The currency war is over, says HSBC

This article by Joseph Adinolfi for Market Watch may be of interest to subscribers. Here is a section:

With the dollar clocking significant declines against the euro and yen since the beginning of the year, it appears that the European Central Bank and the Bank of Japan—who along with the Fed comprise the primary antagonists—have run out of ammunition for driving their currencies lower, according to a team of currency strategists at HSBC.

Investors should welcome this development. The only beneficiaries of the strong dollar were the BOJ and ECB. The strength in the greenback exacerbated global woes by causing emerging-markets currencies and oil prices CLK6, +5.10% to plunge—a one-two punch for oil-exporting developing economies.

A currency war occurs when central banks take turns using monetary policy to deliberately weaken their currencies in a scramble to gain an advantage. The resulting race to the bottom can prove counterproductive.

And

In Europe, the ECB has opted to shift the emphasis to expanding credit by introducing targeted longer-term refinancing operations and by authorizing the purchase of some corporate debt.The Bank of Japan tried switching to negative interest rates to weaken the currency because the number of Japanese government bonds available for purchase has dwindled.

“I think it’s generally acknowledged that [those central banks] welcomed a weaker currency,” said Daragh Maher, HSBC’s U.S. head of currency strategy and one of the report’s authors.

It’s good for other central banks, who can stop chasing the BOJ and ECB, he said.

The Fed’s decision to end its quantitative easing program has reduced pressure on other central banks to persist with their own operations and leaves them with greater leeway to pursue other strategies. The ECB is buying both sovereign and corporate bonds and deployed negative interest deposit rates but is not actively leaning on the currency. The Bank of Japan is following a similar strategy. This has allowed both the Euro and the Yen to appreciate.

However it is worth considering how weak the Dollar is likely to get? The Fed has already raised rates and it will almost certainly be the first central bank to do so again. Additionally while the ECB and BoJ have less active in the currency markets they have ample opportunity to act if their respective currencies represent a threat to their competitiveness.

Let’s address the medium-term chart patterns:

The Euro has rallied back to test the upper side of its yearlong range against the Dollar and a sustained move to new 12-month highs would signal a return to demand dominance beyond the recent short-term rally.

The Dollar completed a medium-term top against the Yen in February and while an increasingly oversold condition is evident a clear upward dynamic will be required to check momentum.

The Pound continues to sell-off as the uncertainty of the June vote on EU membership overshadows the market. A break in the almost yearlong progression of lower rally highs, currently near $1.44, will be required to question the medium-term downward bias.

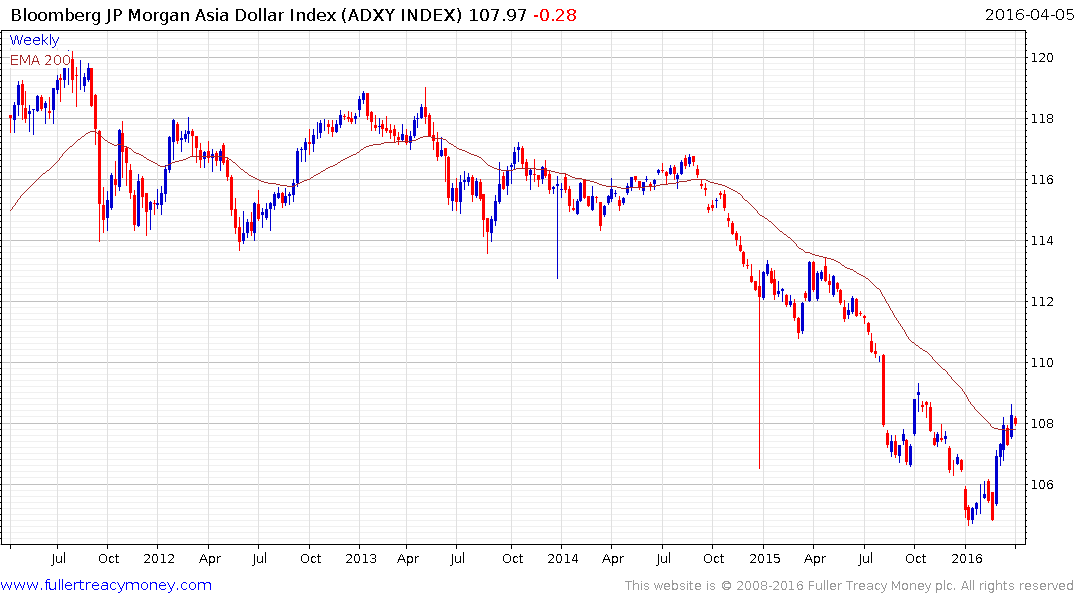

Meanwhile the Asia Dollar Index has now unwound its oversold condition relative to the trend mean and a break in the short-term progression of higher reaction lows would be required to confirm resistance in the region of 108. The rebound in emerging market currencies has been a major factor in the outperformance of their respective stock markets in the first quarter. How well the rally holds over the coming weeks will be a good indication of whether a medium-term low has been found.