The Ugly Unethical Underside of Silicon Valley

This article by Erin Griffith for Fortune may be of interest to subscribers. Here is a section:

No industry is immune to fraud, and the hotter the business, the more hucksters flock to it. But Silicon Valley has always seen itself as the virtuous outlier, a place where altruistic nerds tolerate capitalism in order to make the world a better place. Suddenly the Valley looks as crooked and greedy as the rest of the business world. And the growing roster of scandal-tainted startups share a theme. Faking it, from marketing exaggerations to outright fraud, feels more prevalent than ever—so much so that it’s time to ask whether startup culture itself is becoming a problem.

Fraud is not new in tech, of course. Longtime investors remember when MiniScribe shipped actual bricks inside its hard-disk boxes in an inventory accounting scam in the 1980s. The ’90s and early aughts brought WorldCom, Enron, and the dot-bombs. But today more money is sloshing around ($73 billion in venture capital invested in U.S. startups in 2016, compared with $45 billion at the peak of the dotcom boom, according to PitchBook), there’s less transparency as companies stay private longer (174 private companies are each worth $1 billion or more), and there’s an endless supply of legal gray areas to exploit as technology invades every sector, from fintech and med-tech to auto-tech and ed-tech.

The drama has some investors predicting more disasters. “What if Theranos is the canary in the coal mine?” says Roger McNamee, a 40-year VC veteran and managing director at Elevation Partners. “Everyone is looking at Theranos as an outlier. We may discover it’s not an outlier at all.” That would be bad news, because without trust, the tech industry’s intertwined ecosystem of money, products, and people can’t function. Investors may find the full version of the old proverb is more accurate: “One bad apple spoils the whole barrel.”

Fraud isn’t generally identified immediately because it takes time for such contrivances to be discovered. The impetus for investigation doesn’t generally arise until someone goes looking for the money that was invested, when the expected return does not materialise. It took the credit crisis to reveal problems with Madoff’s Ponzi scheme, yet it had functioned unperturbed by regulators for years before that event. The above article does an excellent job of identifying the frauds which have occurred in Silicon Valley as well as the culture that promotes exaggeration.

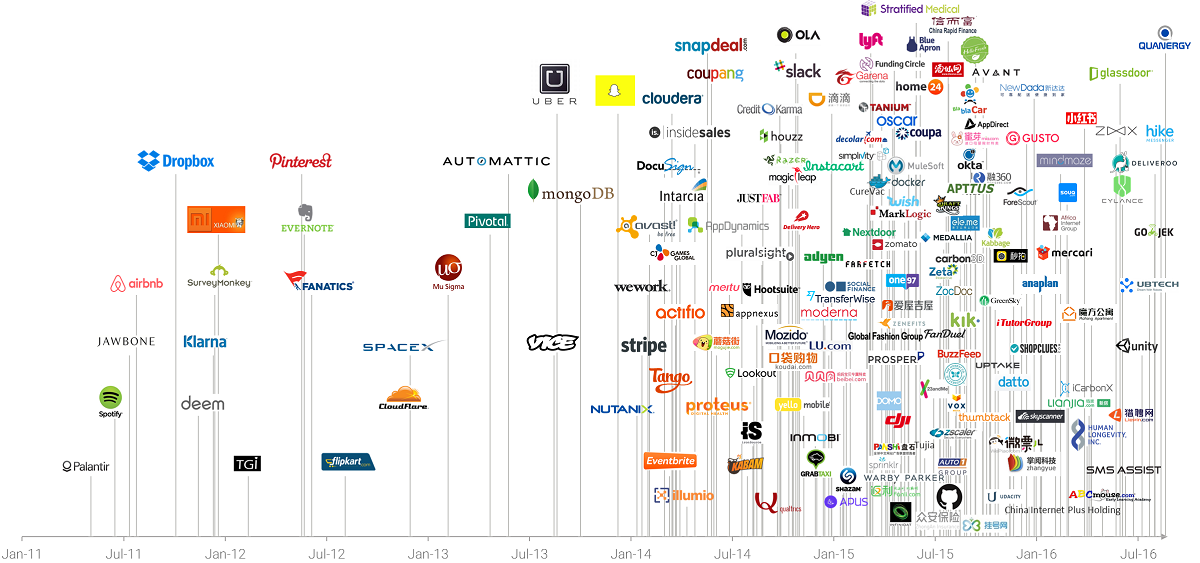

It occurs to me that none of these issues are new. However what is different now is that the pace of unicorn births has slowed down. This insightful graphic from CBInsights clearly highlights how the minting of new unicorns peaked 18 months ago and, while still quite high, it has moderated considerably.

I wonder if this is a function of interest rates. Extraordinary monetary policy inflated asset prices by reducing the cost of borrowing to almost zero and making untold quantities of capital available. That set up a competitive environment for investing in start-ups since more money was chasing a relatively limited number of companies. That encouraged more people to come up with ideas that might be turned into companies.

For example Uber is wonderful but it is in effect a hackney company that succeeds by stamping down on the heavily regulated taxi business. When it eventually has to make a profit it will need to raise prices and taxis may become competitive again. That is of course why it is so eager to support autonomous vehicles. It is probably the only way the company has of remaining competitive.

With the Fed now in tightening mode, albeit at a very modest pace, the cost and availability of capital for start-ups can be expected to at least become more selective and that is perhaps what we are already seeing in the above graphic. That may force more companies into IPOs but it will also result in better companies receiving funding which is to be welcomed.

The Bloomberg IPO Index has been rallying for more than a year and recouped almost the entire 2015 decline. It is heavily weighted by new food related and financial listings and a sustained move below the trend mean would be required to question the consistency of the medium-term advance.