The rising star of Africa :Beer

Thanks to a subscriber for this interesting report from Deutsche Bank which may be of interest. Here is a section:

Driving the next decade of beer growth

Over the next decade, Africa should account for 40% of global volume and profit growth. In our view, population dynamics will drive structural growth; realistic pricing will accelerate per capita growth, taking share from illicit alcohol in a continent where only 15% can currently afford a beer. Structurally protective "moats" and strong positions for established players help ensure sustainable profits. Any corporate activity would likely be limited to the last independent brewer, Castel, and consolidation in ancillary businesses including soft drinks. Heineken (Buy) and SABMiller (Hold) appear best positioned to capture the growth.

Africa to lead the growth in beer

The next decade will see disproportionate growth in beer driven by Africa, with volume rising 8% per annum, on our estimates. Unlike the previous decade where most of the volume growth was driven by China, the gains in Africa should mean profitable growth as high revenues and margins look to be sustainable by established players with high barriers to entry. We expect the profit pool in Africa to expand US$5billion in EBIT by 2025.

Favorable population dynamics, especially with the key beer-drinking 20-35 year-old cohort expanding almost 3% per year, should drive half the growth. Realistic pricing at or below inflation should raise per capita consumption, taking share from illicit alcohol, which accounts for 80% of all alcohol on the continent. Growth will not be smooth; it never is in Africa. However, the swings in commodities such as oil in Nigeria have a nuanced impact on the robustness of beer growth.

Castel, Coke, Guinness

Family-owned Castel, accounting for $2bn of EBITDA in Africa, is often seen as a potential target for future M&A on the continent – but a deal would be more complicated for a company with no need to sell. More activity is likely in ancillary beverages to leverage the brewing platforms of established players. Further consolidation of the Coca Cola bottlers, led by SABMiller, should lead activity in the short term. Despite its advantaged position, if Diageo’s underperformance in beer continues, we see the company possibly exiting the operational elements in Africa, but not beer per se.

Here is a link to the full report.

On aggregate we can conclude that governance is improving across most of Africa, not least in its major population growth centres, which is succeeding in lifting millions of people out of abject poverty. As consumer demand for mobile phones and other goods increases so should demand for leisure drinks such as alcohol. A number of globally oriented brewers are already well positioned for growth in Africa.

Diageo rallied to break a yearlong progression of lower rally highs in November and has been ranging above the 200-day MA since. A sustained move below the trend mean, currently near 1850p would be required to question current scope for continued higher to lateral ranging.

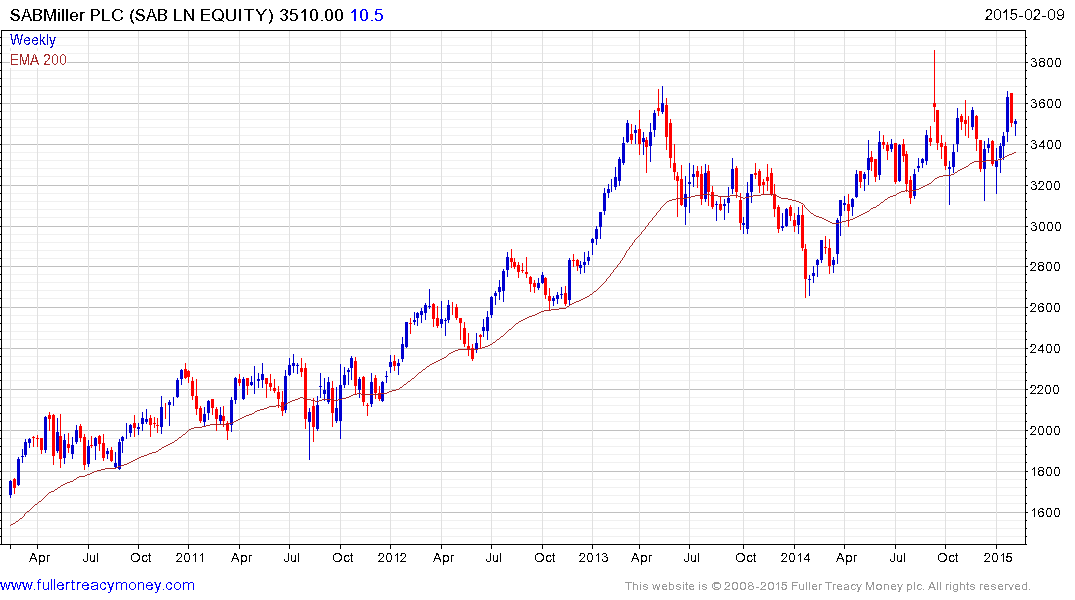

SABMiller has been ranging higher over the last six months and is currently testing the region of the 2013 peak. A sustained move below the trend mean would be required to question medium-term potential for a resumption of the medium-term uptrend.

SABMiller has been ranging higher over the last six months and is currently testing the region of the 2013 peak. A sustained move below the trend mean would be required to question medium-term potential for a resumption of the medium-term uptrend.

Heineken has held a progression of higher reaction lows since finding support in early 2014 and hit new all time highs in January. Some consolidation of recent gains is looking increasingly likely but a sustained move below the trend mean be would be required to question medium-term potential for additional upside.