The Cannibalised Company

Thanks to a subscriber for this article from Reuters which contains an interesting graphic illustrating just how much money some of the largest companies are spending on buybacks. Here is a section:

In theory, buybacks add another way, on top of dividends, of sharing profits with shareholders. Because buybacks increase demand and reduce supply for a company’s shares, they tend to increase the share price, at least in the short-term, amplifying the positive effect. By decreasing the number of shares outstanding, they also increase earnings per share, even when total net income is flat.

Companies say buybacks are warranted when demand for their products and services isn’t enough to justify spending on R&D, or when they deem their shares to be undervalued, and therefore a better investment than new projects.

And

“Their investment community and the analysts that cover them are all saying, ‘We want a better return and we want EPS to grow,’ ” Melcher said. “That’s not a sustainable long-term strategy unless all these companies are going to go private. ... Even the Wall Street analyst crowd at some point will say, ‘When are you going to grow?’”

Buybacks are an emotive topic and are likely to become more so as politicians seek populist scapegoats to further their personal ambition in an election year.

We can argue about whether buybacks represent a short-term gain at the expense of long-term success. There are philosophical issues about the role of corporations in achieving goals other than shareholder value. Linking executive pay to earnings per shares rather than simply revenue or profits raises important questions about conflicts of interest. Corporations with substantial cash are rightfully cautious because governments have a tendency to invent new taxes particularly when they are running deficits. However there is one overriding issue which makes buybacks attractive.

Debt is cheap and equity is expensive. Take a look at the above screenshot of the weighted average cost of capital for Apple. Debt costs the company 1.2% and the cost of equity is 10%. It makes sense to sell debt and buy shares in order to bring down the total cost of funding and this is particularly true for companies which had previously eschewed the debt markets in favour of equity.

For a high yield issuer such as Sprint Corp which has historically favoured debt over equity the argument is reversed. Debt is still cheaper than equity so there is much less incentive to buy back shares.

The management teams at large corporations tend to come from the same set of business schools so it is unsurprising they adhere to the same financial engineering playbook. We can also conclude that as long as the cost of equity exceeds the cost of taking out debt corporate desire to continue buying back shares will persist.

The appetite of investors for this additional new debt has been tested over the last few months with LBO’s requiring discounts and a growing number of companies forced into paying more for debt. As the market prices in the potential for the Fed to raise rates before the end of the year it is a good time to consider the role buybacks have had in sustaining the momentum of the uptrend in equities from the 2009 lows.

Many money managers have been underweight equities over the last five years and retail investors have really only come back into the market over the last two years. Someone must have been buying for the market to rally more than 200% and the most likely candidate is $4 trillion in buybacks have been a major contributor. Low interest rates and tight spreads in the debt markets facilitated this trend and it is reasonable to conclude higher interest rates will make the case for buybacks less compelling.

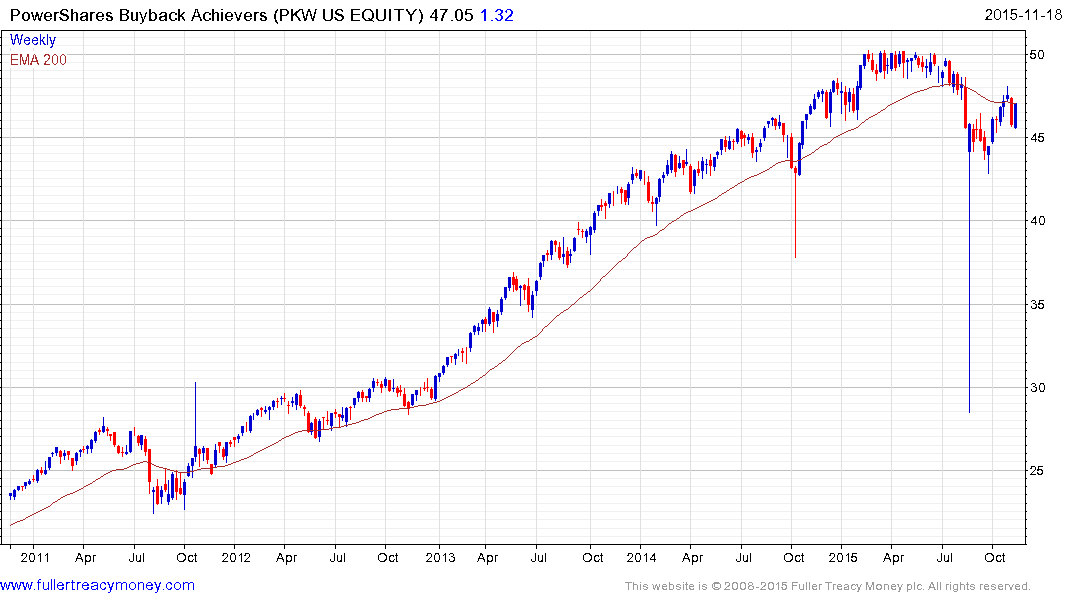

The PKW Buyback Achievers ETF has lagged the wider market over the last year. It was not immune to the issues which assailed the ETF industry in August and has been slow to rebound since. For a group that had outperformed by such a wide margin for most of the medium-term bull market, the more recent underperformance suggests demand is losing impetus. The ETF will need to hold $45 if potential for additional higher to lateral ranging is to be given the benefit of the doubt.