The Ukraine crisis: what's at stake for investors?

This note from Pictet may be of interest to subscribers. Here is a section:

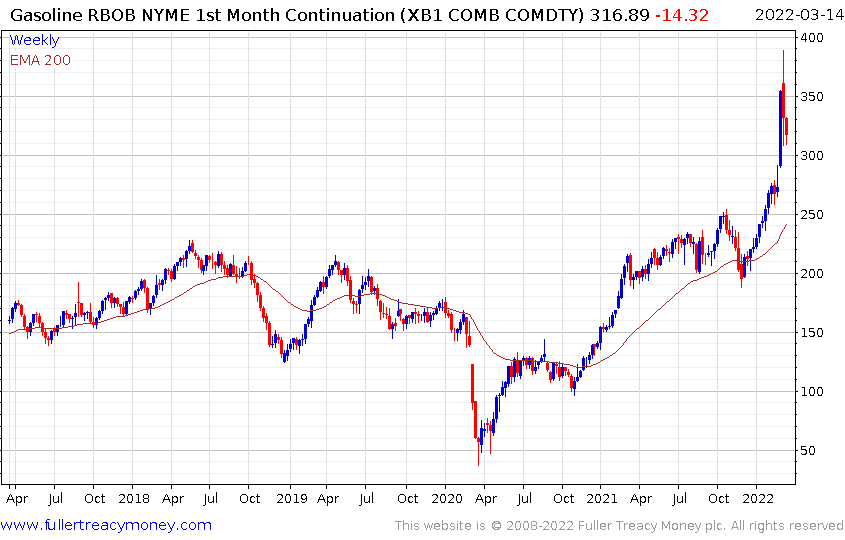

Our analysis shows that every time the oil price surged 50 per cent above trend – as it has now – a recession followed. Even though the world is less reliant on oil than a generation ago, crude still makes up a substantial slice of global GDP and it drives inflation expectations and, in turn, consumer confidence.

The impact of these shocks won’t be evenly distributed. For instance, the euro zone’s dependence on energy imports from Russia – they represent 40 per cent of the region’s gas consumption – leaves it particularly vulnerable.

At the same time, large public sector budget deficits and high inflation rates leave limited, if any, headroom for additional fiscal or monetary stimulus from the world's major economies. The market still expects US interest rates to rise some 150 basis points this year. As for the euro zone, the market is discounting two rate hikes this year – down from three before the invasion. And while a European Central Bank intervention to support the euro zone can’t be ruled out, it would take a bad recession or spreads on Italian government bonds to move above 250 basis points for the ECB to launch fresh stimulus.

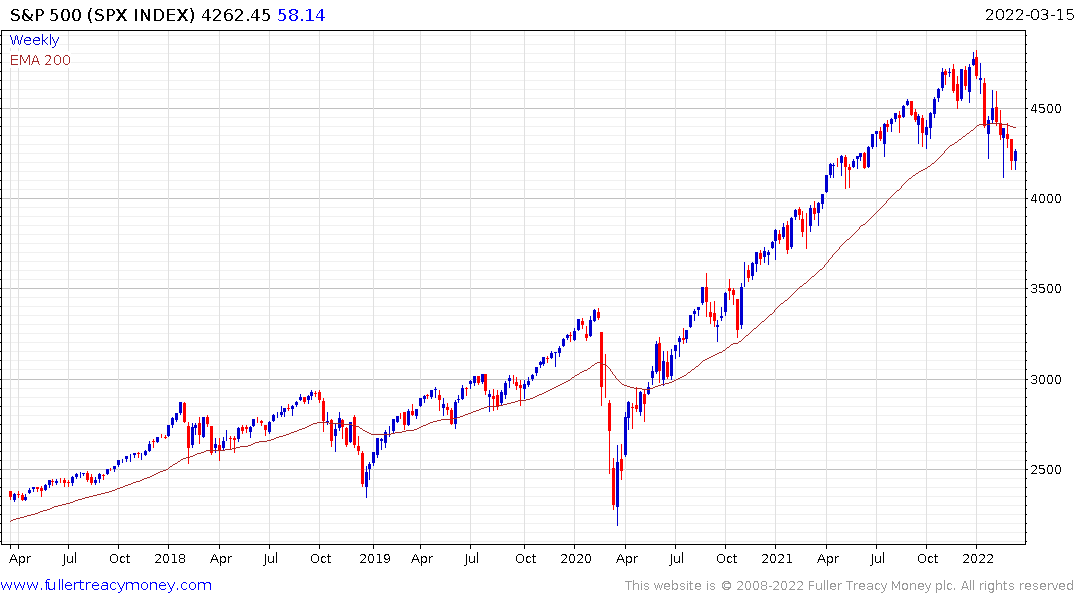

But even if the risks have clearly risen, it is important to highlight that geopolitical shocks tend to be short-lived. Typically, crises such as military conflicts trigger a 10 per cent decline in equities over a period of one to two months, only for that sell-off to give way to strong rally once a resolution begins to take shape.

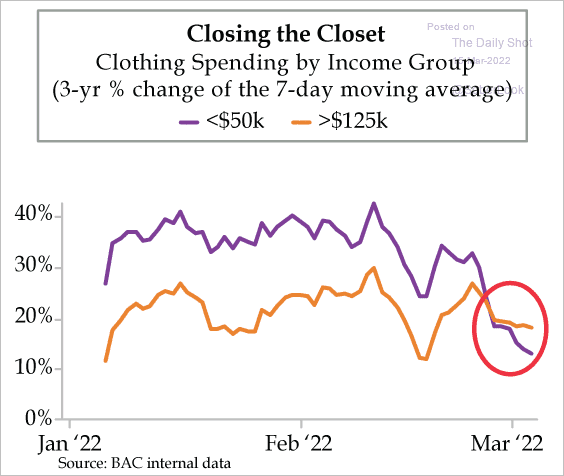

Gasoline prices are on everyone's lips at present and that has a psychological impact on purchasing decisions. For example, this graphic depicting spending on clothing over the last three months shows a steep decline for the poorer quadrant of the population. The correlation with the spike in energy prices must be at least partially to blame.

.png)

It would be easy to point to the fact the price of oil adjusted for purchasing power parity is not at the same extreme as in 2007. However, the reality is the for the poorer portion of society, who have not seen significant wage gains since 2007, and who are also less likely to be able to work from home, this gasoline price spike matters.

This graphic looking at potential scenarios for the outcome of the Russian aggression in Ukraine may also be of interest. I think entrenched conflict is a much more likely scenario than 30% but we will see.

Stocks steadied today following a statement from Ukraine’s Zelensky that he believes his people need to accept they will not be joining NATO. That’s a predictable condition of any negotiated settlement.