The U.S. Economy Is Just Starting to Tap Into a Big Source of Dry Powder

This article by Luke Kawa for Bloomberg may be of interest to subscribers. Here is a section:

On a recent interview on BloombergTV, New River Investment portfolio manager Conor Sen indicated that the U.S. single-family housing market would enjoy a strong secular tailwind over the next 10 to 15 years as millennials formed households and shifted from renting to owning homes.

Sen separately observed that single-family housing starts, as a share of the prime age population (25 to 54 years old), remain at very subdued levels. If single-family starts normalize to 1.25 million, more than 250,000 workers would be needed to erect them, assuming that the ratio between starts and residential construction jobs reverts to what it has averaged since the start of 1985.

Dutta concurred with the demographic support for construction activity, pointing out that children born in the 1980s, when the birth rate was climbing, will make up the next batch of first-time homebuyers. He also noted that cyclical forces, such as easing lending standards and rising homebuilder confidence, buoy the outlook for the sector.

"Bad things do not happen to America when housing is moving up and to the right while Americans are finding jobs," said Dutta.

The US housing market has had a patchy recovery. Prices in desirable coastal locations surmounted their bubble peaks more than a year ago while inland areas, where the majority of overbuilding took place, have taken longer to rebound not least because of the number of foreclosures the market had to work through.

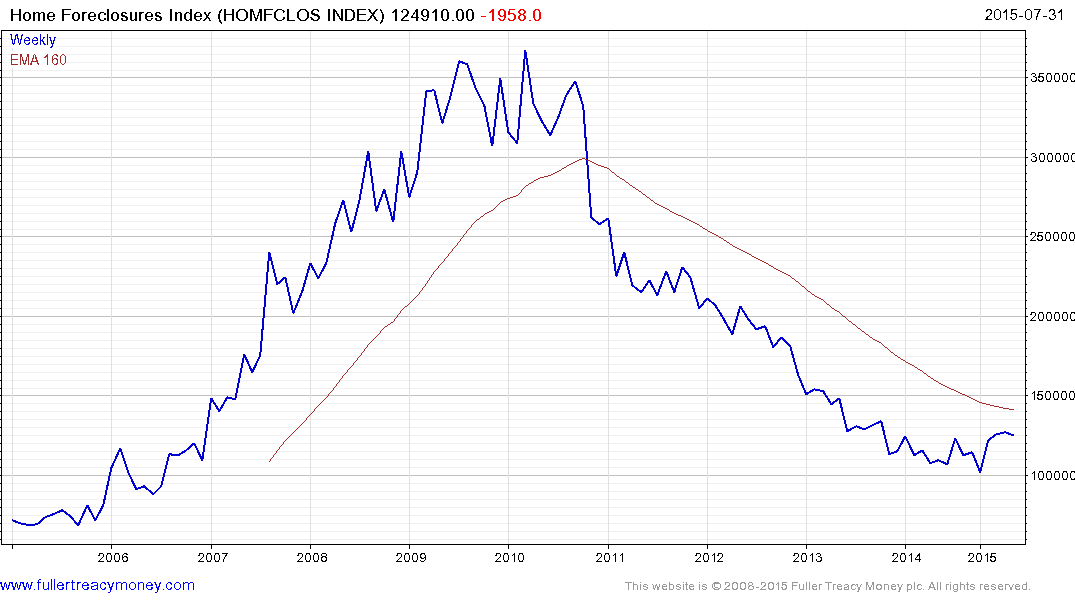

The Home Foreclosure rate peaked in 2010 and has stabilised at close to 100,000 which is a fraction of the peak level. The decline represents a diminished source of supply on the market which has helped prices recover.

Despite outsized volatility on the wider market the Homebuilders Index has been notably steady and a sustained move below the 200-day, currently near 670, would be required to begin to question medium-term scope for continued upside.

The UK’s housing sector has performed similarly to the USA’S and remains in a consistent medium-term uptrend. A sustained move below the trend mean, currently near 580, would be required to question medium-term scope for additional upside.