The Week in Currencies

To say it’s been a busy week in the currency market is something of an understatement so I thought it would be opportune to review some of the most dynamic moves in the market in one place with the aim of identifying whether commonality is evident.

The UK now looks like it will be the first major market to follow the USA in raising interest rates. The Pound rallied 4¢ this week alone to reassert its recovery by breaking out of the most recent short-term range. It has held a progression of higher reaction lows since October last year and a break in that sequence would be required to challenge potential for additional upside.

The Pound’s strength took a bite out of the stock market’s performance with the FTSE-100 pulling back below the trend mean. It will need to rally soon if medium-term scope for additional higher to lateral ranging is to be given the benefit of the doubt.

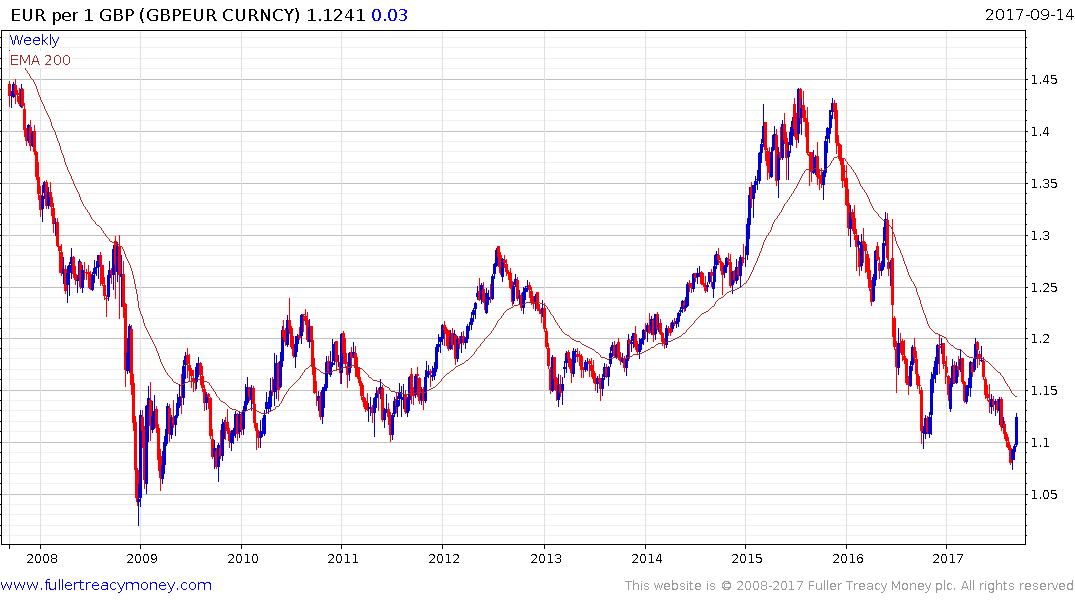

Against the Euro, the Pound is rapidly unwinding its oversold condition relative to the trend mean.

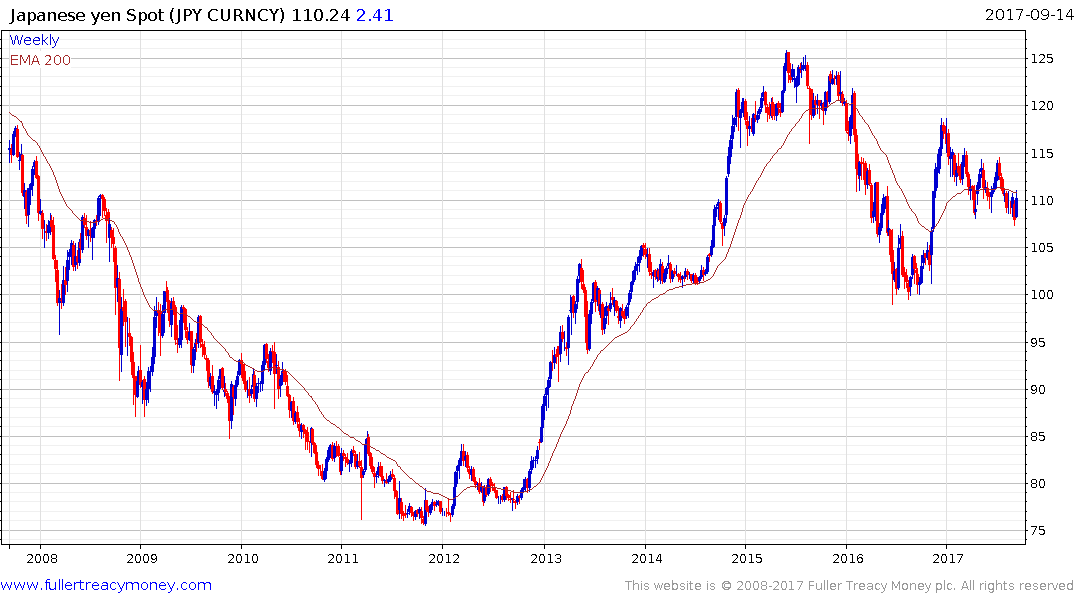

If the UK is  going to be first major economy to raise rates perhaps Japan will be the last. The Dollar rallied back above the psychological ¥110 level this week. Upside follow through next week confirm a failed downside break and suggest expectations of a rally towards ¥115 are credible. That should also help to boost the stock market could revitalise interest in hedged products like DXJ in the USA or IJPH in the UK.

going to be first major economy to raise rates perhaps Japan will be the last. The Dollar rallied back above the psychological ¥110 level this week. Upside follow through next week confirm a failed downside break and suggest expectations of a rally towards ¥115 are credible. That should also help to boost the stock market could revitalise interest in hedged products like DXJ in the USA or IJPH in the UK.

The Dollar is now unwinding its deep oversold condition relative to the Renminbi and a sustained move below CNY6.5 would be required to question medium-term scope for a further rally.

The Canadian Dollar has been among the best performing currencies globally since it rallied in June to break a yearlong progression of lower rally highs. It cleared the psychological 80 area last week a sustained move below that level would be required to question medium-term scope for additional upside. It has been aided in its advance by two interest rate hikes since June.

The Mexican Peso has also staged an impressive rally from the beginning of the year and has been aided by interest rates rising from 3% to 7% since late 2015.

If we look at the commonality of these moves then what we have evidence of is the market beginning to react to interest rates again. After all interest rate differentials are just about the only hard fundamental one has in the currency markets and they were largely negated in the era of extraordinary loose monetary policy. As central banks begin to migrate towards some form of normalisation it makes sense that interest rate differentials would become more relevant again.

Back to top