The Weekly View November 27th 2018

This note from Rod Smyth at Riverfront may be of interest to subscribers. Here is a section:

Global stocks are reflecting slowing economic date in Europe, Japan and China, and are anticipating the same for the US as the stimulus wears off and higher interest rates start to slow demand for housing and autos. The chart pattern also suggests to us that investors are building in an increased probability of a global recession. We are more positive and believe that there is a good chance that global stocks will bottom around these levels as value investors are likely able to find what the see as bargains at current levels. We too are looking for opportunities where we believe investors have become too pessimistic.

Here is a link to the full report.

I don’t tend to look at the MSCI World very often because it is heavily skewed towards the performance of the largest companies with a clear overweight in the USA, followed by China. However, it is a global benchmark for many asset managers and therefore its performance represents a significant input into their thinking.

The Index accelerated to its January peak and quickly pulled back to close its overextension relative to the trend mean. It broke downwards again in October and continues to trade below the trend mean.

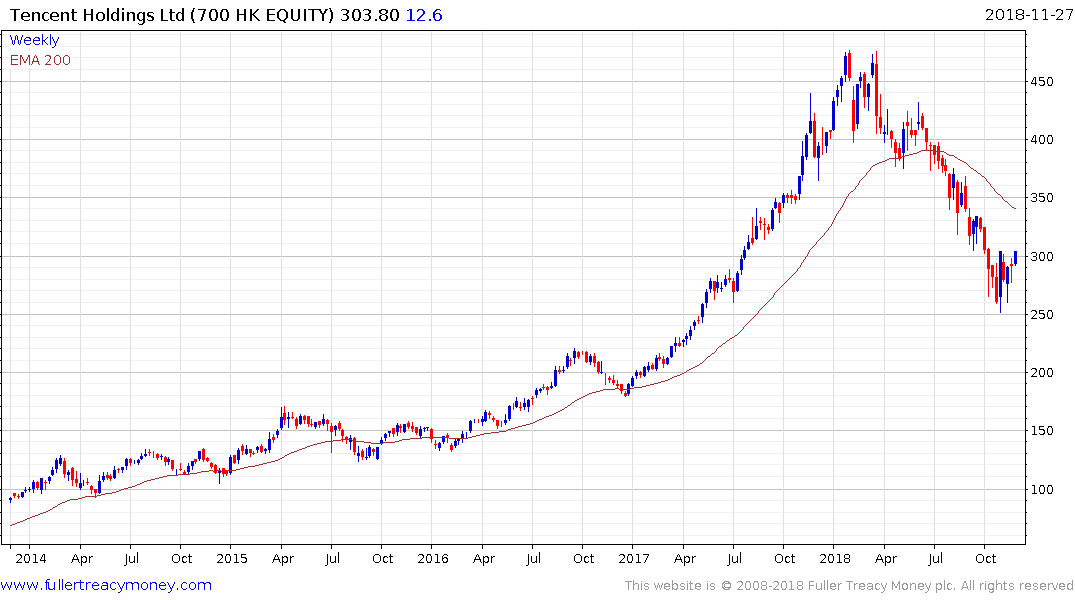

At The Chart Seminar in London two weeks ago one of the delegates quipped Tencent is my favourite share because I have been highlighting all year what a deleterious effect it’s acceleration and subsequent decline has had on the performance of the emerging markets Index. However, it is also worth remembering that it is also a constituent of the MSCI World Index.

After a 47% from the January peak, the share posted an upside weekly key reversal earlier this month. It did not follow through on the upside immediately but pushed back above the HK$300 level today which is increasing the potential it will unwind its oversold condition relative to the trend mean.

Meanwhile Apple is flirting with losing its crown as the world’s largest company. The share has pulled back very sharply over the last month and a short-term oversold condition is evident; suggesting scope for a reversionary rally.

Microsoft remains in a reasonably consistent medium-term uptrend.

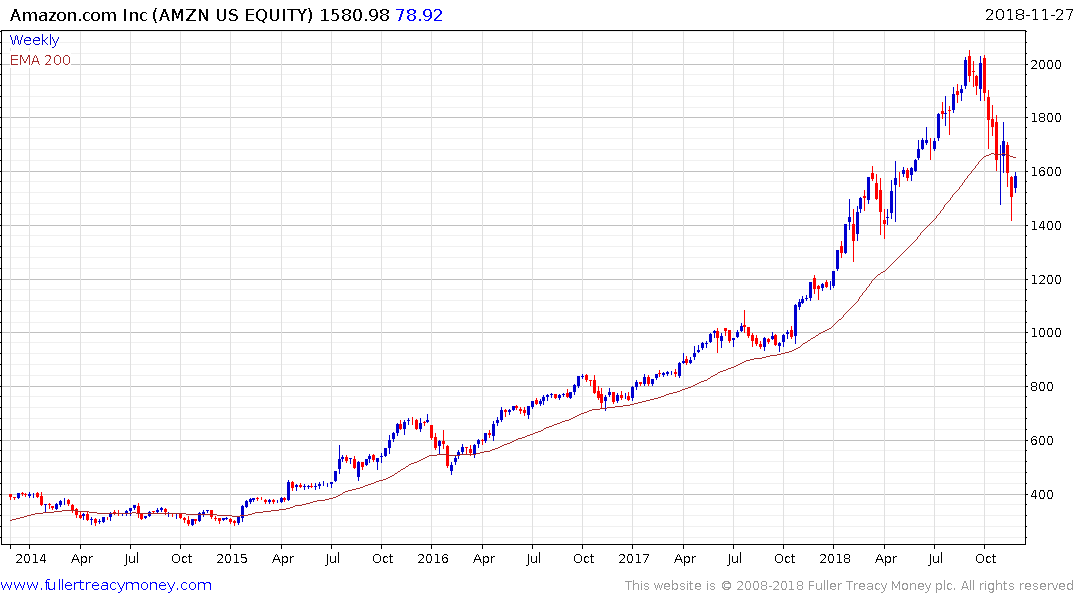

Amazon has experienced its largest pullback since the September peak, with a sequence of lower highs and lower lows. It is currently unwinding its short-term oversold condition but a sustained move above $1800 will be required to question the supply dominated environment.

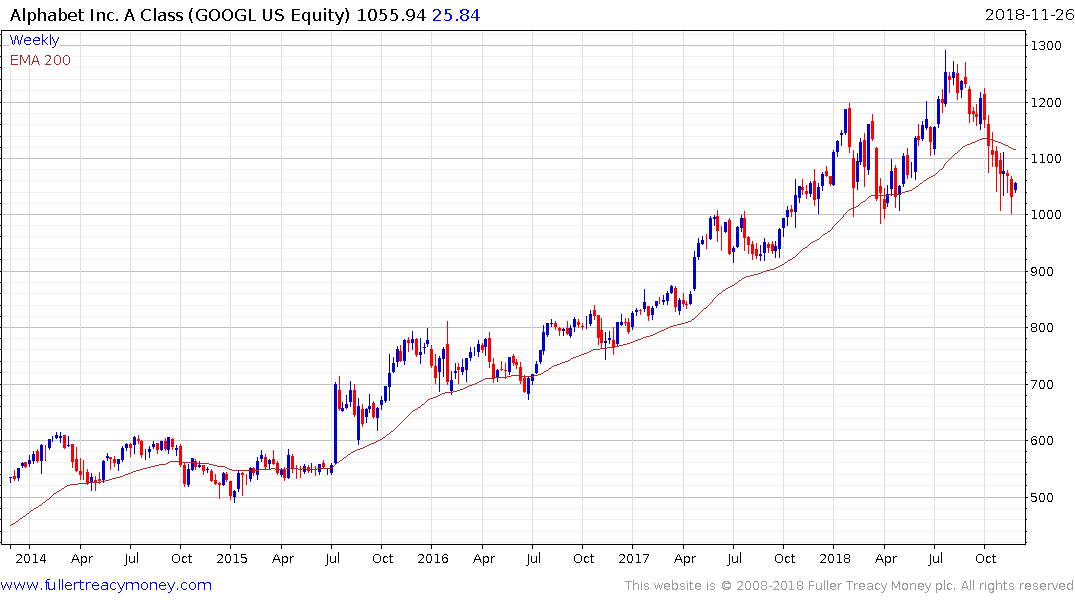

Alphabet now has a much less consistent chart that at any time since 2010. It is firming from the $1000 level at present but needs to hold that level on the next pullback if top formation completion is to be avoided.

Berkshire Hathaway remains in a reasonably consistent medium-term uptrend.

Alibaba broke failed to hold its breakout to new highs in June and broke down in August. A reversionary rally is now underway but it needs to sustain a move back above $170 to check the supply dominated environment.

Facebook peaked with a large downside weekly key reversal at the 2nd quarter earnings call. While oversold in the short term, a break in the sequence of lower rally highs will be required to question the downward bias.

Johnson & Johnson remains in a reasonably consistent medium-term uptrend.

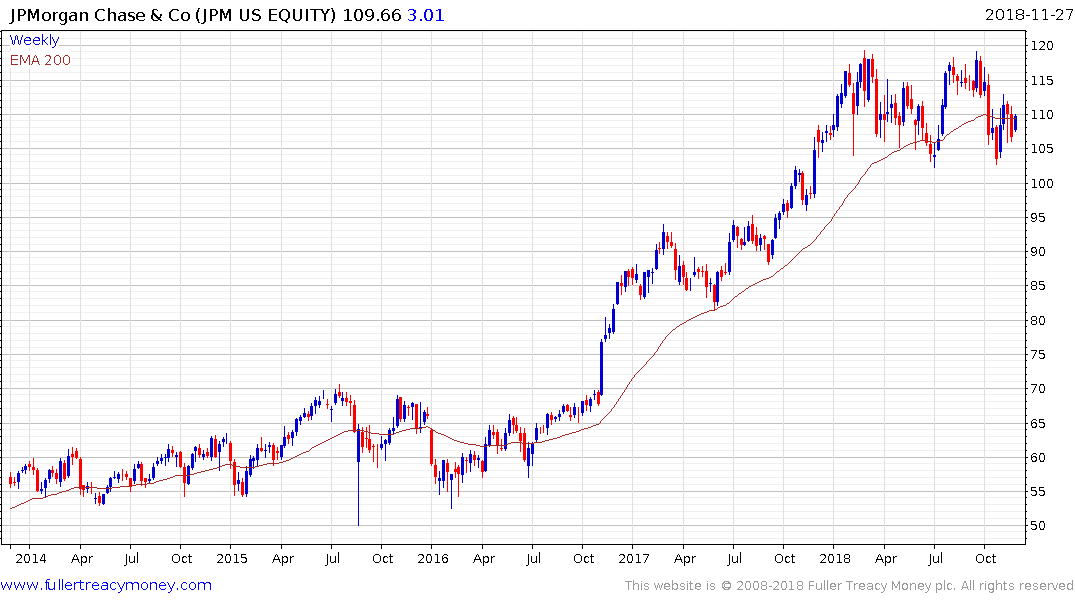

JPMorgan Chase has spent 2018 ranging above the psychological $100 and will need to hold that level if the medium-term trend is to remain consistent.

I agree that the market is increasingly pricing in a very bearish scenario and tightening of global liquidity is a significant contributing factor in the slowing pace of the global expansion. If we assess the charts of the world’s 10 largest companies then we can see there has been a significant sell off in the highflying technology companies which are also the world’s largest companies. Outside of that group companies with solid cashflows continue to attract investor interest and it is these that are likely to lead the recovery from this correction.

The question of whether this correction is close to ending is going to be dictated by global liquidity conditions which are influenced by the actions of central banks and the strength of the Dollar.

The ECB is ending its QE program but is a long way from raising rates.

The Fed’s Mr. Bullard said today “Whether there are cracks in the U.S. economy’s performance is one of the main challenges for the Fed going forward,” said Bullard. “I don’t have any reason to doubt the economy will slow in 2019 and 2020. It would be much tougher for the Fed to continue to raise at this pace in a slowing economy relative to where we have been.”

Concurrently, China is easing up on its tightening of monetary conditions. Therefore, there are some indications global central bank enthusiasm for tightening is waning but clear evidence of a change of tack will likely be required to begin to repair investor confidence.