The rise and rise of private markets

Thanks to a subscriber for this report from McKinsey which may be of interest. Here is a section:

Dry powder: How much is too much? With competition rising and deals hard to find, GPs’ stocks of uncommitted capital, or dry powder, reached a record high of $1.8 trillion in 2017 (Exhibit 14). That was up 9 percent year on year; indeed, dry powder has grown by 10 percent on average every year since 2012. Does the industry have too much capital? Probably not, or at least not yet. If we compare dry powder to other measures, such as funds raised and AUM, “stocks” of capital available for investment have changed little over the past few years vis-à-vis the size of the industry. Dry powder as a percentage of in-year fundraising has been between 220 and 280 percent for the past six years. As a percentage of AUM, dry powder has been similarly consistent, at 30 to 34 percent. Nor are there any significant variations among asset classes, suggesting that GPs are finding adequate opportunities in every field. Furthermore, by the metric we introduced in the 2017 edition of this report, years of PE inventory on hand, dry powder still seems adequate to deal flow. If we divide dry powder by deal volume on a seven-year trailing basis, the industry seems to have cycled through its capital in a stable way for the past several years (Exhibit 15).

Here is a link to the full report.

This report while focusing on 2018, references a lot of data from 2017. The quantity of capital now held by private equity groups in anticipation of a buying opportunity stands at $3 trillion. That’s almost a multiple from a couple of years ago and speaks both to the quantity of money still sloshing around and the dearth of attractively valued assets to buy with it.

I spent the last few days at a Marcus Evans conference in Palm Springs where there were a number of private equity groups pitching their latest funds. What I found especially interesting was the focus most of them had on only supporting businesses that had already got a product ready for market and had sourced their first customer. Most of the strategies I heard about were focusing on medical devices/software and B2B software as well as clean tech outside the power generation space.

A conversation I had with another delegate highlighted for me how bubbly the prviate investment sector has become. He was a long/short portfolio manager at Pimco for seven years but has now secured seed funding, from a billionaire former client, to start a fund looking at investing more than half its assets in private deals. The promise of returns that outpace what can be achieved in public markets is just too good to pass up, despite having no experience in the sector..

Software and the inefficiency of banking back offices as well as the inefficiency of the medical sector represent interesting avenues for private capital because of the margins that exist in those businesses. There is an increasing amount of competition in these sectors since these are well understood opportunities but the opportunity is also large.

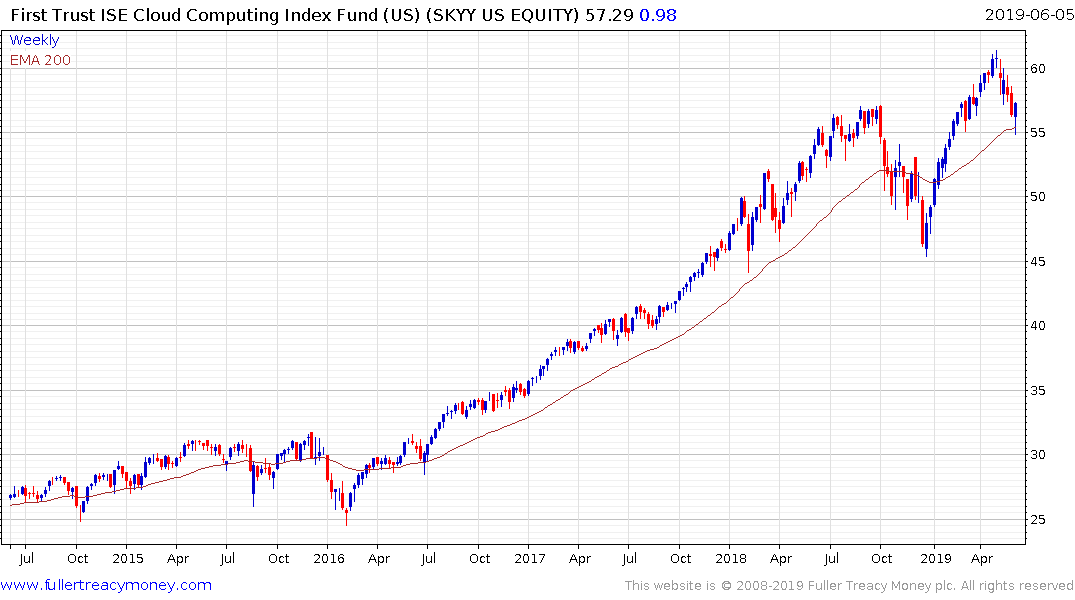

The First Trust Cloud Computing ETF bounced this week from the region of its trend mean and the 2018 peak.

I also talked to an energy fund run by the former COO of Anadarko which has just bought the energy services and oil production business of GE at what they claim 10 cents on the dollar. The breakeven they cited for their oil production projects is $50 and that is about where the price is right now. When I asked how well they can survive at prices of $35 and $40 they said they would just stop drilling. That is the true advantage of unconventional drilling business models. When prices are low, supply gets shut in and where prices rise it flows again. The elasticity of supply is not available to conventional producers.

Back to top