The Deepening Deficit That Makes Zinc One of 2016�s Top Bets

This article from Bloomberg News may be of interest to subscribers. Here is a section:

The Chinese smelters that churn out more than 40 percent of the world’s zinc may cut production for the first time in four years because they can’t get enough raw material, further lifting prices of one of this year’s strongest-performing commodities.

Zinc, used for rustproofing steel in everything from auto bodies to suspension bridges, has surged as much as 25 percent in 2016 to the highest since July as miners supply less of the ore concentrate that’s refined to produce the metal, just as to Macquarie Group Ltd. see further gains, while Glencore Plc, the biggest miner of the metal, says structural deficits are back.

$1800 represented the lower side of a five-year range in zinc prices, so when it broke below that level in August sentiment understandably turned bearish. However the rally that has been underway since the beginning of the year has not only taken the price back up into the overhead range, but zinc has rallied enough so that the drop below $1800 can be considered a failed downside break. A sustained move below $1800 would now be required to question potential for additional upside.

While the focus of investor attention tends to be on oil and gold prices the wider commodity sector is also worth taking a look at. The Continuous Commodity Index broke out a new recovery high today to reconfirm the uptrend evident since January.

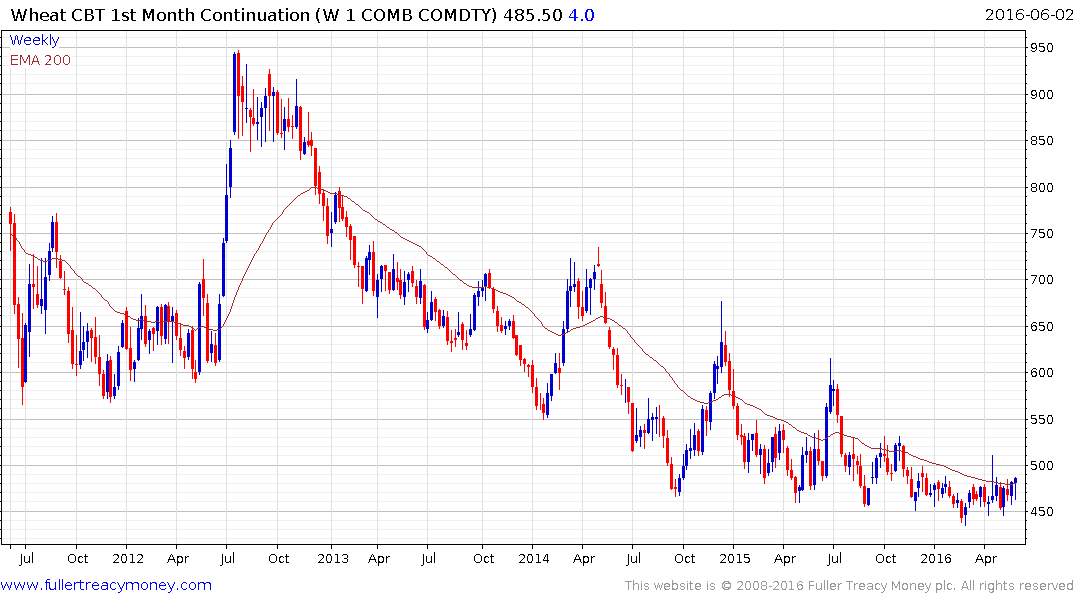

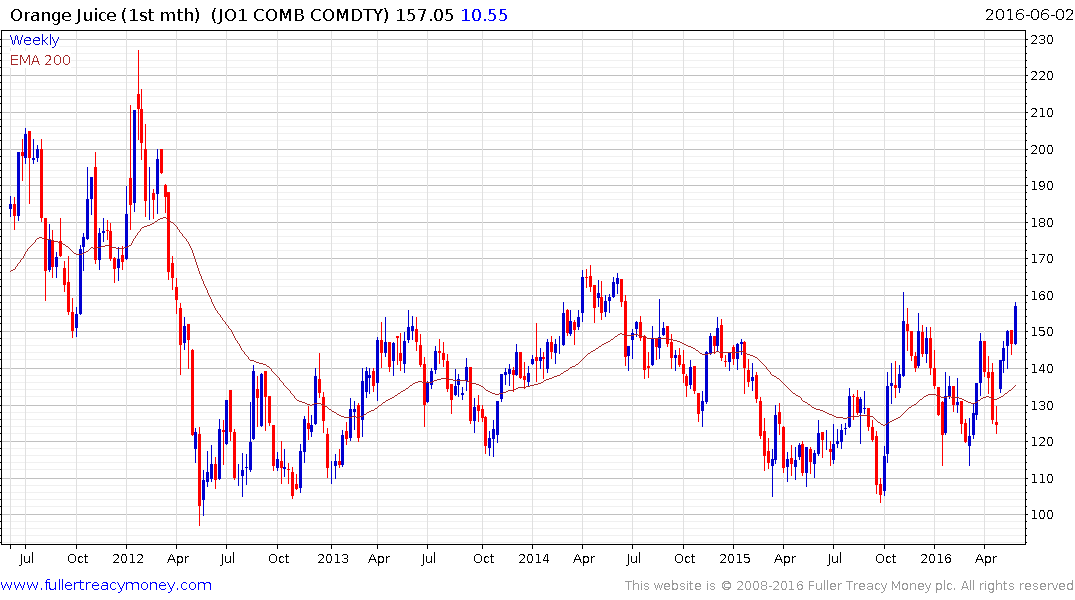

White Sugar, Soybeans, Corn, Wheat, Orange Juice are all also hitting new highs. Some of the commonality in the soft commodity sector has been influenced by El Nino but the broader point is that rebound in the commodity complex more generally appears to be well supported. .