Tesla Dodges Nickel Crisis With Secret Deal to Get Supplies

This article from Bloomberg may be of interest to subscribers. Here is a section:

“What Tesla has done with nickel is a hidden competitive advantage,” said Gene Munster, managing partner of Loup Ventures. “Tesla continues to be a couple of steps ahead of the rest.”

Musk has repeatedly flagged nickel supply as the company’s biggest concern as it boosts output, and the metal’s availability is a source of anxiety throughout the EV sector.

Battery-sector demand for nickel is expected to jump to about 1.5 million tons in 2030 from 400,745 tons this year, according to Bloomberg NEF.

“Please mine more nickel,” Musk urged producers on an earnings call two years ago. “Tesla will give you a giant contract for a long period of time if you mine nickel efficiently and in an environmentally sensitive way.”

Tesla’s management deserves credit for ensuring they have access to the resources needed to make production targets. Tesla’s vertically integrated business model is what the conventional auto sector used to do. Ford closed its last steel plant nearly thirty years ago. Selling steel to the major US automakers now represents the bulk of Cleveland Cliffs’ revenue.

As the geopolitical environment grows progressively more complicated, and competition for access to supply of copper, nickel, lithium, manganese and cobalt intensify, inventory management is going to become more important for major industrial companies.

Tesla delivered 936,000 vehicles in 2021. Toyota sold 7.5 million, Volkswagen’s were 8.9 million and that was a 10-year low. Tesla has successfully been able to manage its supply chain because of its relatively small size. That’s going to become progressively more difficult as competition increases.

The share is currently rebounding because of speculation the stock split will boost demand.

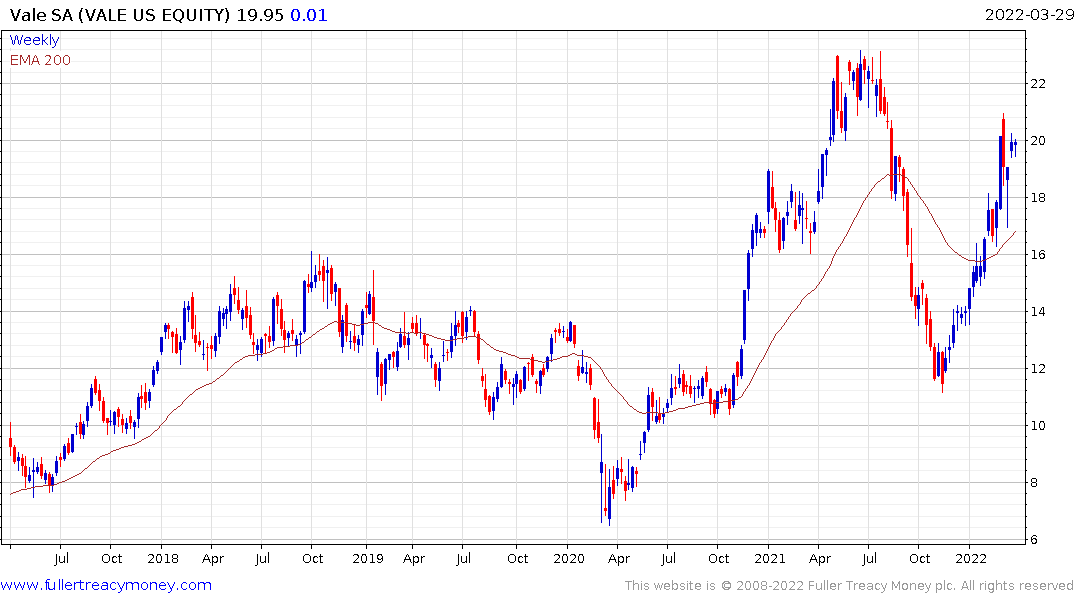

Vale has also rebounded impressively over the last four months. The company is benefitting from a desire to source non-Russian supply of nickel. The iron-ore market is also firm as steel demand improves in line with the need to boost infrastructure investment.

The VanEck Steel ETF is back testing the upper side of the 13-year base formation.

The VanEck Steel ETF is back testing the upper side of the 13-year base formation.

Arcelor Mittal has a similar pattern.