The future of Emerging Markets

This report from Dimitris Melas for MSCI may be of interest to subscribers. Here is a section:

The rationale for allocating to emerging markets rests on three pillars: Superior economic growth has resulted in positive market returns historically, low correlation within emerging markets and across asset classes has provided diversification benefits, and relative scarcity of information has created opportunities for active portfolio management. Long-term historical data confirms that emerging markets have provided positive long-term risk-adjusted excess returns and enhanced portfolio diversification. Their diversity has led to high cross-sectional return dispersion, both at the country and at the security level, creating opportunities to add value through active country allocation and stock selection. Omitting this equity segment would have introduced a performance drag on global indexed strategies and reduced the investment opportunity set of active strategies. The opening of the domestic Chinese capital market and its integration into international markets is likely to have a transformative effect on the emerging markets equity segment. MSCI introduced domestic Chinese equities (A shares) into the MSCI Emerging Markets Index in June 2018 at a reduced weight. Chinese equities listed in mainland China and Hong Kong currently represent 30% of the index but could grow to over 40% when A shares are included at full weight. The growing size of China within emerging markets raises the prospect for investors of making dedicated allocations to China. Whether investors make separate China allocations or continue to seek opportunities across global emerging markets, the segment likely will remain an essential element of the global equity universe in the future.

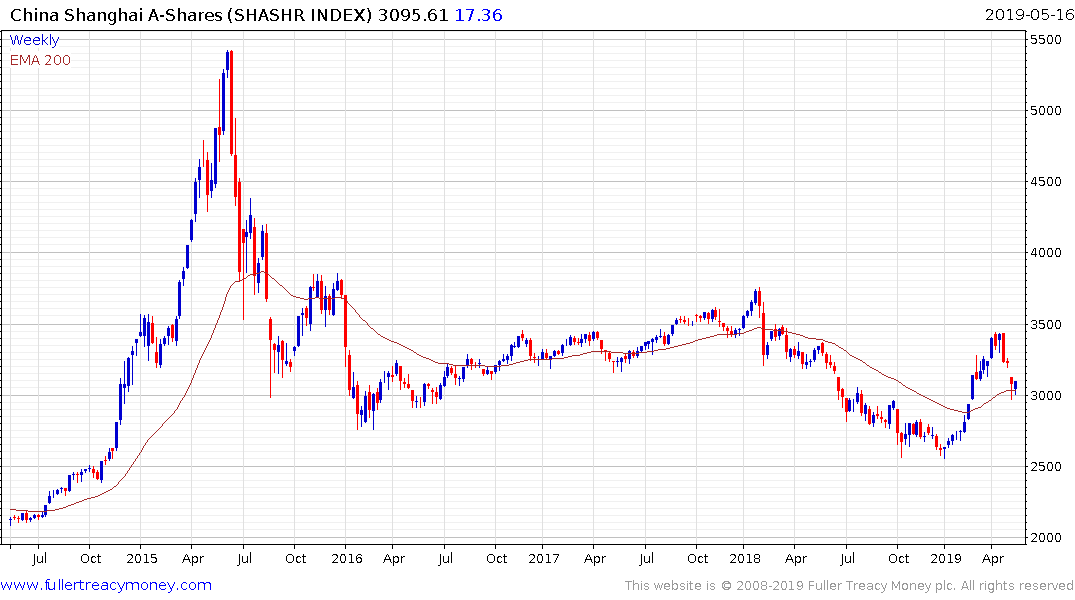

China already dominates the emerging markets sector and its influence is likely to further increases with the increased weighting of A-Shares. At 40% of the Index it will become increasingly difficult to invest in emerging markets without gaining at least some exposure to China. That will be either because of direct participation or because of the reliance of some markets on Chinese demand.

That is likely to be fine as long as China’s markets are recovering. However, bull markets in China are state sponsored and when it again becomes less of a priority that will be felt right across the sector. Therefore, a de facto China leash effect is in place for the emerging markets sector.

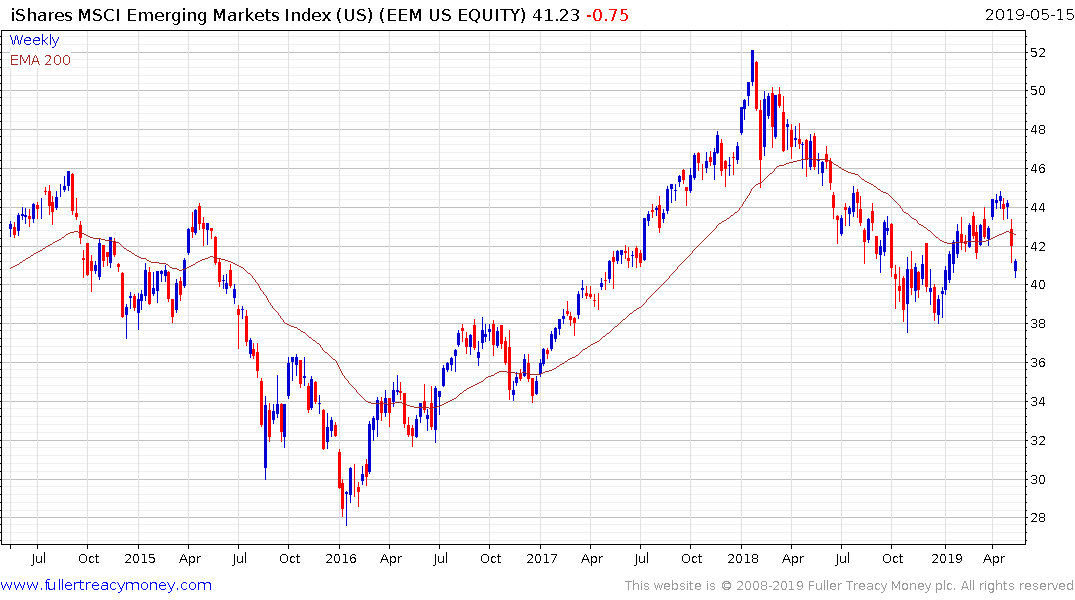

The iShares Emerging Markets ETF pulled back sharply in line with the weakness in the Chinese market last week. However, while the A-Shares found support in the region of the trend mean, the ETF is well below it. So far, the bounce in China has been relatively modest but the better it does the greater the potential it will pull the ETF back towards it mean.