The Fed's Preferred Inflation Gauge Cooled...or Did It?

This article from Barron’s may be of interest. Here is a section:

But in a Nov. 30 speech at the Hutchins Center on Fiscal and Monetary Policy at the Brookings Institution, Powell said he was watching something even more specific -- not core PCE, but core services PCE less housing. "[This] may be the most important category for understanding the future evolution of core inflation," Powell said at the time.

That isn't just specific, it is super specific. Core PCE already strips out food and energy. Core services PCE strips out food, energy, and the cost of physical goods. Powell wants to remove housing as well because "as long as new lease inflation keeps falling, we would expect housing services inflation to begin falling sometime next year," he explained.

When Powell refers to core services PCE less housing, he is really talking about the job market. "Because wages make up the largest cost in delivering these services, the labor market holds the key to understanding inflation in this category," he said. "Thus, another condition we are looking for is the restoration of balance between supply and demand in the labor market."

The Core services ex-housing PCE inflation measure continues to hold above 4% which is higher than at any time since 1992. It does look like it has peaked so the question is how quickly it will contract. The hopes for a soft landing reside in this measure falling back to below 3% and staying there without an uptick in unemployment.

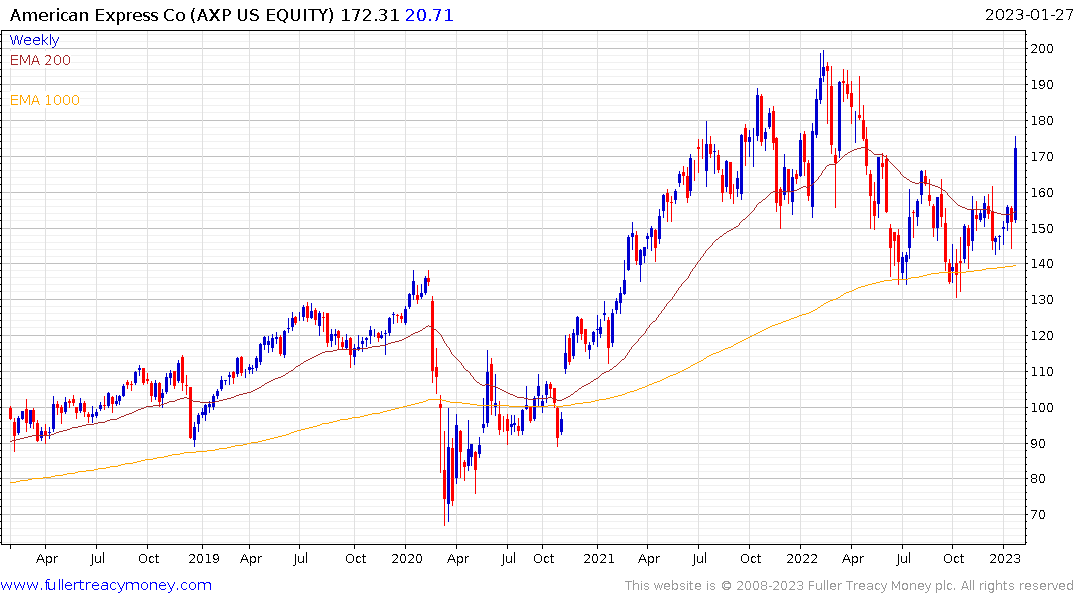

American Express reported today that spending among the wealthier portion of its client base has held up very well and they are bullish about the prospect of that continuing. That boosted the share and also supported Visa.

This kind of bullishness in consumer credit providers is helping to ensure financial conditions ease. High yield spreads continue to follow the path of the Goldman Sachs Financial Conditions Index lower. That is fueling speculative appetite in the stock market.

The soft landing hypothesis has gained a lot of traction with the rebound in the mega-cap sector. However, in order for that to come to fruition a lot has to go right. Most particularly a spike in unemployment needs to be avoided and inflation needs to continue to decline.

In the short-term we have seen an impressive counter trend rally into the Fed meeting on February 1st. That is pricing in a further reduction in the pace of Fed hikes and the assumption this may be the last one. That view is also helping to support homebuilders and has shrunk the average mortgage rate by 100 basis points to 6%. If Fed decides to keep its options open and indicates further slow and steady hikes, stock market risk appetite will wobble. We may be in the process of being set up for a buy the rumour, sell the news reversal.

Back to top