The Cold, Hard Facts Raining on China's Commodity Parade

This article by Alfred Cang for Bloomberg may be of interest to subscribers. Here is a section:

The rally last month was accompanied by a surge in trading volumes, with as much as 1.7 trillion yuan ($261 billion) in commodity futures changing hands in a single day. That drew comparisons with 2015’s credit-driven stock market rally that preceded a $5 trillion rout, and prompted exchanges to raised transaction fees and margins amid orders from regulators to limit speculation.

Waning Enthusiasm

As the exchanges stepped in, trading volumes shrank. About 20 million contracts of everything from eggs to steel changed hands on the Dalian Commodity Exchange, Zhengzhou Commodity Exchange and Shanghai Futures Exchange on Friday, down from a peak of 80.6 million contracts on April 22.“Bullish enthusiasm in Chinese commodities futures has been rapidly declining, especially after the exchanges pushed out massive measures to curb speculative trading,” Yu said.

Iron ore futures in Dalian sank to 388 yuan a metric ton on Monday, while rebar, used to strengthen concrete, slumped by the Shanghai Futures Exchange limit to 2,175 yuan a ton. Coking coal, used in steel making, dropped as much as 6.3 percent to 650.50 yuan a ton and copper slid to 35,840 yuan a ton. Cotton, of which enough was traded in a single day last month to make a pair of jeans for all of humanity, lost as much as 3.9 percent to 11,865 yuan a ton.Iron ore inventories held at ports across China increased 1.4 percent last week to the highest since March 2015, according to data from Shanghai Steelhome Information Technology Co., while rebar stockpiles rose for the first time in nine weeks.

Imports of unwrought copper and products slumped to 450,000 tons last month from 570,000 tons in March, Chinese customs data showed on Sunday, as swelling stockpiles discouraged shipments.

The casino culture that has been increasingly evident in Chinese financial markets does nothing to encourage confidence among investors that the market is functioning correctly as a price discovery mechanism. In fact one can but draw the conclusion it is the subject of wild swings by leveraged traders out for quick profits at the expense of consumers without the inhibition of the kind of regulatory oversight we are accustomed to in more developed markets.

The problem is that China might not have the regulatory oversight of other markets but it does influence how investors perceive market global fundamentals because it is such a large consumer of commodities. With tightening margin requirements some of the speculative fervour has been squeezed out of the market and iron-ore prices have now unwound their overextension relative to the trend mean.

The rally from the early December low broke the medium-term downtrend and the question now is to what extent that low will be held, whether a lengthy base formation is going to unfold which would result in a great deal of volatility or if the majority of recent gains can be held and a trending environment will prevail. With such divergent potential outcomes possible some further consolidation of gains looks likely before new recovery highs can be sustained. That would be consistent with what still appears to be a Type-2 bottom with right hand extension as taught at The Chart Seminar.

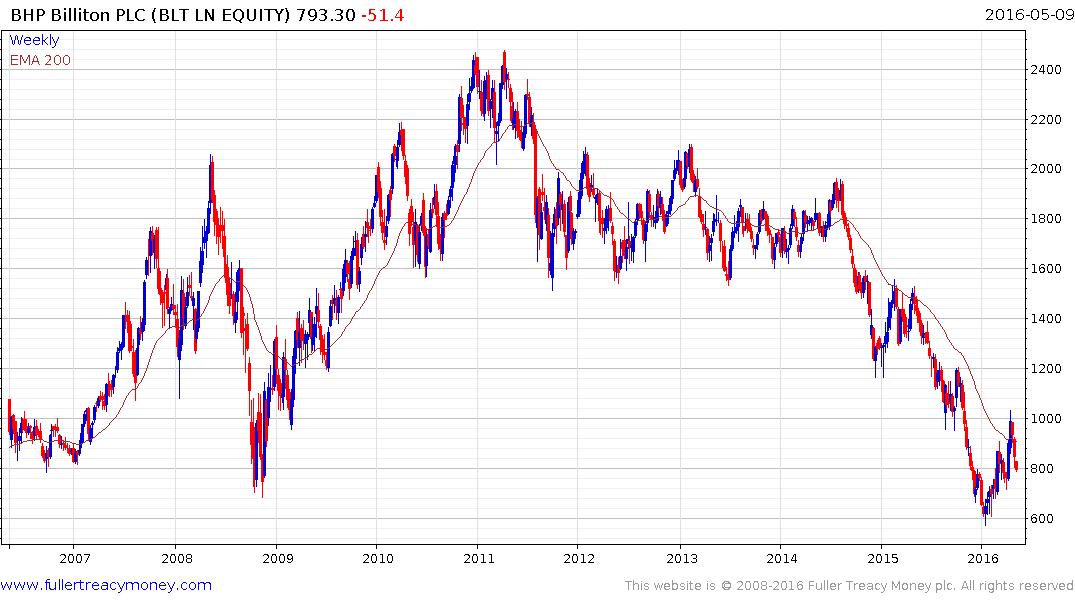

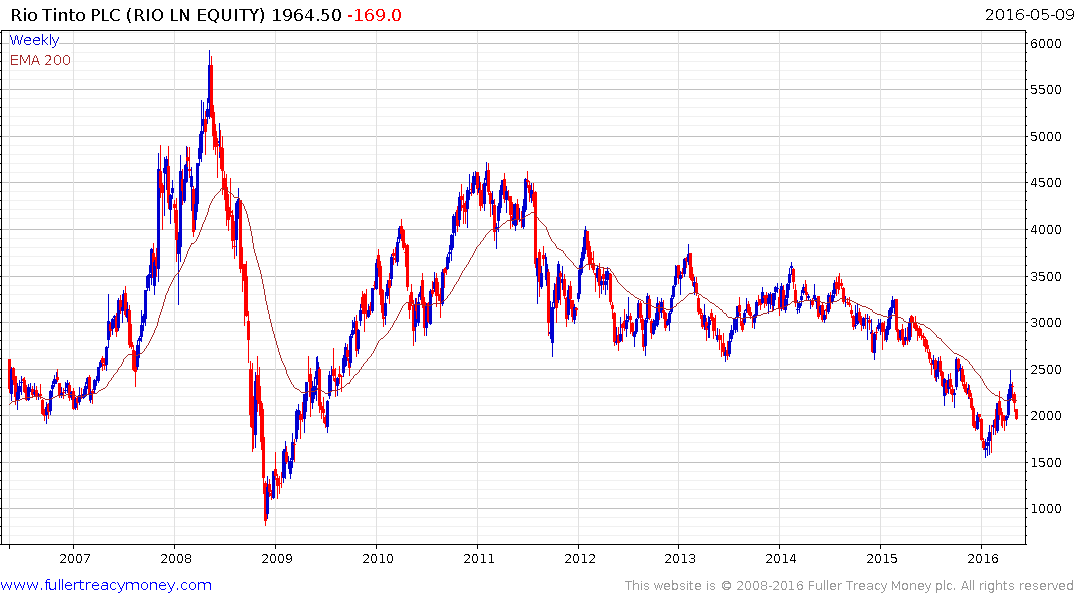

The major iron-ore miners BHP Billiton, Rio Tinto and VALE have fallen even more sharply and are rapidly approaching the region of their respective short-term progressions of higher reaction lows. They will need to hold those sequences if potential for additional higher to lateral ranging is to be given the benefit of the doubt.