The Great Rotation May Finally Be at Hand

This article by Sid Varma for Bloomberg may be of interest to subscribers. Here is a section:

George Pearce’s, a macro strategist with Bespoke Investment Group LLC, said: “Higher risk-adjusted returns for stocks should draw inflows, and we know from our work that Americans are relatively unexposed to the market.”

Companies have been the main buyer of U.S. equities since the post-crisis low, while households and institutions have divested, according to Credit Suisse. The outperformance of bonds since the financial crisis, risk aversion and regulations unfriendly to equities have helped create a preference for fixed income.

Global bond funds -- which include government and high-yield obligations -- have seen $1.3 trillion of net inflows since 2009, while stocks have taken in less than half of that at $600 billion, according to Jefferies Group LLC, citing EPFR Global data, which reflect holdings among mutual and exchange-traded funds.

In the first half of the year, bond funds took in $204 billion while stocks saw $167 billion of inflows. A $107 billion injection into fixed-income in the second quarter was the highest on record going back to 2002, Jefferies said. This happened despite fears of higher global yields.

The size of the bond market is multiples the size of the equity market. Bonds are held in pension funds because they are supposed to offer stability, yield and some diversification from the perception of higher risk attached to stocks. Right now, the US 10-year Treasury yield is around 1.23% and the S&P500 yields 1.98% which is not a very wide spread.

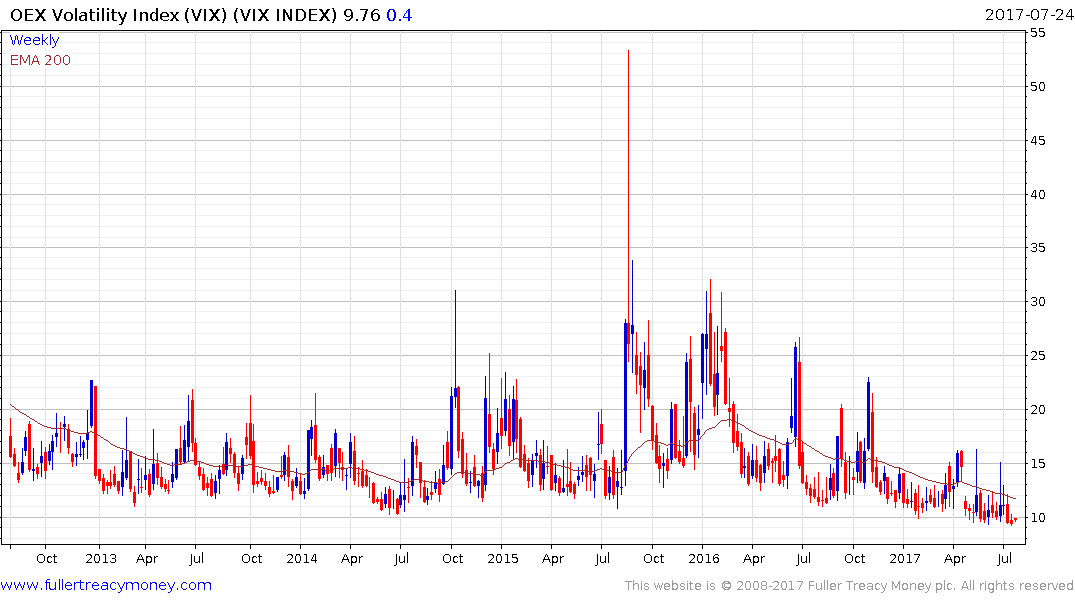

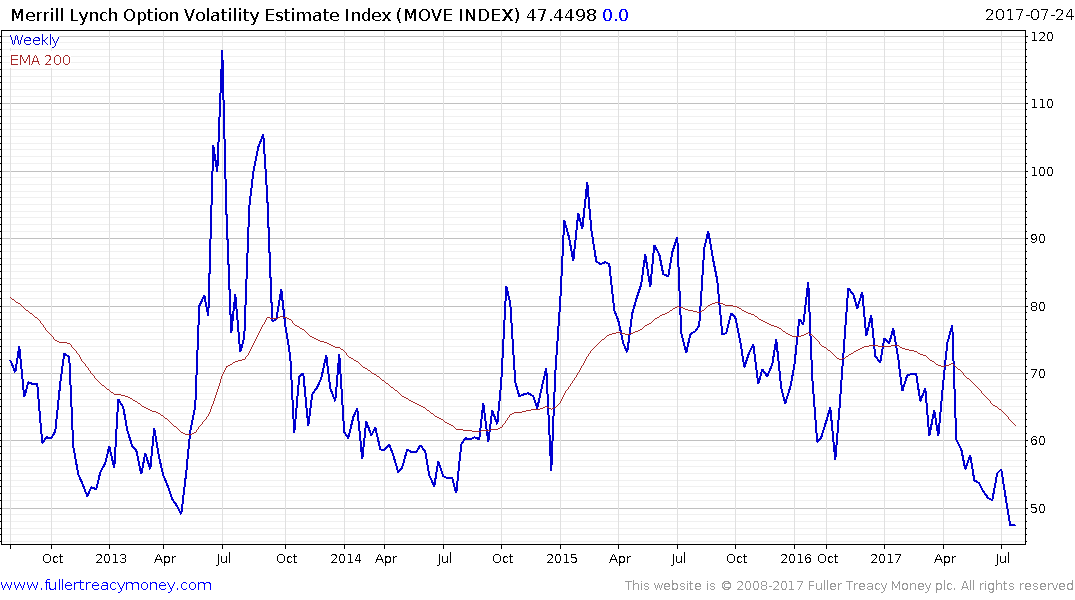

Meanwhile both bond and equity volatility metrics are close to all-time lows which tips the scale in favour of equities, given the higher returns available for as long as that condition lasts.

From a different perspective, rotation out of bonds and into equities can just as easily be rationalised by the prospect of inflation rising. Stocks offer one of the best hedges against inflation because companies can raise prices and dividends. On the other hand, fixed income securities offer some of the worst protection, since new issues have higher yields which reduce the appeal of the existing inventory of bonds in the secondary market.

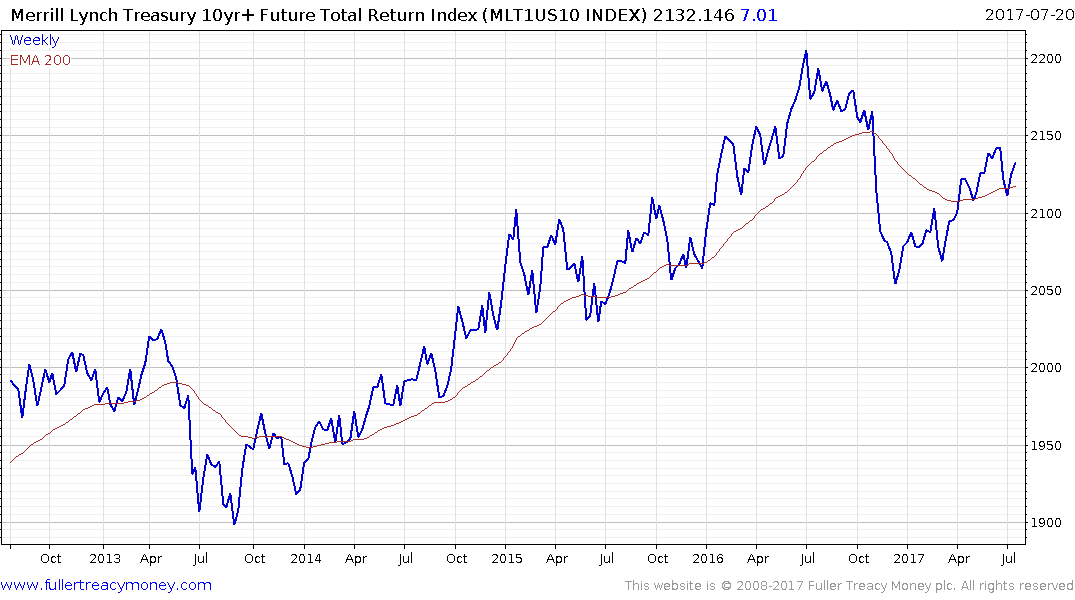

The Merrill Lynch Total Return on US 10-year Treasuries has been rallying just about all year, following its Q4 sharp pullback and bounced from the region of the trend mean two weeks ago. A sustained move below it would be required to signal a return to supply dominance.

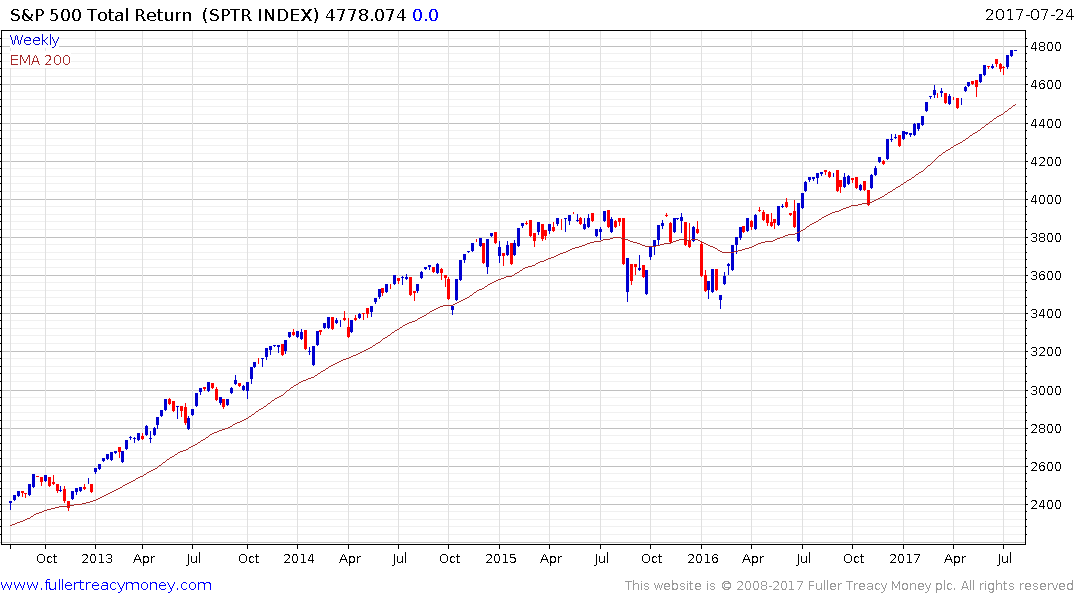

The S&P500 Total Return Index remains in a consistent medium-term uptrend defined by a staircase step sequence uptrend. A break in that consistency would be required to begin to question upside potential.