The Tax Bill Is Hurting Tech Stocks

This article by Sarah Ponczek and Elena Popina for Bloomberg may be of interest to subscribers. Here is a section:

“It’s the tax bill hurting tech,” said Frank Ingarra, head trader at Greenwich, Connecticut-based NorthCoast Asset Management LLC, which oversees $1.8 billion. “When you have something that’s got so extended and done so well, and people start thinking about these things, of course you’re going to have profit taking.”

Equities were caught in another violent rotation Wednesday, with financial stocks poised for the best two-day rally in more than a year and tech shares their worst rout since last August’s meltdown. Companies from Nvidia Corp. and Facebook Inc., up more than 50 percent in 2017, are nursing losses of 3 percent or more Wednesday. Their effective tax rates are 6.5 percent and 10.1 percent, respectively, data compiled by Bloomberg show.

The technology sector has delivered some of the most impressive performance of any sector this year with the result that a considerable number of wide overextensions relative to the trend mean are now evident. Mean reversion is therefore an increasingly likely possibility.

Investors are eager to parse the news flow about the exact detail of the tax plan which will eventually be passed and what that is likely to mean for corporations. Since technology companies already optimize their operations to pay the least possible they are less likely to benefit from the 20% corporate tax rate. A potentially more pressing question is whether changes to repatriation of profits or how global operations are treated will in fact represent a punitive development.

Softbank’s demand for a 30% discount on Uber shares is an additional indication that valuations might be a little ambitious at present for highly leveraged companies.

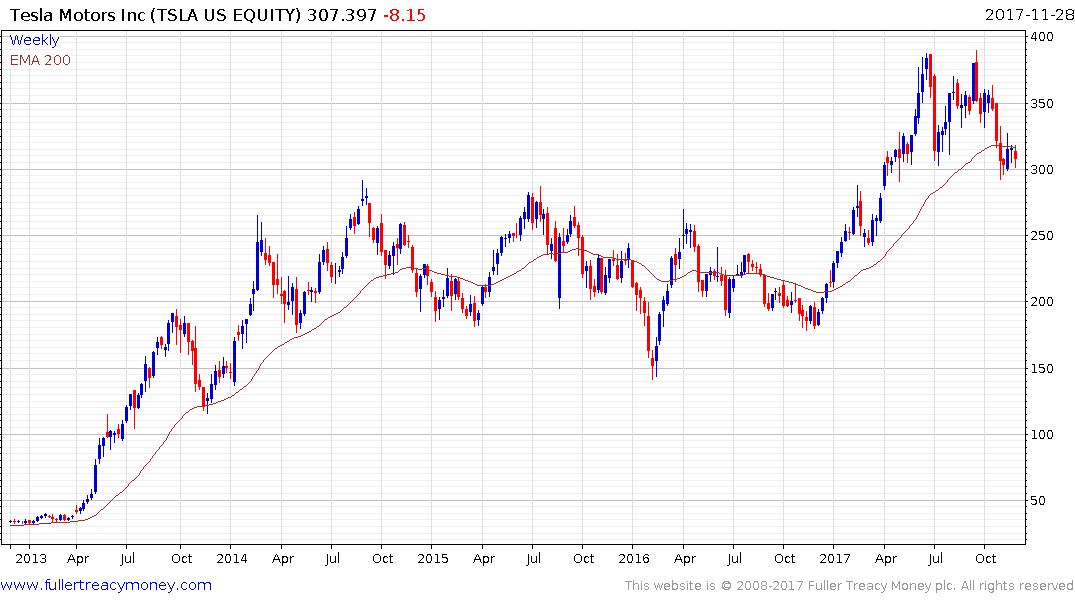

The potential for mean reversion has increased in shares like Amazon and Facebook but from a medium-term perspective of market health it might be more instructive to monitor Tesla and Netflix.

Tesla is encountering resistance in the region of the trend mean and a sustained move above $320 will be required to signal a return to demand dominance.

Netflix has been ranging in the region of $200 but today’s pullback increases potential for at least a reversion towards the mean.

Nvidia is also susceptible to mean reversion as are the shares of video game publishers like Activision Blizzard.