The Big Golden Book 26 Gold Stocks in the One Report

Thanks to a subscriber for this report from Morgan Stanley focusing on the Australian gold mining sector. Here is a section:

Our gold price outlook remains relatively subdued:

A strengthening USD, rising US interest rates and a muted inflation outlook are all headwinds to gold prices, though geopolitical tensions (such as rising concerns around Greece’s debt position) and extensions to consensus views on timing of US rate tightening have added volatility. Under this backdrop, equity selection is critical.Reduced capital spend has been the collective approach:

Within the ASX gold miners discussed in the Big Golden Book, total cash costs have declined ~7% since the last Golden Book six months ago, while production is up 4%, implying relatively flat absolute operating costs over the period. The “cost-out” trend continued to include some capital spend reductions, particularly from Newcrest following completion of Cadia East and Lihir investments, but capex reduction trend looks to have slowed, with improved sector free cash generation appearing to now include real cost reductions at the operating level.

Here is a link to the full report.

Australian gold miners have faced a number of the same issues as their counterparts elsewhere but have been insulated somewhat by the weakness of the Australian Dollar. The price of gold in Australian Dollars dropped from A$1800 to A$1400 between 2011 and early 2013. It broke out of a yearlong range in January and has returned to test the upper side of the underlying base near $1500. A sustained move below that level would be required to question medium-term scope for additional upside.

.png)

Newcrest Mining (Est P/E 21.52, DY N/A) completed a more than yearlong base in January and found support in the region of the 200-day MA from March. It is currently testing the A$15 area and a sustained move below A$13.85 would be required to question medium-term scope for additional upside.

Northern Star Resources (Est P/E 9.27, DY 2.98%) found support last week in the region of A$2 and a sustained move below the 200-day MA would be required to question medium-term scope for additional upside.

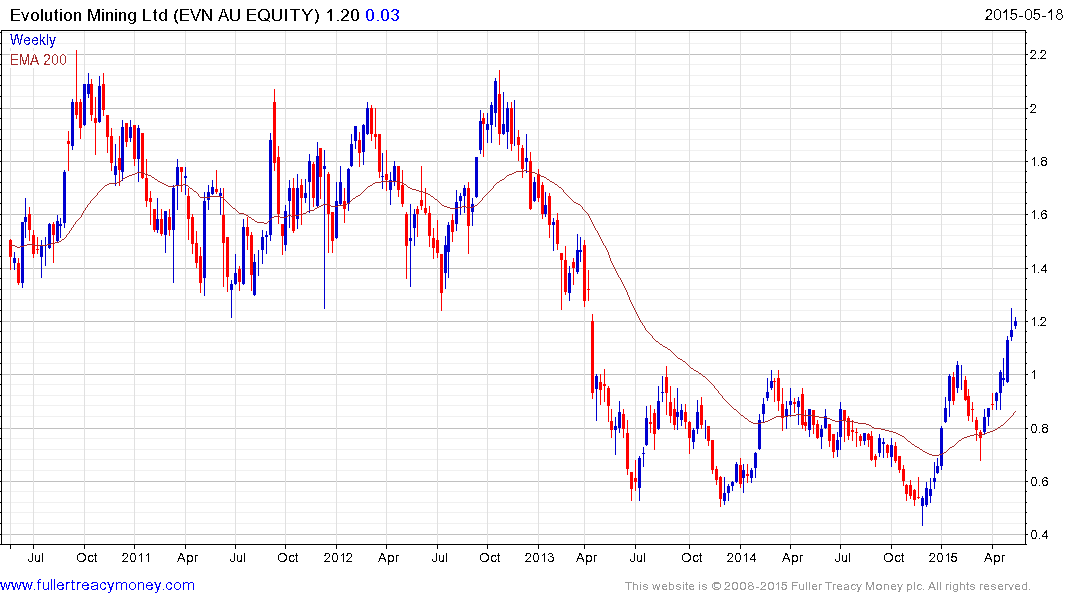

Evolution Mining (Est P/E 9.6, DY 1.67%) broke out of an 18-month base two weeks ago and a sustained move below A$1 would be required to question medium-term recovery potential.