The World Has Started Spending More on Weapons

This article by Benjamin D Katz for Bloomberg may be of interest to subscribers. Here is a section:

Global military spending has begun rising in real terms for the first time since the U.S. began its withdrawal of troops from wars in Iraq and Afghanistan, according to the Stockholm International Peace Research Institute.

Defence budgets rose 1 percent to $1.68 trillion in 2015, making up about 2.3 percent of the world’s gross domestic product, Sipri said in a report Tuesday. While the U.S. spent the most at $596 billion, that was down 2.4 percent compared with 2014, while China’s outlay increased 7.4 percent to $215 billion.

Concern about a possible advance by Russia into North Atlantic Treaty Organization territory following the Crimea invasion and hostilities in east Ukraine led to a surge in spending in Eastern Europe, as Chinese ambitions in the South China Sea spurred arms purchases among Southeast Asian states.

During times of economic expansion there doesn’t tend to be much in the way of mischief making in terms of geopolitics. However when expansions come under pressure from overheating or commodity prices dropping the potential for countries to try making up for lost ground through adventurism increases. Russia’s actions in Ukraine, the Caucasus and Syria offer useful examples as does China’s increasingly assertive posturing in the South China Sea.

The takeaway is that for better or worse, the USA’s withdrawal from pursuing an active interest in major geopolitical theatres has left a vacuum where Russia, China and Iran are increasingly active. This is forcing other countries to increase spending on defence.

This has contributed to the shares of major defence companies continuing to trend consistently higher.

Lockheed Martin, Northrup Grumman, Raytheon and Thales are all hitting new highs.

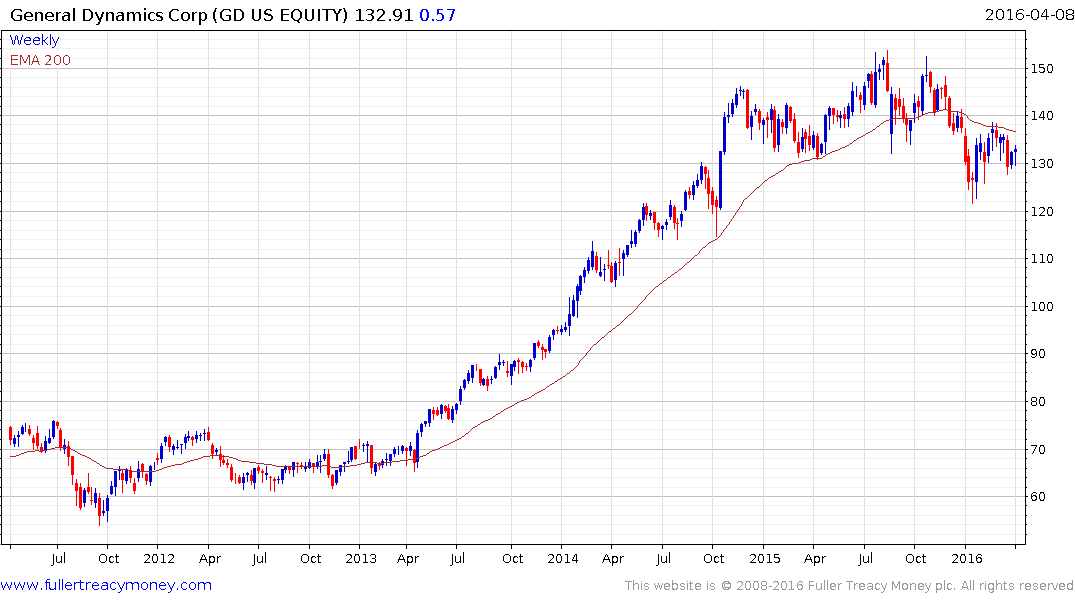

General Dynamics pulled back below the MA for the first time since completing a lengthy range in 2013. It has firmed recently but will need to sustain a move above $140 to signal a return to demand dominance beyond the short term.