrote.

While the hedging needs of big banks have helped keep a lid on volatility by providing a backstop to moves in U.S. equities, the analysts note, the rebalancing requirements of the plethora of exchange-traded products now tied to the VIX could pose a risk to that stability. Such ETPs typically buy VIX futures as the underlying index rises, and sell futures as it declines, creating a so-called ‘short gamma’ position."

Options trading offers cost efficient leverage, hedging and variety and it has grown exponentially over the last decade to dominate the derivatives market. The fact that options are predominately used by traders to hedge long equity positions has resulted in the VIX trading at historic lows as mega-caps like Google/Alphabet and Amazon surged to new highs.

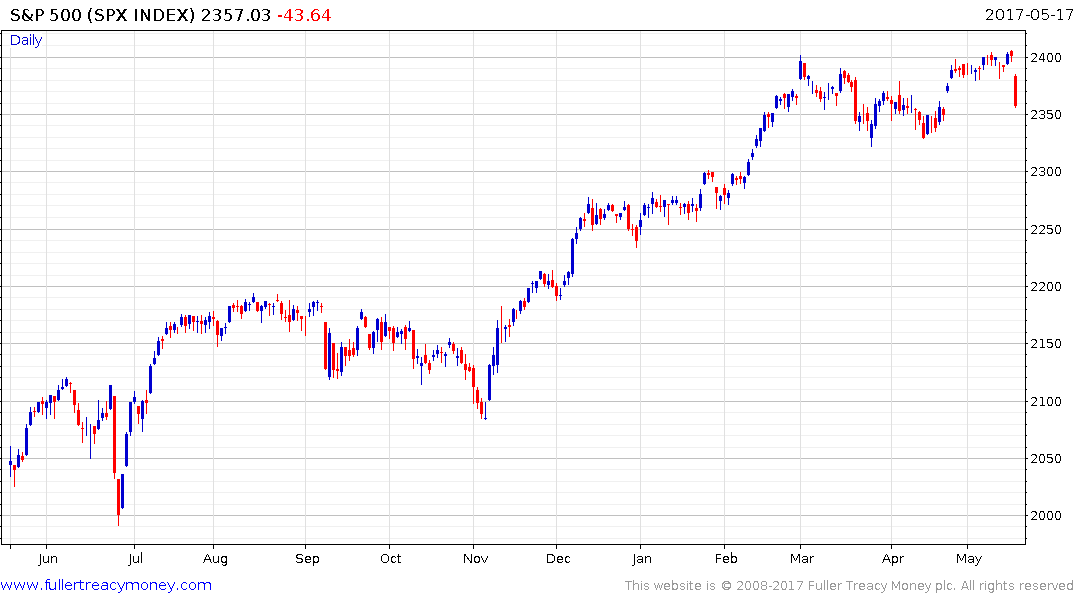

The S&P500 has been ranging for over two months in what has so far been a gradual reversion back towards the mean. It is pulling back from the upper side of the range now so there is a concomitant pop in the VIX Index.

If we look at the internals of the market, the larger shares have accounted for the majority of the advance year-to-date. They have short-term overbought conditions which look susceptible to mean reversion. Meanwhile the market’s laggards such as Under Armour, Mattel and Gilead Sciences show scant signs of rebounding.