The SPAC+ Fund - Uniquely Designed to Solve Today's Most Difficult Portfolio Problem

This promotional piece from Morgan Creek may be of interest to subscribers. Here is a section:

In today’s world of 0% risk-free rates (or less), investors face the difficult choice of either protecting themselves against worst-case scenarios but in turn accepting no return (and much opportunity cost), or of making choices designed to generate at least some return, but in doing so accepting significant potential losses if all goes wrong. SPAC+ is an actively managed strategy designed around the incredibly unique attributes of pre-combinations SPACs – investors are protected on the downside by T-bill collateral but can generate upside through embedded equity options – to help everyday investors solve this difficult portfolio problem. We believe it can improve risk/return in investors’ portfolios.

And

As an example of how these drivers come together to add value, at the end of 2020 the average price of a common share in the SPAC+ portfolio was $10.26 and the average price of a unit in the portfolio was $10.72, and the fund was at 1.45x leverage. At the end of March 2021, the average common price had declined to $9.81 and the average unit price had declined to $9.95, down 4.39% and 7.11% respectively, and the fund was at 1.63x leverage. Despite the significant price declines of the inventory on a levered portfolio, SPAC+ was up +8.45% year to date through March 2021. Moreover, in the absolute worst case scenario of a market downturn where no more SPAC mergers are ever completed, the SPAC+ Fund would only lose 1.5% after waiting and collecting the share of the collateral of all the positions held in T-bills.10 This absolute downside compares favourably to other equity or credit-related products, which would likely face much steeper drawdowns. The strategy of the SPAC+ Fund may improve risk-adjusted returns to investors’ portfolios, while reducing tail risk in a bad event.

The investor scrabble to deal with close to zero interest rates has been going on for more than a decade. The result is the yields available in every asset class have contracted considerably over that time. It is a measure of how desperate investors are for a fixed income-like return that making 8.45% on leverage of 1.69 is considered a bargain.

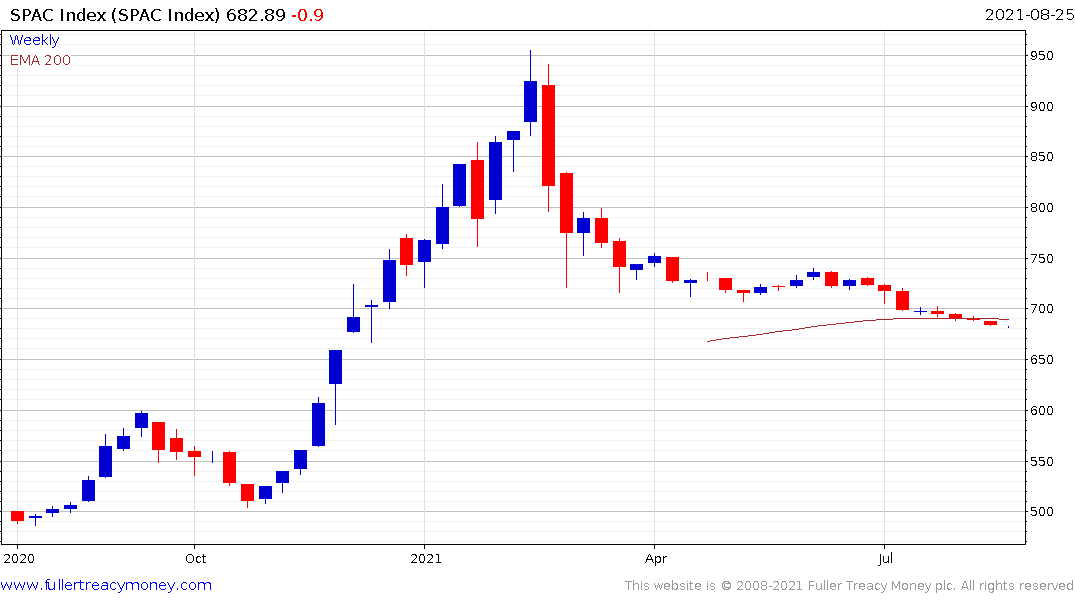

The challenge for investors is this kind of strategy relies on both interest rates remaining inert and demand for SPACs continuing to increase despite the competition for attractive candidates. The performance of the SPAC Index has been disappointing since the peak in March and not least because a number of funds have had difficulty finding suitable investments to make.

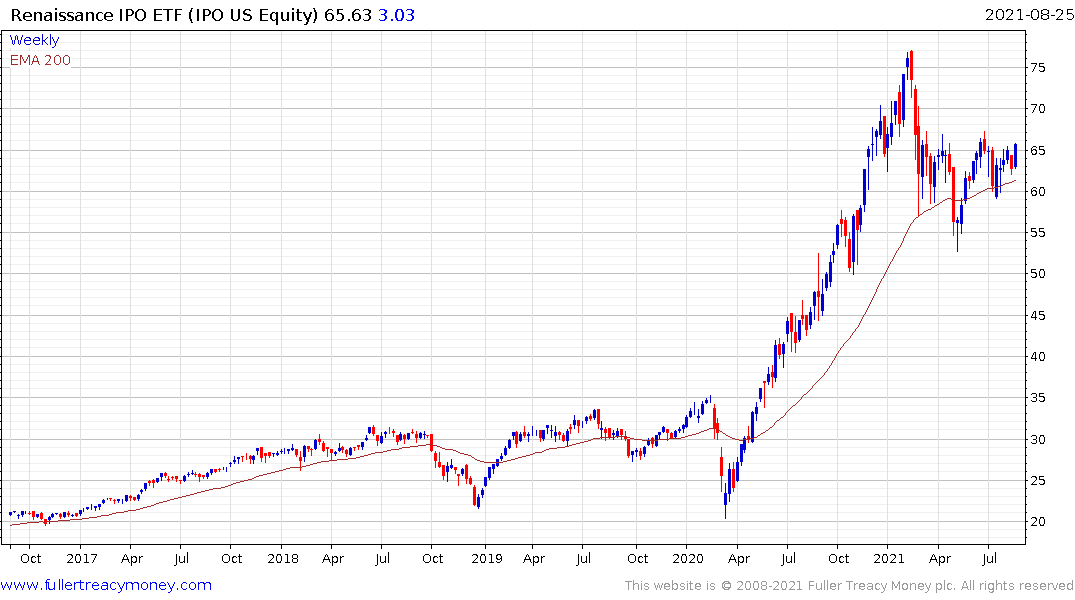

Meanwhile the IPO ETF is currently testing the upper side of a five-month range, as it firms from the region of the trend mean.

Every major bull market experiences a wave of new issuance as sellers are encouraged into the market. The structure of SPACs has facilitated the route to IPO for many companies. However, it is also worth remembering that this pattern of behaviour is very interest rate dependent.

The speculation currently underway about the timing of Fed tapering is likely to have a material impact on the speculative edge of the market represented by SPACs and unprofitable IPOs.

Neither James Bullard nor Esther George are voting members of the FOMC this year so they are free to talk as much about the need to taper as they want. Instead, the market will be paying attention to what Jay Powell has to say tomorrow.

10-year Treasury yields paused today in the region of the upper side of the short-term range. A clear downward dynamic will be required to question potential for continued upside.

Any semblance of an uptrend in yields reintroduces a discount rate to speculative valuations. This report from Morgan Stanley discussing the dividend discount model may be of interest. The simple point that if a company does not have earnings, it had better have a route to profits is well made.

.png)

A falling tide of liquidity is also a relevant consideration for cryptocurrency investors. Bitcoin eased back from the psychological $50,000 area over the last couple of days and will need to find support soon if the nascent recovery is to remain consistent.